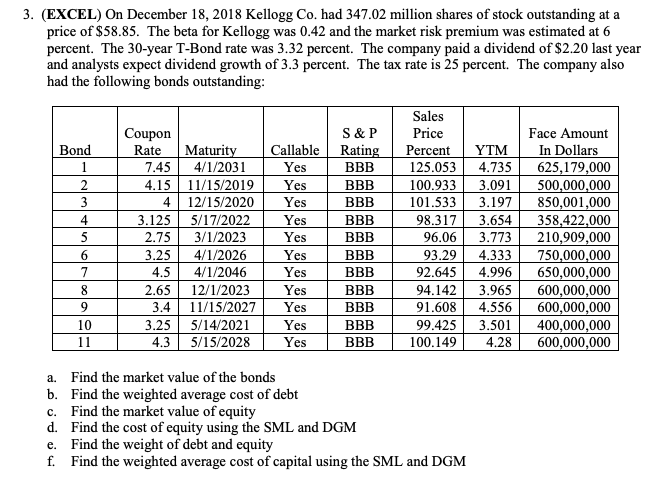

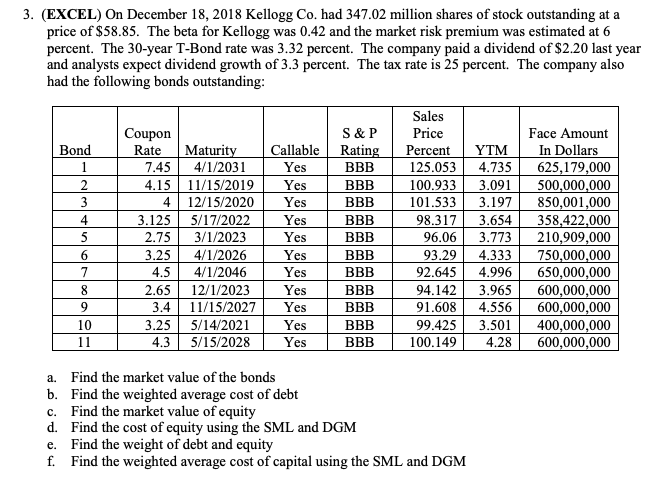

3. (EXCEL) On December 18, 2018 Kellogg Co. had 347.02 million shares of stock outstanding at a price of S58.85. The beta for Kellogg was 0.42 and the market risk premium was estimated at 6 percent. The 30-year T-Bond rate was 3.32 percent. The company paid a dividend of $2.20 last year and analysts expect dividend growth of 3.3 percent. The tax rate is 25 percent. The company also had the following bonds outstanding Sales Price Coupon S & P Face Amount Bond Rate Maturit Callable Ratin PercentYTM In Dollars 7.45 4/1/2031 Yes 4.15 11/15/2019Yes 4 12/15/2020 Yes Yes Yes Yes Yes Yes 3.411/15/2027 Yes Yes Yes 125.0534.735625,179,000 00.933 3.09 500,000,000 101.5333.197850,001,000 98.3173.654 358,422,000 96.063.773210,909,000 93.29 4.333750,000,000 92.645 4.996650,000,000 94.142 3.965600,000,000 91.6084.556600,000,000 99.425 3.501400,000,000 100.1494.28 600,000,000 3.125 5/17/2022 2.75 3/1/2023 3.25 4/1/2026 4.5 4/1/2046 4 2.65 12/1/2023 3.25 5/14/2021 4.35/15/2028 a. b. c. d. e. f. Find the market value of the bonds Find the weighted average cost of debt Find the market value of equity Find the cost of equity using the SML and DGM Find the weight of debt and equity Find the weighted average cost of capital using the SML and DGM 3. (EXCEL) On December 18, 2018 Kellogg Co. had 347.02 million shares of stock outstanding at a price of S58.85. The beta for Kellogg was 0.42 and the market risk premium was estimated at 6 percent. The 30-year T-Bond rate was 3.32 percent. The company paid a dividend of $2.20 last year and analysts expect dividend growth of 3.3 percent. The tax rate is 25 percent. The company also had the following bonds outstanding Sales Price Coupon S & P Face Amount Bond Rate Maturit Callable Ratin PercentYTM In Dollars 7.45 4/1/2031 Yes 4.15 11/15/2019Yes 4 12/15/2020 Yes Yes Yes Yes Yes Yes 3.411/15/2027 Yes Yes Yes 125.0534.735625,179,000 00.933 3.09 500,000,000 101.5333.197850,001,000 98.3173.654 358,422,000 96.063.773210,909,000 93.29 4.333750,000,000 92.645 4.996650,000,000 94.142 3.965600,000,000 91.6084.556600,000,000 99.425 3.501400,000,000 100.1494.28 600,000,000 3.125 5/17/2022 2.75 3/1/2023 3.25 4/1/2026 4.5 4/1/2046 4 2.65 12/1/2023 3.25 5/14/2021 4.35/15/2028 a. b. c. d. e. f. Find the market value of the bonds Find the weighted average cost of debt Find the market value of equity Find the cost of equity using the SML and DGM Find the weight of debt and equity Find the weighted average cost of capital using the SML and DGM