Answered step by step

Verified Expert Solution

Question

1 Approved Answer

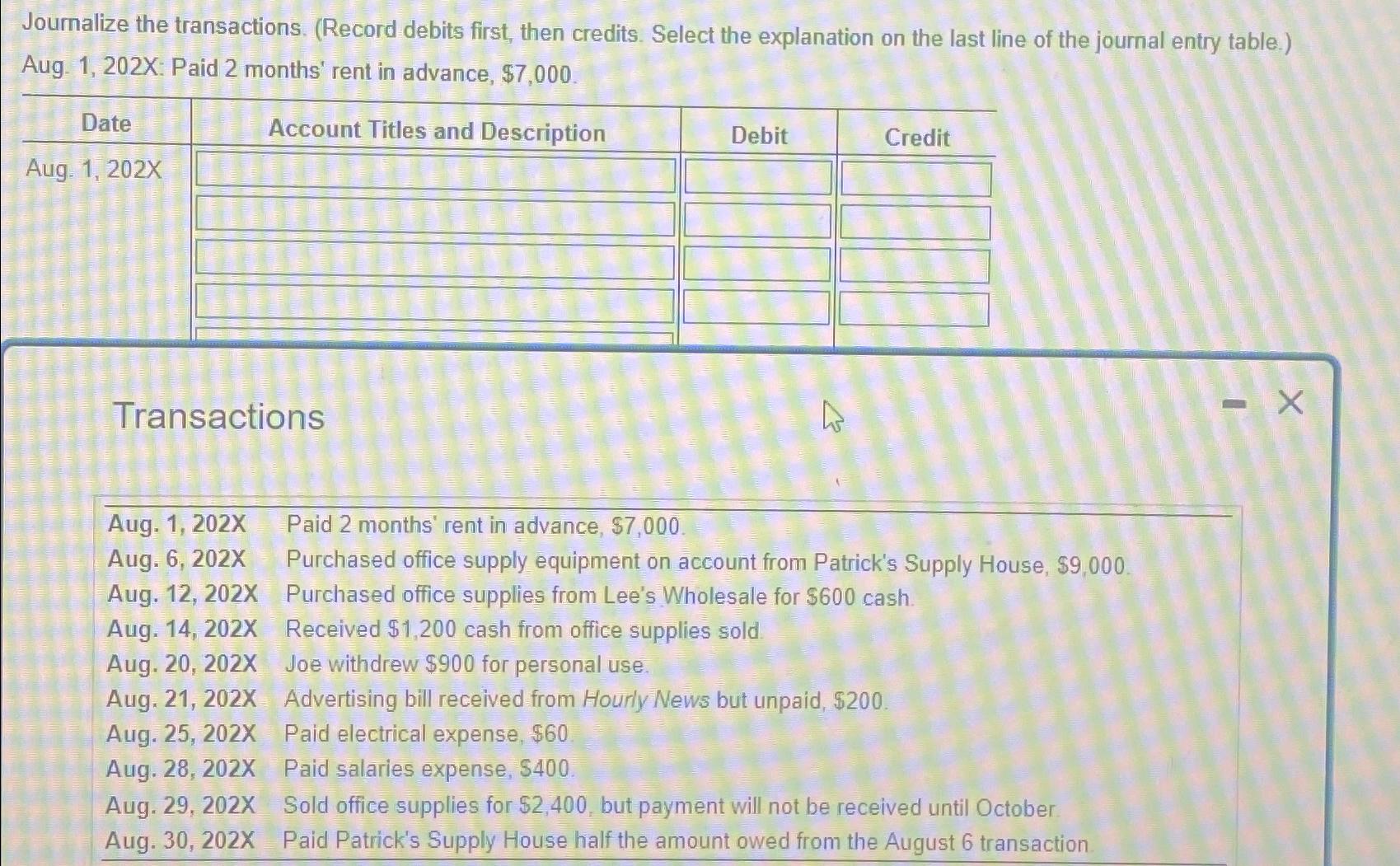

Journalize the transactions. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Aug. 1, 202X: Paid

Journalize the transactions. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Aug. 1, 202X: Paid 2 months' rent in advance, $7,000. Date Aug. 1, 202X Account Titles and Description Transactions Debit Credit Aug. 1, 202X Paid 2 months' rent in advance, $7,000. Aug. 6, 202X Aug. 12, 202X Aug. 14, 202X Aug. 20, 202X Purchased office supply equipment on account from Patrick's Supply House, $9,000. Purchased office supplies from Lee's Wholesale for $600 cash. Received $1,200 cash from office supplies sold. Joe withdrew $900 for personal use. Aug. 21, 202X Aug. 25, 202X Advertising bill received from Hourly News but unpaid, $200. Paid electrical expense, $60. Aug. 28, 202X Aug. 29, 202X Aug. 30, 202X Paid salaries expense, $400. Sold office supplies for $2,400, but payment will not be received until October Paid Patrick's Supply House half the amount owed from the August 6 transaction - X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image is a bit blurry but it shows a list of transactions that need to be journalized in doubleentry bookkeeping format Doubleentry bookkeeping re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started