Answered step by step

Verified Expert Solution

Question

1 Approved Answer

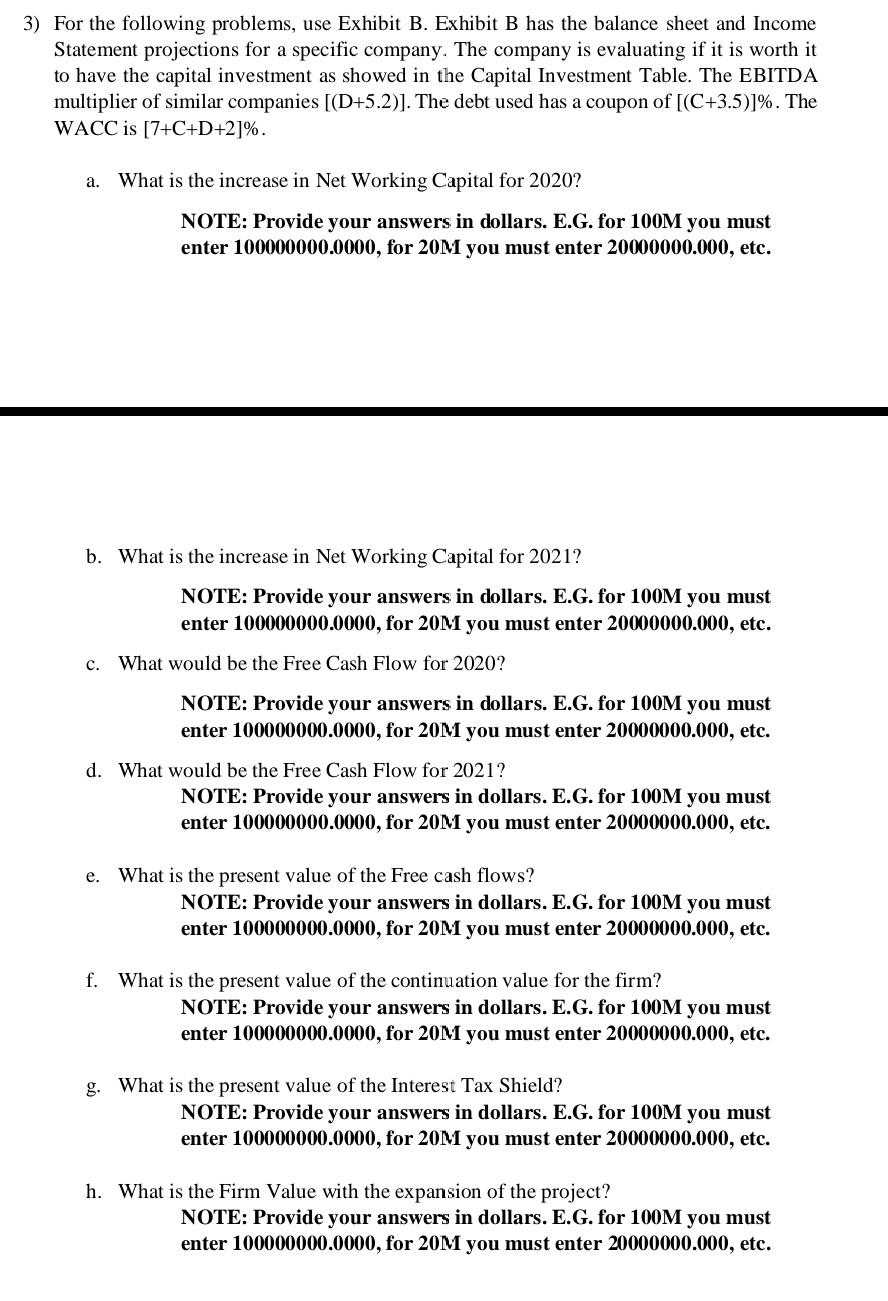

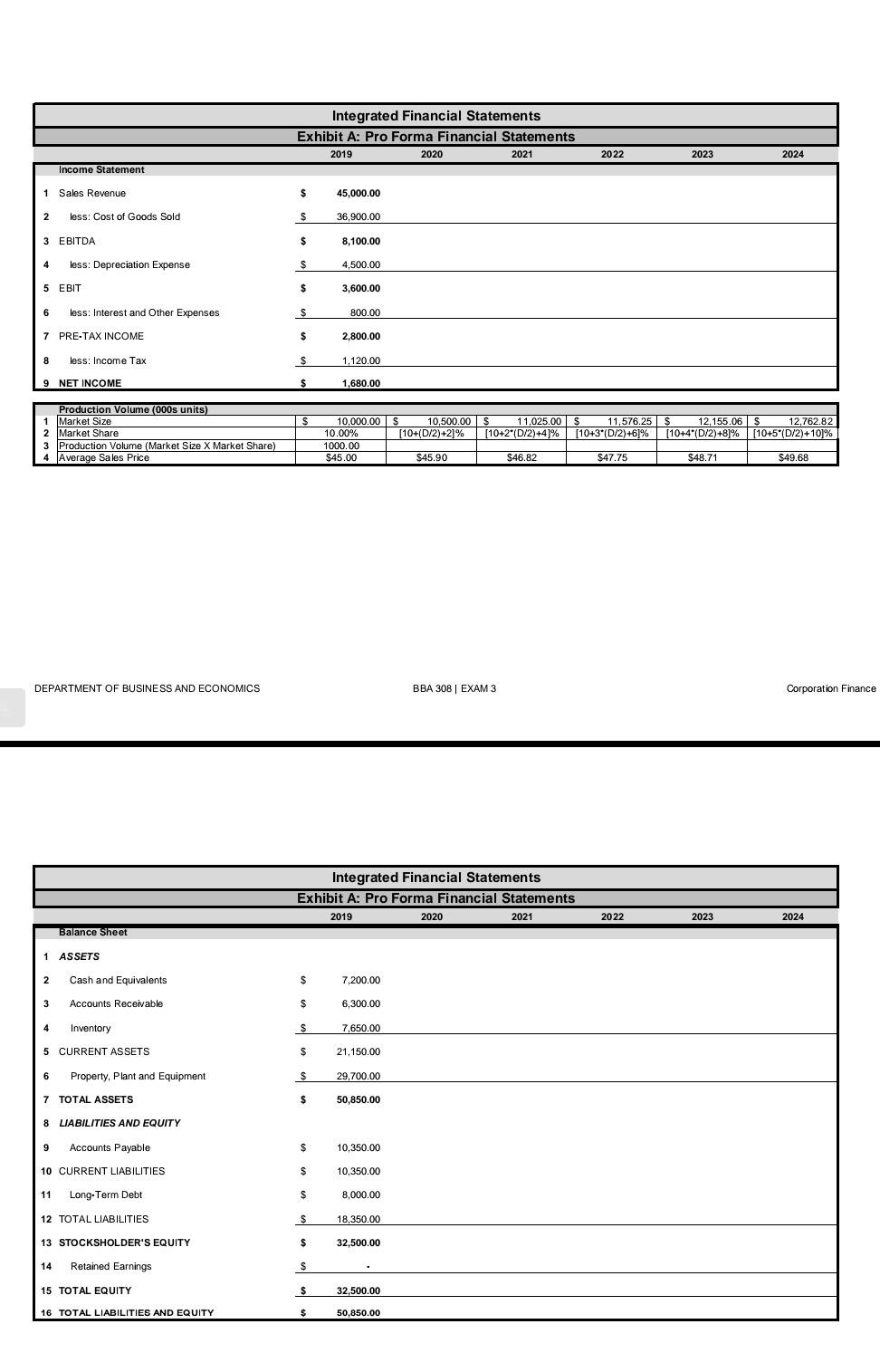

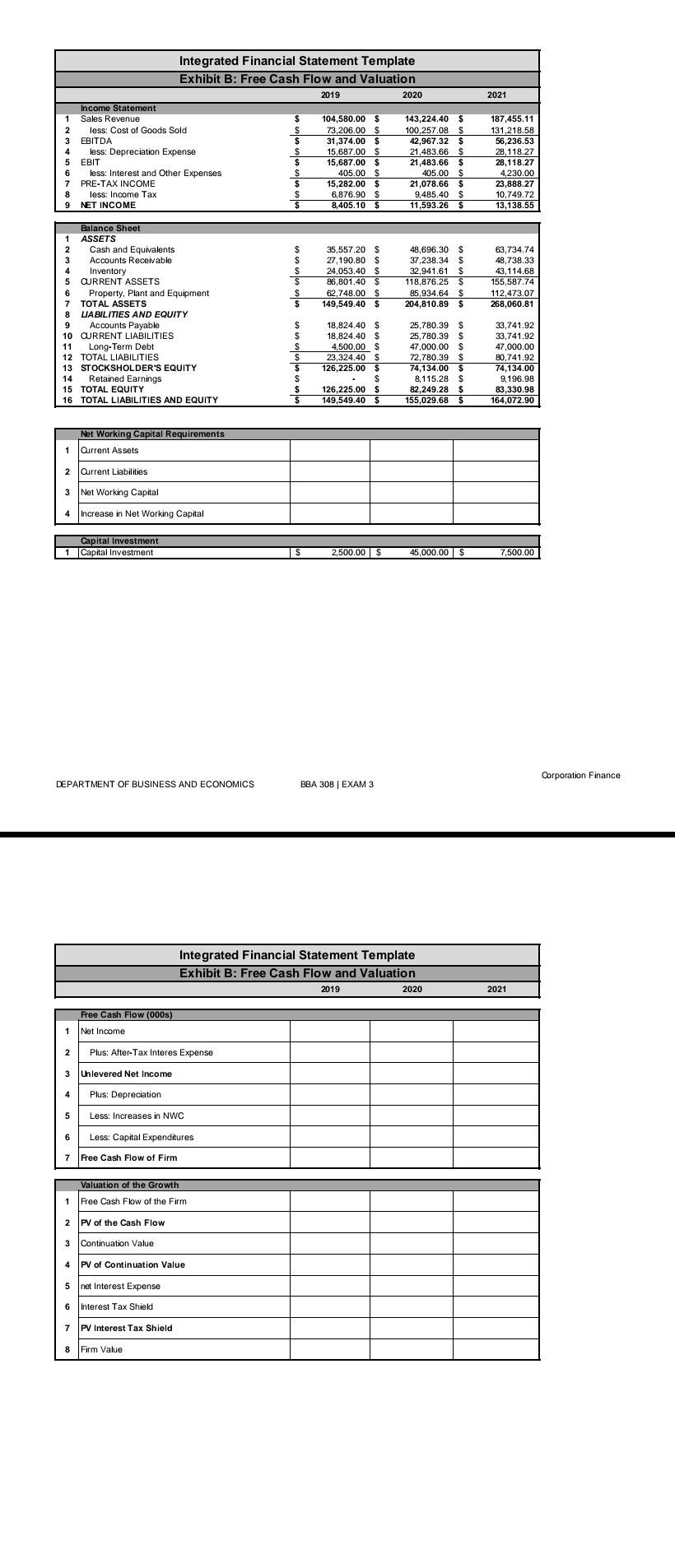

3) For the following problems, use Exhibit B. Exhibit B has the balance sheet and Income Statement projections for a specific company. The company is

3) For the following problems, use Exhibit B. Exhibit B has the balance sheet and Income Statement projections for a specific company. The company is evaluating if it is worth it to have the capital investment as showed in the Capital Investment Table. The EBITDA multiplier of similar companies [CD+5.2)]. The debt used has a coupon of [(C+3.5))%. The WACC is [7+C+D+2]%. a. What is the increase in Net Working Capital for 2020? NOTE: Provide your answers in dollars. E.G. for 100M you must enter 100000000.0000, for 20M you must enter 20000000.000, etc. b. What is the increase in Net Working Capital for 2021? NOTE: Provide your answers in dollars. E.G. for 100M you must enter 100000000.0000, for 20M you must enter 20000000.000, etc. C. What would be the Free Cash Flow for 2020? NOTE: Provide your answers in dollars. E.G. for 100M you must enter 100000000.0000, for 20M you must enter 20000000.000, etc. d. What would be the Free Cash Flow for 2021? NOTE: Provide your answers in dollars. E.G. for 100M you must enter 100000000.0000, for 20M you must enter 20000000.000, etc. e. is the present value of the Free cash flows? NOTE: Provide your answers in dollars. E.G. for 100M you must enter 100000000.0000, for 20M you must enter 20000000.000, etc. f. What is the present value of the continuation value for the firm? NOTE: Provide your answers in dollars. E.G. for 100M you must enter 100000000.0000, for 20M you must enter 20000000.000, etc. g. What is the present value of the Interest Tax Shield? NOTE: