Answered step by step

Verified Expert Solution

Question

1 Approved Answer

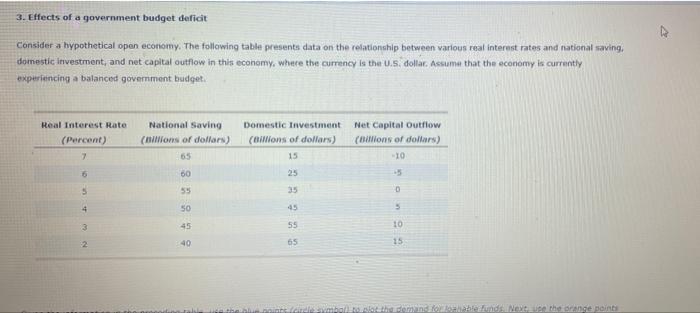

3. Effects of a government budget deficit Consider a hypothetical open economy. The following table presents data on the relationship between various real interest rates

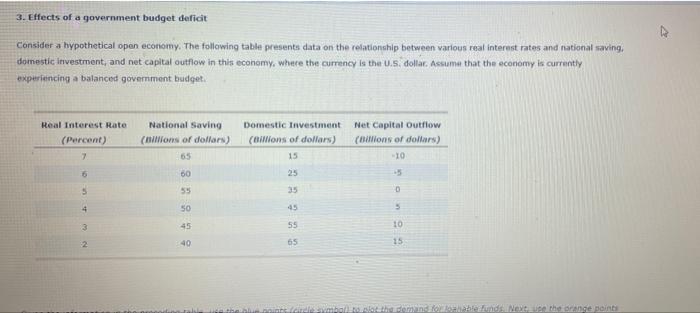

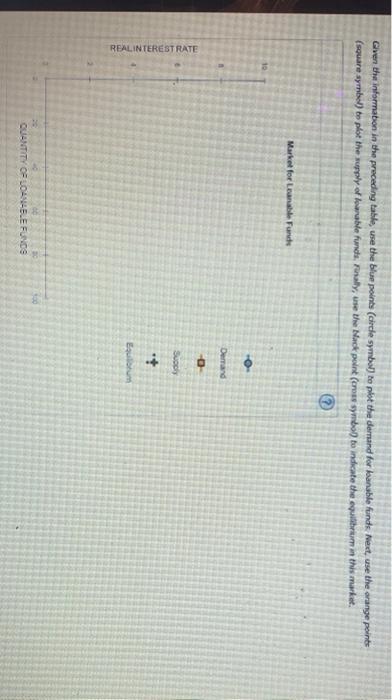

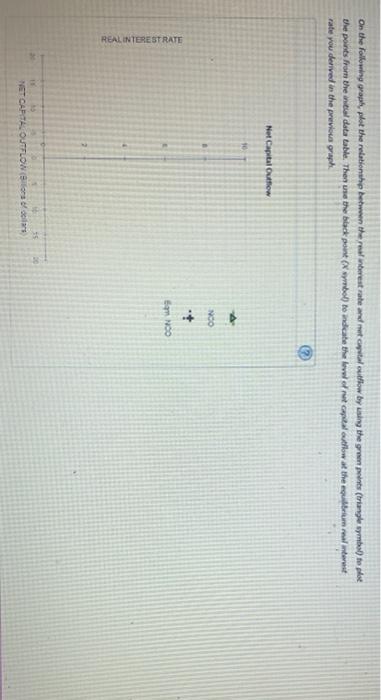

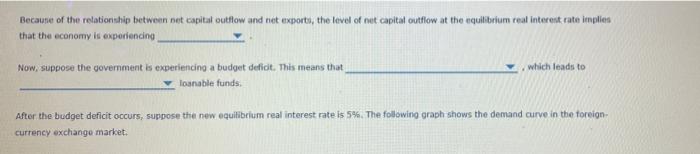

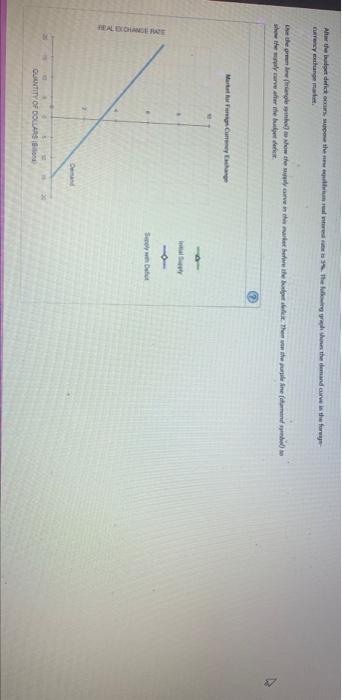

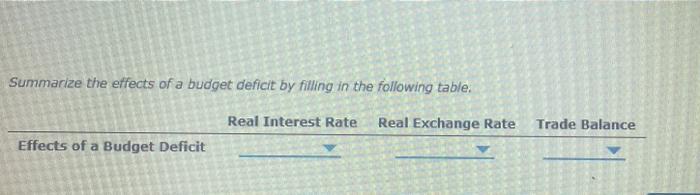

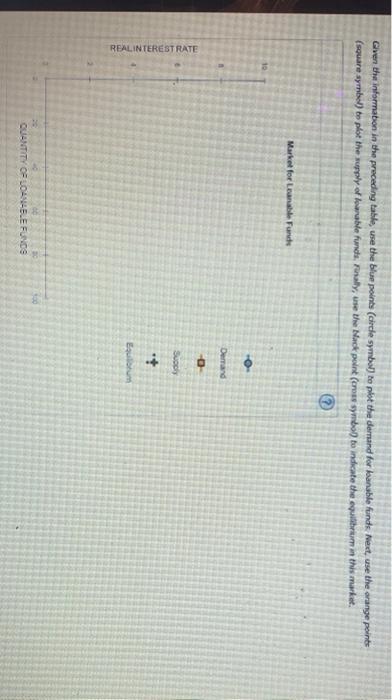

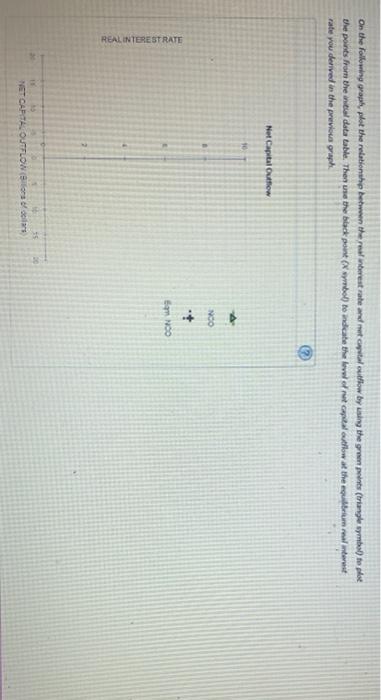

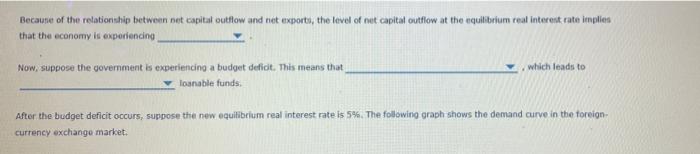

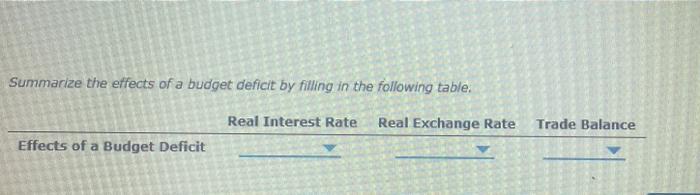

3. Effects of a government budget deficit Consider a hypothetical open economy. The following table presents data on the relationship between various real interest rates and national saving, domestic investment, and net capital outflow in this economy, where the currency is the U.S. dollar. Assume that the economy is currently experiencing a balanced government budget Real Interest Rate (Percent) 7 National Saving (millions of dollars) 65 Domestic Investment (Billions of dollars) 15 Net Capital Outflow (Billions of dollars) TO 60 5 55 35 0 4 50 45 5 3 45 55 10 2 40 65 15 ambathome theagent Given the information in the preceding table, use the blue points (circle symbol) to pot the demand for anable funds. Next, use the orange points (square symbol) to plot the supply of lowable fundsly, use the Mack point (cross symbol) to indicate the equilibrium in this market Market for Loanable Funds 10 - Demand 0 Sody REALINTEREST RATE + Gautatum GUANTITY OF LOLLE FUNDS On the following graph, plot the relationship between the real interest rate and not capital outflow by using