Question

3. Equity Method Investments (15 points) Lobo, Inc. acquired 25% of Bruin, Corp.s outstanding common stock by issuing Lobos common stock worth $125,000 (the par

3. Equity Method Investments (15 points)

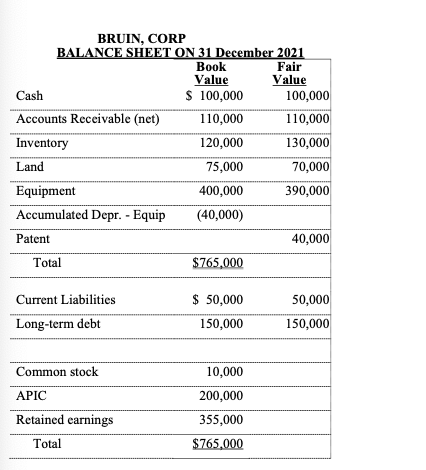

Lobo, Inc. acquired 25% of Bruin, Corp.s outstanding common stock by issuing Lobos common stock worth $125,000 (the par value of issued shares was $2,000) and paying $45,000 in cash on 31 December 2021 (in other words, Lobo exchanged its shares plus cash for shares of Bruin held by Bruins shareholders). Below is the balance sheet for Bruin (and the fair value of Bruins assets and liabilities) before the purchase:

During 2022, Bruin generated $120,000 in net income and declared and paid $30,000 in dividends.

Required:

a) Make Lobos journal entry to record the acquisition on 31 December 2021 and determine the implied goodwill from the acquisition. (5 pts)

b) Make all Lobos required journal entries for 2022, assuming the differential related to inventory will clear in 2022, the estimated remaining economic life of the depreciable assets is ten years, and the economic life of the patent is five years. (10 pts)

BRUIN. CORPStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started