Provide your answers in dollars. E.G. for 100M you must enter 100000000.0000, for 20M you must enter 20000000.000, etc. h. What is the Firm Value with the expansion of the project? NOTE: Provide your answers in dollars. E.G. for 100M you must enter 100000000.0000, for 20M you must enter 20000000.000, etc. Integrated Financial Statements Exhibit A: Pro Forma Financial Statements 2019 2020 2021 2022 2023 2024 Income Statement 1 Sales Revenue $ 45,000.00 2 less: Cost of Goods Sold $ 36,900.00 3 EBITDA $ 8,100.00 4 less: Depreciation Expense $ 4,500.00 5 EBIT $ 3,600.00 less: Interest and Other Expenses S 800.00 7 PRE-TAX INCOME $ 2,800.00 8 less: Income Tax $ 1,120.00 9 NET INCOME $ 1,680.00 Production Volume (000s units) 1 Market Size 2 Market Share 3 Production Volume (Market Size X Market Share) 4 Average Sales Price 10,000.00 10.00% 1000.00 $45.00 $ 10,500.00 S 11,025.00 S 11,576.25 $ 12,155.06 S 12.762.82 [10+(D/2)+21% [10+2*(D/2)+4]% [10+3*(D/2)+6]% [10+4*(D/2)+81% [10+5(D/2)+10]% $45.90 $46.82 $47.75 $48.71 $49.68 DEPARTMENT OF BUSINESS AND ECONOMICS BBA 308 | EXAM 3 Corporation Finance Integrated Financial Statements Exhibit A: Pro Forma Financial Statements 2019 2020 2021 2022 2023 2024 Balance Sheet 1 ASSETS 2 Cash and Equivalents $ 7,200.00 3 Accounts Receivable $ 6,300.00 4 Inventory $ 7,650.00 5 CURRENT ASSETS $ 21,150.00 6 Property, Plant and Equipment $ 29,700.00 7 TOTAL ASSETS $ 50,850.00 8 LIABILITIES AND EQUITY 9 Accounts Payable $ 10.350.00 10 CURRENT LIABILITIES $ 10,350.00 11 Long-Term Debt $ 8,000.00 12 TOTAL LIABILITIES $ 18,350.00 13 STOCKSHOLDER'S EQUITY $ 32,500.00 14 Retained Earnings $ 15 TOTAL EQUITY S 32,500.00 16 TOTAL LIABILITIES AND EQUITY $ 50,850.00 2021 O NOUAWN Integrated Financial Statement Template Exhibit B: Free Cash Flow and Valuation 2019 2020 Income Statement 1 Sales Revenue 104,580.00 