the green points (triangle symbol) toplo the points from the newl data table. Then use the black point wynbol) doandicate the lower ret capital ollow at the equilibrium mal interest rate you derived in the previous graph Net Capital Outflow NOO + som NDO REAL INTEREST RATE NET CAPITAL OUTFLON (los dias Because of the relationship between net capital outflow and net exports, the level of net capital outflow at the equilibrium real interest rate imples that the economy is experiencing which leads to Now, suppose the government is experiencing a budget defidt. This means that loanable funds After the budget deficit occurs, suppose the new equilibrium real interest rate is 5%. The following graph shows the demand curve in the foreign currency exchange market, Nhur the budget delictes me the wenkbrun real witored in the king ya Whites the demand curs de forma y exchange Love the power remote contre este suvely care anche market beroru w kolore studies. There were the periode ine facturend ventil show the water the Martat SD ALL CHANGER QUANTITY OF DOLLARS Summarize the effects of a budget deficit by filling in the following table, Real Interest Rate Real Exchange Rate Trade Balance Effects of a Budget Deficit

3. Effects of a government budget deficit Consider a hypothetical open economy. The following table presents data on the relationship between various real interest rates and national saving, domestic investment, and net capital outflow in this economy, where the currency is the U.S. dollar. Assume that the economy is currently experiencing a balanced government budget Real Interest Rate (Percent) 7 National Saving (millions of dollars) 65 Domestic Investment (Billions of dollars) 15 Net Capital Outflow (Billions of dollars) TO 60 5 55 35 0 4 50 45 5 3 45 55 10 2 40 