Answered step by step

Verified Expert Solution

Question

1 Approved Answer

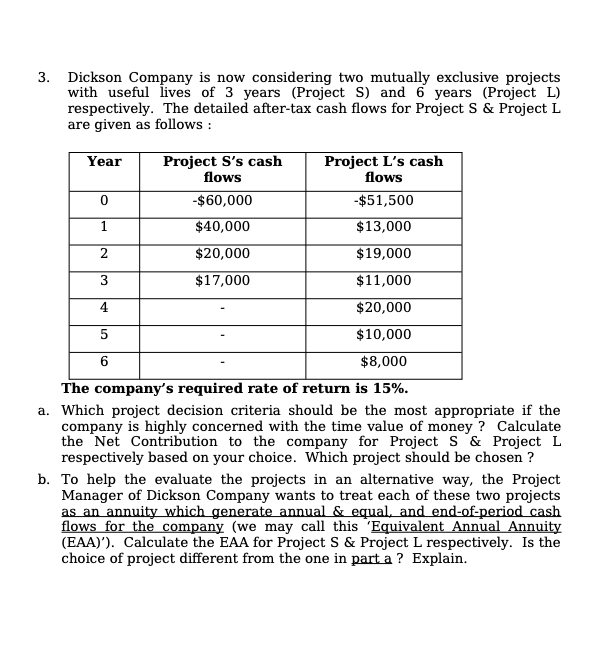

3. Dickson Company is now considering two mutually exclusive projects with useful lives of 3 years (Project S) and 6 years (Project L) respectively.

3. Dickson Company is now considering two mutually exclusive projects with useful lives of 3 years (Project S) and 6 years (Project L) respectively. The detailed after-tax cash flows for Project S & Project L are given as follows: Year Project L's cash flows -$51,500 $13,000 $19,000 $11,000 $20,000 $10,000 $8,000 The company's required rate of return is 15%. a. Which project decision criteria should be the most appropriate if the company is highly concerned with the time value of money? Calculate the Net Contribution to the company for Project S & Project L respectively based on your choice. Which project should be chosen ? 0 1 Project S's cash flows -$60,000 $40,000 $20,000 $17,000 2 3 4 5 6 b. To help the evaluate the projects in an alternative way, the Project Manager of Dickson Company wants to treat each of these two projects as an annuity which generate annual & equal, and end-of-period cash flows for the company (we may call this 'Equivalent Annual Annuity (EAA)'). Calculate the EAA for Project S & Project L respectively. Is the choice of project different from the one in part a ? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To address the question lets proceed step by step a The most appropriate project decision criteria for a company that is highly concerned with the tim...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started