143,224.40 S less: Cost of Goods Sold 73,206.00 $ 100,257.08 S EBITDA 31,374.00 $ 42,967.32 S less: Depreciation Expense 15,687.00 $ 21,483.66 $ 5 EBIT $ 15,687.00 $ 21,483.66 s less: Interest and Other Expenses 405.00 $ 405.00 $ 7 PRE-TAX INCOME 15,282.00 $ 21,078.66 s less: Income Tax 6,876.90 $ 9,485.40 $ NET INCOME 8,405.10 11,593.26 187,455.11 131,218.58 56,236.53 28,118.27 28,118.27 4230.00 23,888.27 10,749.72 13,138.55 35,557.20 $ 27,190.80 $ 24,053.40 $ 86,801.40 $ 62,748.00 $ 149,549.40 $ 48,696.30 $ 37.238.34 S 32,941.61 $ 118,876.25 S 85,934.64 $ 204,810.89 $ 63,734,74 48,738.33 43,114.68 155,587.74 112,473.07 268,060.81 Balance Sheet 1 ASSETS Cash and Equivalents Accounts Receivable Inventory 5 CURRENT ASSETS 6 Property, Plant and Equipment 7 TOTAL ASSETS 8 LABILITIES AND EQUITY 9 Accounts Payable 10 CURRENT LIABILITIES 11 Long-Term Debt 12 TOTAL LIABILITIES 13 STOCKSHOLDER'S EQUITY 14 Retained Earnings 15 TOTAL EQUITY 16 TOTAL LIABILITIES AND EQUITY $ S 18,824.40 $ 18,824.40 $ 4,500.00 $ 23,324.40 S 126,225.00 $ $ 126,225.00 $ 149,549.40 $ 25,780.39 S 25,780.39 $ 47,000.00 S 72,780.39 $ 74,134.00 $ 8,115.28 $ 82,249.28 $ 155,029.68 $ 33.741.92 33,741.92 47,000.00 80,741.92 74,134.00 9.196.98 83,330,98 164,072.90 $ Net Working Capital Requirements Current Assets 2 Current Liabilities 3 Net Working Capital 4 Increase in Net Working Capital Capital Investment 1 Capital Investment $ 2,500.00 45,000.00 S 7,500.00 Corporation Finance DEPARTMENT OF BUSINESS AND ECONOMICS BBA 308 | EXAM 3 Integrated Financial Statement Template Exhibit B: Free Cash Flow and Valuation 2019 2020 2021 Free Cash Flow (000s) 1 Net Income 2 Plus: After-Tax Interes Expense Unlevered Net Income 4 Plus: Depreciation 5 Less: Increases in NWC 6 Less: Capital Expenditures 7 Free Cash Flow of Firm Valuation of the Growth 1 Free Cash Flow of the Firm 2 PV