65 15 ambathome theagent Given the information in the preceding table, use the blue points (circle symbol) to pot the demand for anable funds. Next, use the orange points (square symbol) to plot the supply of lowable fundsly, use the Mack point (cross symbol) to indicate the equilibrium in this market Market for Loanable Funds 10 - Demand 0 Sody REALINTEREST RATE + Gautatum GUANTITY OF LOLLE FUNDS On the following graph, plot the relationship between the real interest rate and not capital outflow by using the green points (triangle symbol) toplo the points from the newl data table. Then use the black point wynbol) doandicate the lower ret capital ollow at the equilibrium mal interest rate you derived in the previous graph Net Capital Outflow NOO + som NDO REAL INTEREST RATE NET CAPITAL OUTFLON (los dias Because of the relationship between net capital outflow and net exports, the level of net capital outflow at the equilibrium real interest rate imples that the economy is experiencing which leads to Now, suppose the government is experiencing a budget defidt. This means that loanable funds After the budget deficit occurs, suppose the new equilibrium real interest rate is 5%. The following graph shows the demand curve in the foreign currency exchange market, Nhur the budget delictes me the wenkbrun real witored in the king ya Whites the demand curs de forma y exchange Love the power remote contre este suvely care anche market beroru w kolore studies. There were the periode ine facturend ventil show the water the Martat SD ALL CHANGER QUANTITY OF DOLLARS Summarize the effects of a budget deficit by filling in the following table, Real Interest Rate Real Exchange Rate Trade Balance Effects of a Budget Deficit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started