Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(3) For each part of this question include a precise explanation to a maximum of 5 lines. a. (5 marks) A firm whose sales revenues

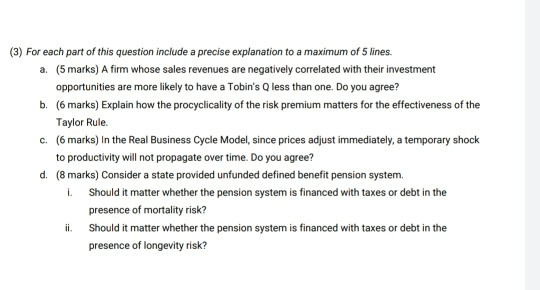

(3) For each part of this question include a precise explanation to a maximum of 5 lines. a. (5 marks) A firm whose sales revenues are negatively correlated with their investment opportunities are more likely to have a Tobin's Q less than one. Do you agree? b. (6 marks) Explain how the procyclicality of the risk premium matters for the effectiveness of the Taylor Rule. C. (6 marks) In the Real Business Cycle Model, since prices adjust immediately, a temporary shock to productivity will not propagate over time. Do you agree? d. (8 marks) Consider a state provided unfunded defined benefit pension system. Should it matter whether the pension system is financed with taxes or debt in the presence of mortality risk? Should it matter whether the pension system is financed with taxes or debt in the presence of longevity risk? 1 (3) For each part of this question include a precise explanation to a maximum of 5 lines. a. (5 marks) A firm whose sales revenues are negatively correlated with their investment opportunities are more likely to have a Tobin's Q less than one. Do you agree? b. (6 marks) Explain how the procyclicality of the risk premium matters for the effectiveness of the Taylor Rule. C. (6 marks) In the Real Business Cycle Model, since prices adjust immediately, a temporary shock to productivity will not propagate over time. Do you agree? d. (8 marks) Consider a state provided unfunded defined benefit pension system. Should it matter whether the pension system is financed with taxes or debt in the presence of mortality risk? Should it matter whether the pension system is financed with taxes or debt in the presence of longevity risk? 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started