of the Cash Flow 3 Continuation Value 4 PV of Continuation Value 5 net Interest Expense 6 Interest Tax Shield 7 PV Interest Tax Shield 8 Firm Value 3) For the following problems, use Exhibit B. Exhibit B has the balance sheet and Income Statement projections for a specific company. The company is evaluating if it is worth it to have the capital investment as showed in the Capital Investment Table. The EBITDA multiplier of similar companies [CD+5.2)]. The debt used has a coupon of [(C+3.5))%. The WACC is [7+C+D+2]%. a. What is the increase in Net Working Capital for 2020? NOTE: Provide your answers in dollars. E.G. for 100M you must enter 100000000.0000, for 20M you must enter 20000000.000, etc. b. What is the increase in Net Working Capital for 2021? NOTE: Provide your answers in dollars. E.G. for 100M you must enter 100000000.0000, for 20M you must enter 20000000.000, etc. C. What would be the Free Cash Flow for 2020? NOTE: Provide your answers in dollars. E.G. for 100M you must enter 100000000.0000, for 20M you must enter 20000000.000, etc. d. What would be the Free Cash Flow for 2021? NOTE: Provide your answers in dollars. E.G. for 100M you must enter 100000000.0000, for 20M you must enter 20000000.000, etc. e. is the present value of the Free cash flows? NOTE: Provide your answers in dollars. E.G. for 100M you must enter 100000000.0000, for 20M you must enter 20000000.000, etc. f. What is the present value of the continuation value for the firm? NOTE: Provide your answers in dollars. E.G. for 100M you must enter 100000000.0000, for 20M you must enter 20000000.000, etc. g. What is the present value of the Interest Tax Shield? NOTE: Provide your answers in dollars. E.G. for 100M you must enter 100000000.0000, for 20M you must enter 20000000.000, etc. h. What is the Firm Value with the expansion of the project? NOTE: Provide your