Answered step by step

Verified Expert Solution

Question

1 Approved Answer

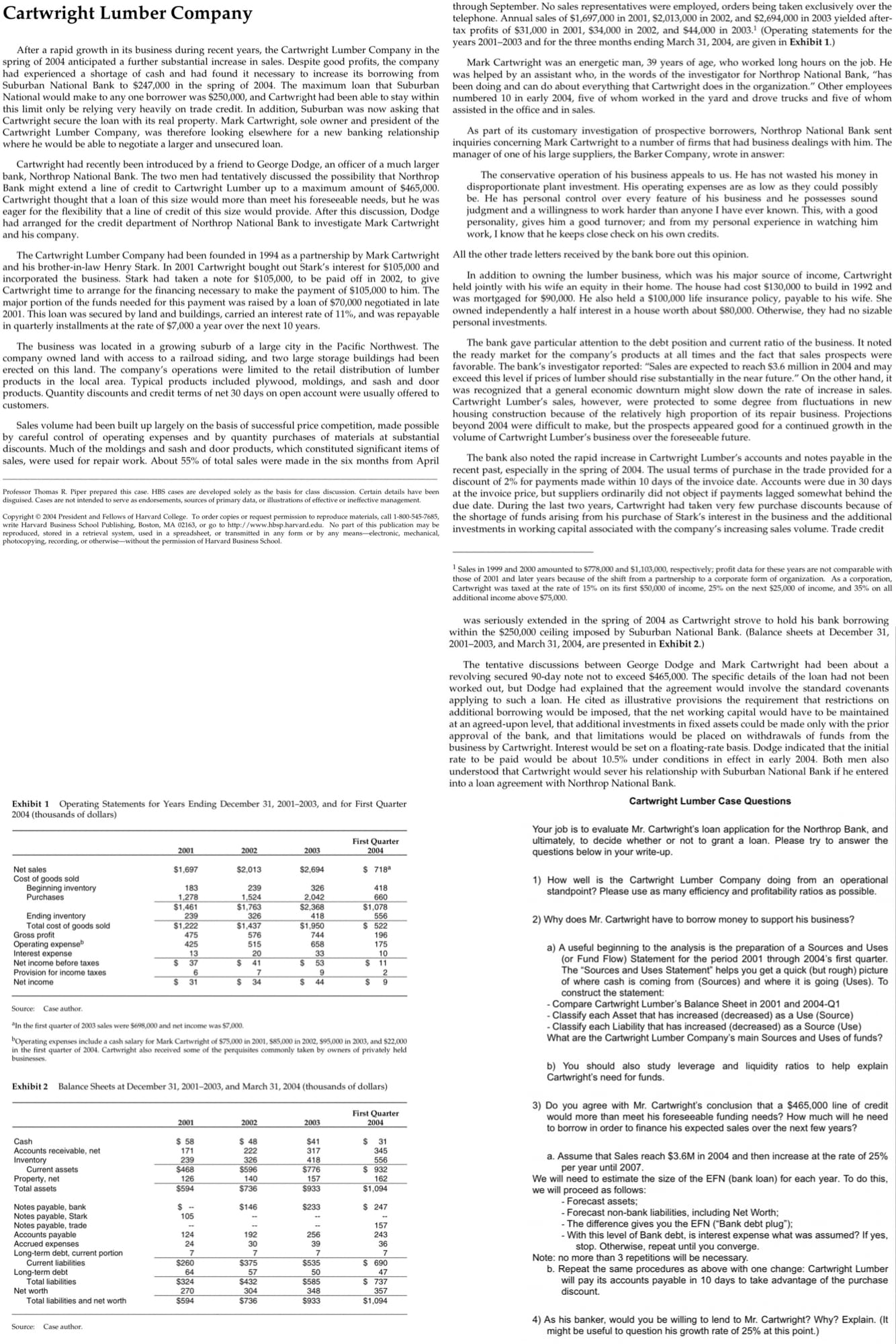

3 ) Do you agree with Mr . Cartwright s conclusion that a $ 4 6 5 , 0 0 0 line of credit would

Do you agree with Mr Cartwrights conclusion that a $ line of credit would more than meet his foreseeable funding needs? How much will he need to borrow in order to finance his expected sales over the next few years?

a Assume that Sales reach $M in and then increase at the rate of per year until

We will need to estimate the size of the EFN bank loan for each year. To do this, we will proceed as follows:

Forecast assets;

Forecast nonbank liabilities, including Net Worth;

The difference gives you the EFN Bank debt plug;

With this level of Bank debt, is interest expense what was assumed? If yes, stop. Otherwise, repeat until you converge.

Note: no more than repetitions will be necessary.

b Repeat the same procedures as above with one change: Cartwright Lumber will pay its accounts payable in days to take advantage of the purchase discount.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started