Question

3. For each line item under expenses that is classified as semi-variable, use simple regression analysis with revenue hours as the cost driver to determine

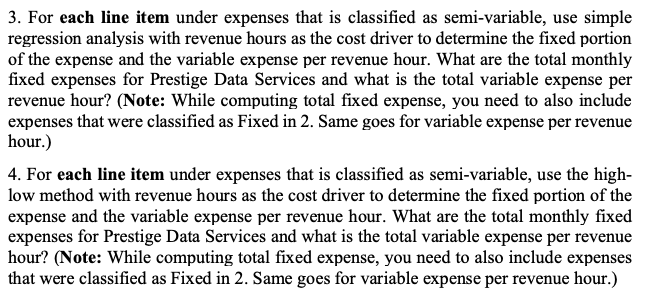

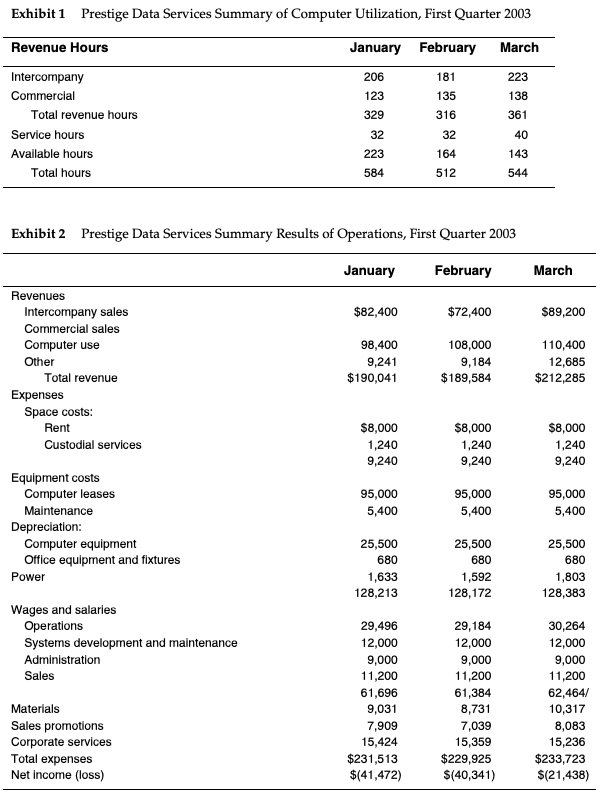

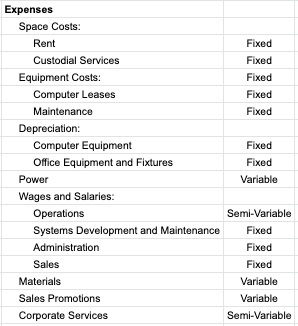

3. For each line item under expenses that is classified as semi-variable, use simple regression analysis with revenue hours as the cost driver to determine the fixed portion of the expense and the variable expense per revenue hour. What are the total monthly fixed expenses for Prestige Data Services and what is the total variable expense per revenue hour? (NOTE: While computing total fixed expenses, you need to also include expenses that were classified as Fixed in 2. Same goes for variable expense per revenue hour.)

4. For each line item under expenses that is classified as semi-variable, use the high-low method with revenue hours as the cost driver to determine the fixed portion of the expense and the variable expense per revenue hour. What are the total monthly fixed expenses for Prestige Data Services and what is the total variable expense per revenue hour? (NOTE: While computing total fixed expense, you need to also include expenses that were classified as Fixed in 2. Same goes for variable expense per revenue hour.)

