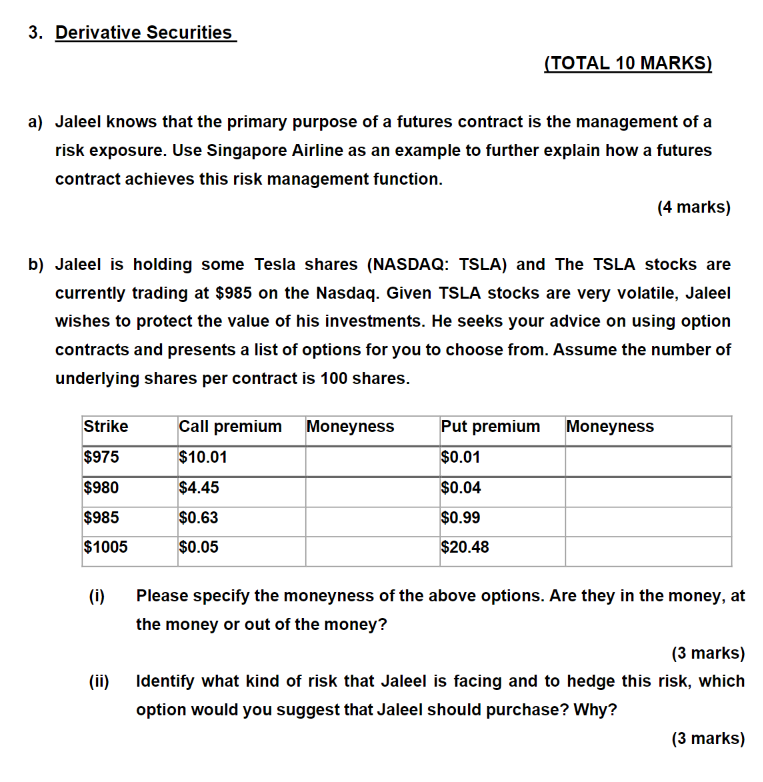

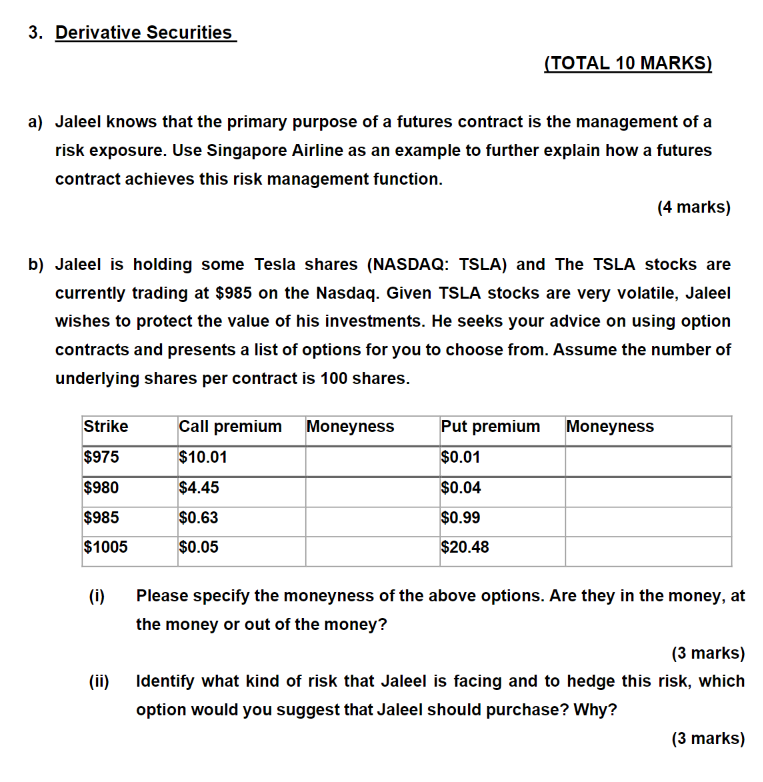

3. Derivative Securities (TOTAL 10 MARKS) a) Jaleel knows that the primary purpose of a futures contract is the management of a risk exposure. Use Singapore Airline as an example to further explain how a futures contract achieves this risk management function. (4 marks) b) Jaleel is holding some Tesla shares (NASDAQ: TSLA) and The TSLA stocks are currently trading at $985 on the Nasdaq. Given TSLA stocks are very volatile, Jaleel wishes to protect the value of his investments. He seeks your advice on using option contracts and presents a list of options for you to choose from. Assume the number of underlying shares per contract is 100 shares. Call premium Moneyness Strike $975 Put premium Moneyness $0.01 $10.01 $980 $4.45 $0.04 $985 $0.63 $0.99 $1005 $0.05 $20.48 (i) Please specify the moneyness of the above options. Are they in the money, at the money or out of the money? (3 marks) (ii) Identify what kind of risk that Jaleel is facing and to hedge this risk, which option would you suggest that Jaleel should purchase? Why? (3 marks) 3. Derivative Securities (TOTAL 10 MARKS) a) Jaleel knows that the primary purpose of a futures contract is the management of a risk exposure. Use Singapore Airline as an example to further explain how a futures contract achieves this risk management function. (4 marks) b) Jaleel is holding some Tesla shares (NASDAQ: TSLA) and The TSLA stocks are currently trading at $985 on the Nasdaq. Given TSLA stocks are very volatile, Jaleel wishes to protect the value of his investments. He seeks your advice on using option contracts and presents a list of options for you to choose from. Assume the number of underlying shares per contract is 100 shares. Call premium Moneyness Strike $975 Put premium Moneyness $0.01 $10.01 $980 $4.45 $0.04 $985 $0.63 $0.99 $1005 $0.05 $20.48 (i) Please specify the moneyness of the above options. Are they in the money, at the money or out of the money? (3 marks) (ii) Identify what kind of risk that Jaleel is facing and to hedge this risk, which option would you suggest that Jaleel should purchase? Why