answers in dollars. E.G. for 100M you must enter 100000000.0000, for 20M you must enter 20000000.000, etc. Integrated Financial Statements Exhibit A: Pro Forma Financial Statements 2019 2020 2021 2022 2023 2024 Income Statement 1 Sales Revenue $ 45,000.00 2 less: Cost of Goods Sold $ 36,900.00 3 EBITDA $ 8,100.00 4 less: Depreciation Expense $ 4,500.00 5 EBIT $ 3,600.00 less: Interest and Other Expenses S 800.00 7 PRE-TAX INCOME $ 2,800.00 8 less: Income Tax $ 1,120.00 9 NET INCOME $ 1,680.00 Production Volume (000s units) 1 Market Size 2 Market Share 3 Production Volume (Market Size X Market Share) 4 Average Sales Price 10,000.00 10.00% 1000.00 $45.00 $ 10,500.00 S 11,025.00 S 11,576.25 $ 12,155.06 S 12.762.82 [10+(D/2)+21% [10+2*(D/2)+4]% [10+3*(D/2)+6]% [10+4*(D/2)+81% [10+5(D/2)+10]% $45.90 $46.82 $47.75 $48.71 $49.68 DEPARTMENT OF BUSINESS AND ECONOMICS BBA 308 | EXAM 3 Corporation Finance Integrated Financial Statements Exhibit A: Pro Forma Financial Statements 2019 2020 2021 2022 2023 2024 Balance Sheet 1 ASSETS 2 Cash and Equivalents $ 7,200.00 3 Accounts Receivable $ 6,300.00 4 Inventory $ 7,650.00 5 CURRENT ASSETS $ 21,150.00 6 Property, Plant and Equipment $ 29,700.00 7 TOTAL ASSETS $ 50,850.00 8 LIABILITIES AND EQUITY 9 Accounts Payable $ 10.350.00 10 CURRENT LIABILITIES $ 10,350.00 11 Long-Term Debt $ 8,000.00 12 TOTAL LIABILITIES $ 18,350.00 13 STOCKSHOLDER'S EQUITY $ 32,500.00 14 Retained Earnings $ 15 TOTAL EQUITY S 32,500.00 16 TOTAL LIABILITIES AND EQUITY $ 50,850.00 2021 O NOUAWN Integrated Financial Statement Template Exhibit B: Free Cash Flow and Valuation 2019 2020 Income Statement 1 Sales Revenue 104,580.00 143,224.40 S less: Cost of Goods Sold 73,206.00 $ 100,257.08 S EBITDA 31,374.00 $ 42,967.32 S less: Depreciation Expense 15,687.00 $ 21,483.66 $ 5 EBIT $ 15,687.00 $ 21,483.66 s less: Interest and Other