Answered step by step

Verified Expert Solution

Question

1 Approved Answer

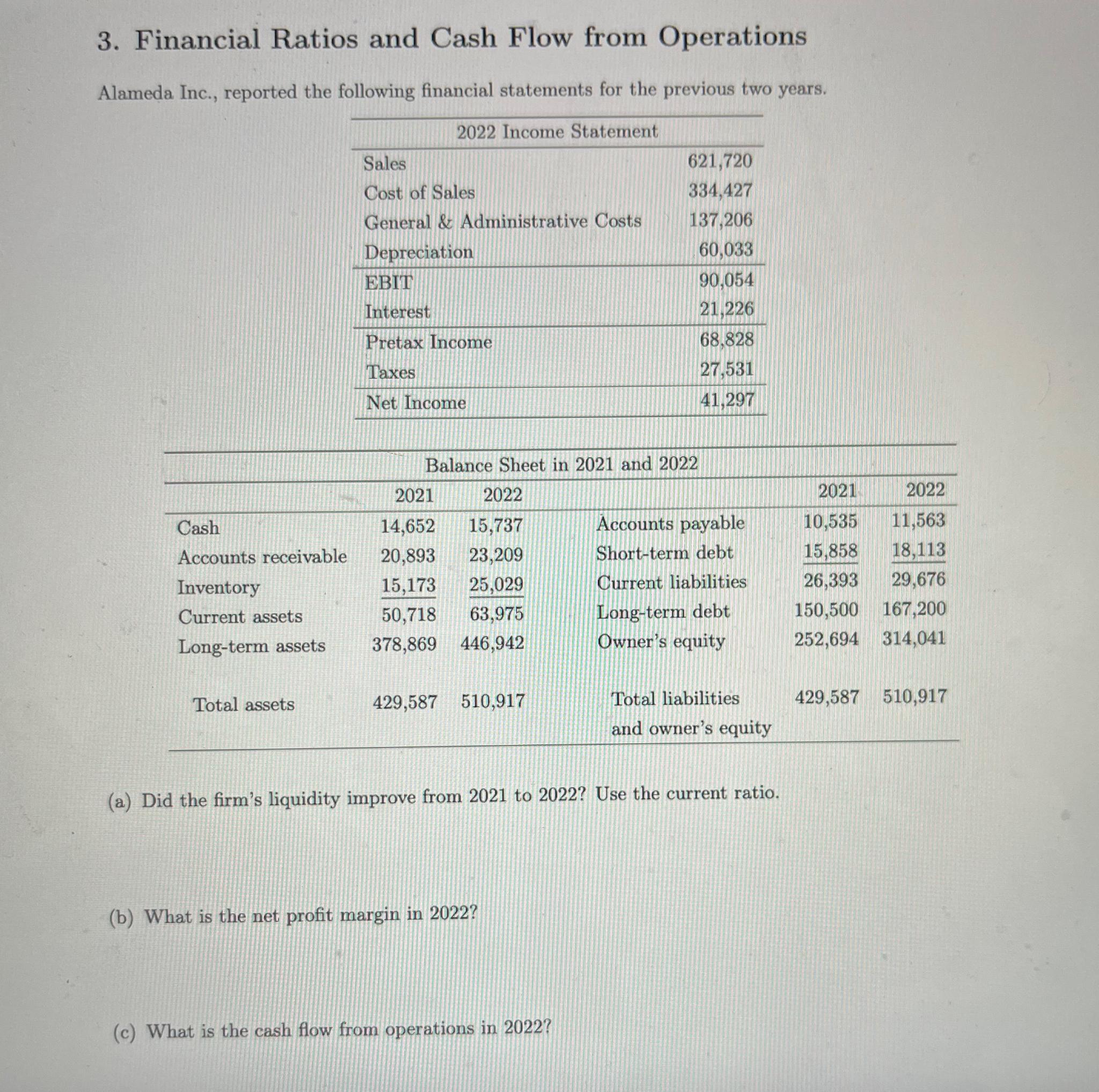

3. Financial Ratios and Cash Flow from Operations Alameda Inc., reported the following financial statements for the previous two years. 2022 Income Statement Sales

3. Financial Ratios and Cash Flow from Operations Alameda Inc., reported the following financial statements for the previous two years. 2022 Income Statement Sales 621,720 Cost of Sales 334,427 General & Administrative Costs 137,206 Depreciation 60,033 EBIT 90,054 Interest 21,226 Pretax Income 68,828 Taxes 27,531 Net Income 41,297 Balance Sheet in 2021 and 2022 2021 2022 2021 2022 Cash 14,652 15,737 Accounts receivable 20,893 Inventory Current assets Long-term assets 23,209 15,173 25,029 50,718 63,975 378,869 446,942 Accounts payable Short-term debt Current liabilities Long-term debt Owner's equity 10,535 11,563 15,858 18,113 26,393 29,676 150,500 167,200 252,694 314,041 Total assets 429,587 510,917 Total liabilities and owner's equity 429,587 510,917 (a) Did the firm's liquidity improve from 2021 to 2022? Use the current ratio. (b) What is the net profit margin in 2022? (c) What is the cash flow from operations in 2022?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine if the firms liquidity improved from 2021 to 2022 we will calculate the current ratio ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started