3. For each line item under expenses that is classified as semi-variable, use simple regression analysis with revenue hours as the cost driver to determine the fixed portion of the expense and the variable expense per revenue hour. What are the total monthly fixed expenses for Prestige Data Services and what is the total variable expense per revenue hour? (Note: While computing total fixed expense, you need to also include expenses that were classified as Fixed in 2. Same goes for variable expense per revenue hour.) 4. For each line item under expenses that is classified as semi-variable, use the high- low method with revenue hours as the cost driver to determine the fixed portion of the expense and the variable expense per revenue hour. What are the total monthly fixed expenses for Prestige Data Services and what is the total variable expense per revenue hour? (Note: While computing total fixed expense, you need to also include expenses that were classified as Fixed in 2. Same goes for variable expense per revenue hour.) Exhibit 1 Prestige Data Services Summary of Computer Utilization, First Quarter 2003 Revenue Hours January February March 206 181 223 316 361 Intercompany Commercial Total revenue hours Service hours Available hours Total hours 584 512 544 Exhibit 2 Prestige Data Services Summary Results of Operations, First Quarter 2003 January February March $82,400 $72,400 $89,200 Revenues Intercompany sales Commercial sales Computer use Other Total revenue Expenses Space costs: Rent Custodial services 98,400 9,241 $190,041 108,000 9,184 $189,584 110,400 12,685 $212,285 $8,000 1,240 9,240 $8,000 1,240 9,240 $8,000 1,240 9,240 95,000 5,400 95,000 5,400 95,000 5,400 Equipment costs Computer leases Maintenance Depreciation: Computer equipment Office equipment and fixtures Power 25,500 680 1,633 128,213 25,500 680 1,592 128,172 25,500 680 1,803 128,383 Wages and salaries Operations Systems development and maintenance Administration Sales 29,496 12,000 9,000 11,200 61,696 9,031 7,909 15,424 $231,513 $(41,472) 29,184 12,000 9,000 11,200 61,384 8,731 7,039 15,359 $229,925 $(40,341) 30,264 12,000 9,000 11,200 62,464/ 10,317 8,083 15,236 $233,723 $(21,438) Materials Sales promotions Corporate services Total expenses Net Income (loss) Fixed Fixed Fixed Fixed Fixed Expenses Space Costs: Rent Custodial Services Equipment Costs: Computer Leases Maintenance Depreciation: Computer Equipment Office Equipment and Fixtures Power Wages and Salaries: Operations Systems Development and Maintenance Administration Sales Materials Sales Promotions Corporate Services Fixed Fixed Variable Semi-Variable Fixed Fixed Fixed Variable Variable Semi-Variable 3. For each line item under expenses that is classified as semi-variable, use simple regression analysis with revenue hours as the cost driver to determine the fixed portion of the expense and the variable expense per revenue hour. What are the total monthly fixed expenses for Prestige Data Services and what is the total variable expense per revenue hour? (Note: While computing total fixed expense, you need to also include expenses that were classified as Fixed in 2. Same goes for variable expense per revenue hour.) 4. For each line item under expenses that is classified as semi-variable, use the high- low method with revenue hours as the cost driver to determine the fixed portion of the expense and the variable expense per revenue hour. What are the total monthly fixed expenses for Prestige Data Services and what is the total variable expense per revenue hour? (Note: While computing total fixed expense, you need to also include expenses that were classified as Fixed in 2. Same goes for variable expense per revenue hour.) Exhibit 1 Prestige Data Services Summary of Computer Utilization, First Quarter 2003 Revenue Hours January February March 206 181 223 316 361 Intercompany Commercial Total revenue hours Service hours Available hours Total hours 584 512 544 Exhibit 2 Prestige Data Services Summary Results of Operations, First Quarter 2003 January February March $82,400 $72,400 $89,200 Revenues Intercompany sales Commercial sales Computer use Other Total revenue Expenses Space costs: Rent Custodial services 98,400 9,241 $190,041 108,000 9,184 $189,584 110,400 12,685 $212,285 $8,000 1,240 9,240 $8,000 1,240 9,240 $8,000 1,240 9,240 95,000 5,400 95,000 5,400 95,000 5,400 Equipment costs Computer leases Maintenance Depreciation: Computer equipment Office equipment and fixtures Power 25,500 680 1,633 128,213 25,500 680 1,592 128,172 25,500 680 1,803 128,383 Wages and salaries Operations Systems development and maintenance Administration Sales 29,496 12,000 9,000 11,200 61,696 9,031 7,909 15,424 $231,513 $(41,472) 29,184 12,000 9,000 11,200 61,384 8,731 7,039 15,359 $229,925 $(40,341) 30,264 12,000 9,000 11,200 62,464/ 10,317 8,083 15,236 $233,723 $(21,438) Materials Sales promotions Corporate services Total expenses Net Income (loss) Fixed Fixed Fixed Fixed Fixed Expenses Space Costs: Rent Custodial Services Equipment Costs: Computer Leases Maintenance Depreciation: Computer Equipment Office Equipment and Fixtures Power Wages and Salaries: Operations Systems Development and Maintenance Administration Sales Materials Sales Promotions Corporate Services Fixed Fixed Variable Semi-Variable Fixed Fixed Fixed Variable Variable Semi-VariableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started