Expenses 405.00 $ 405.00 $ 7 PRE-TAX INCOME 15,282.00 $ 21,078.66 s less: Income Tax 6,876.90 $ 9,485.40 $ NET INCOME 8,405.10 11,593.26 187,455.11 131,218.58 56,236.53 28,118.27 28,118.27 4230.00 23,888.27 10,749.72 13,138.55 35,557.20 $ 27,190.80 $ 24,053.40 $ 86,801.40 $ 62,748.00 $ 149,549.40 $ 48,696.30 $ 37.238.34 S 32,941.61 $ 118,876.25 S 85,934.64 $ 204,810.89 $ 63,734,74 48,738.33 43,114.68 155,587.74 112,473.07 268,060.81 Balance Sheet 1 ASSETS Cash and Equivalents Accounts Receivable Inventory 5 CURRENT ASSETS 6 Property, Plant and Equipment 7 TOTAL ASSETS 8 LABILITIES AND EQUITY 9 Accounts Payable 10 CURRENT LIABILITIES 11 Long-Term Debt 12 TOTAL LIABILITIES 13 STOCKSHOLDER'S EQUITY 14 Retained Earnings 15 TOTAL EQUITY 16 TOTAL LIABILITIES AND EQUITY $ S 18,824.40 $ 18,824.40 $ 4,500.00 $ 23,324.40 S 126,225.00 $ $ 126,225.00 $ 149,549.40 $ 25,780.39 S 25,780.39 $ 47,000.00 S 72,780.39 $ 74,134.00 $ 8,115.28 $ 82,249.28 $ 155,029.68 $ 33.741.92 33,741.92 47,000.00 80,741.92 74,134.00 9.196.98 83,330,98 164,072.90 $ Net Working Capital Requirements Current Assets 2 Current Liabilities 3 Net Working Capital 4 Increase in Net Working Capital Capital Investment 1 Capital Investment $ 2,500.00 45,000.00 S 7,500.00 Corporation Finance DEPARTMENT OF BUSINESS AND ECONOMICS BBA 308 | EXAM 3 Integrated Financial Statement Template Exhibit B: Free Cash Flow and Valuation 2019 2020 2021 Free Cash Flow (000s) 1 Net Income 2 Plus: After-Tax Interes Expense Unlevered Net Income 4 Plus: Depreciation 5 Less: Increases in NWC 6 Less: Capital Expenditures 7 Free Cash Flow of Firm Valuation of the Growth 1 Free Cash Flow of the Firm 2 PV of the Cash Flow 3 Continuation Value 4 PV of Continuation Value 5 net Interest Expense 6 Interest Tax Shield 7 PV Interest Tax Shield 8 Firm Value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started