Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Defending against mergers Many mergers are the result of a friendly and collaborative agreement between the participating companies. Some combinations, however, are unfriendly or

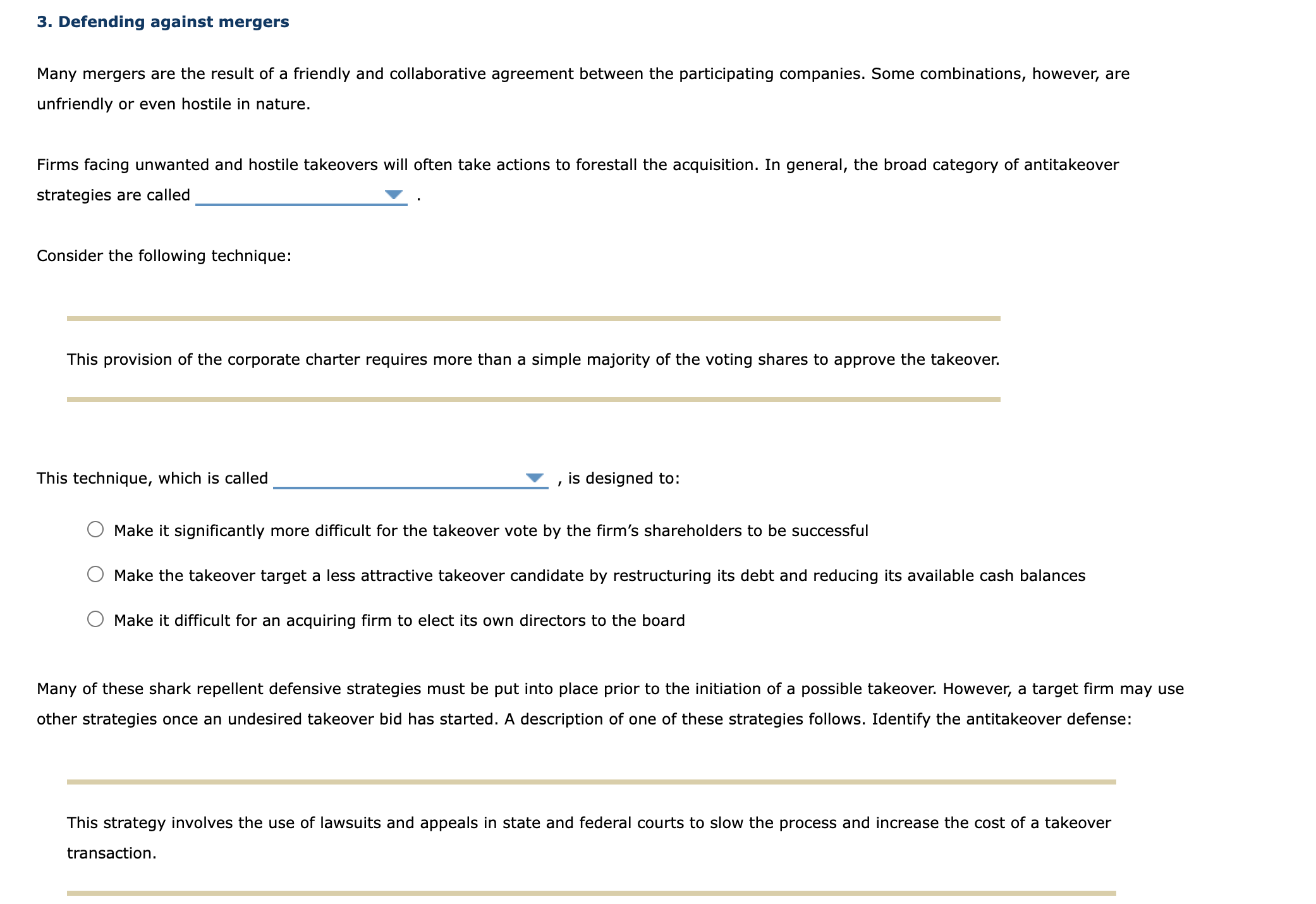

3. Defending against mergers Many mergers are the result of a friendly and collaborative agreement between the participating companies. Some combinations, however, are unfriendly or even hostile in nature. Firms facing unwanted and hostile takeovers will often take actions to forestall the acquisition. In general, the broad category of antitakeover strategies are called Consider the following technique: This provision of the corporate charter requires more than a simple majority of the voting shares to approve the takeover. This technique, which is called , is designed to: Make it significantly more difficult for the takeover vote by the firm's shareholders to be successful Make the takeover target a less attractive takeover candidate by restructuring its debt and reducing its available cash balances Make it difficult for an acquiring firm to elect its own directors to the board Many of these shark repellent defensive strategies must be put into place prior to the initiation of a possible takeover. However, a target firm may use other strategies once an undesired takeover bid has started. A description of one of these strategies follows. Identify the antitakeover defense: This strategy involves the use of lawsuits and appeals in state and federal courts to slow the process and increase the cost of a takeover transaction. This strategy is best described as the: Pacman defense Greenmail defense Asset or liability restructuring defense Litigation defense

3. Defending against mergers Many mergers are the result of a friendly and collaborative agreement between the participating companies. Some combinations, however, are unfriendly or even hostile in nature. Firms facing unwanted and hostile takeovers will often take actions to forestall the acquisition. In general, the broad category of antitakeover strategies are called Consider the following technique: This provision of the corporate charter requires more than a simple majority of the voting shares to approve the takeover. This technique, which is called , is designed to: Make it significantly more difficult for the takeover vote by the firm's shareholders to be successful Make the takeover target a less attractive takeover candidate by restructuring its debt and reducing its available cash balances Make it difficult for an acquiring firm to elect its own directors to the board Many of these shark repellent defensive strategies must be put into place prior to the initiation of a possible takeover. However, a target firm may use other strategies once an undesired takeover bid has started. A description of one of these strategies follows. Identify the antitakeover defense: This strategy involves the use of lawsuits and appeals in state and federal courts to slow the process and increase the cost of a takeover transaction. This strategy is best described as the: Pacman defense Greenmail defense Asset or liability restructuring defense Litigation defense Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started