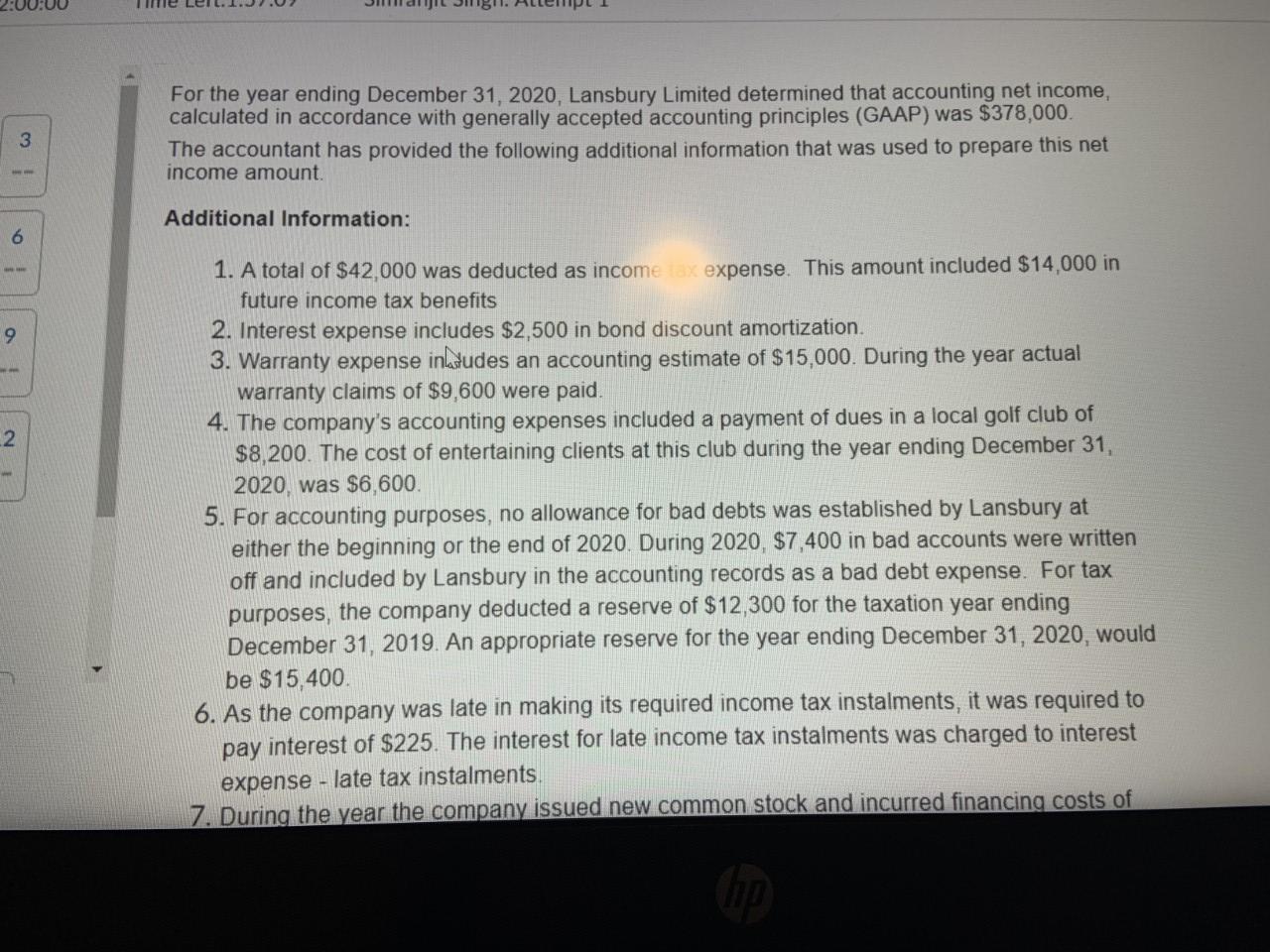

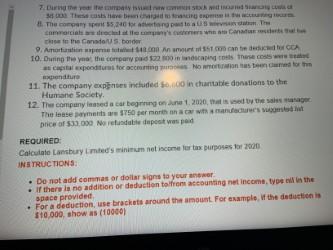

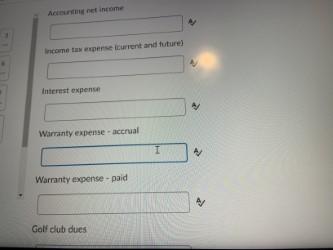

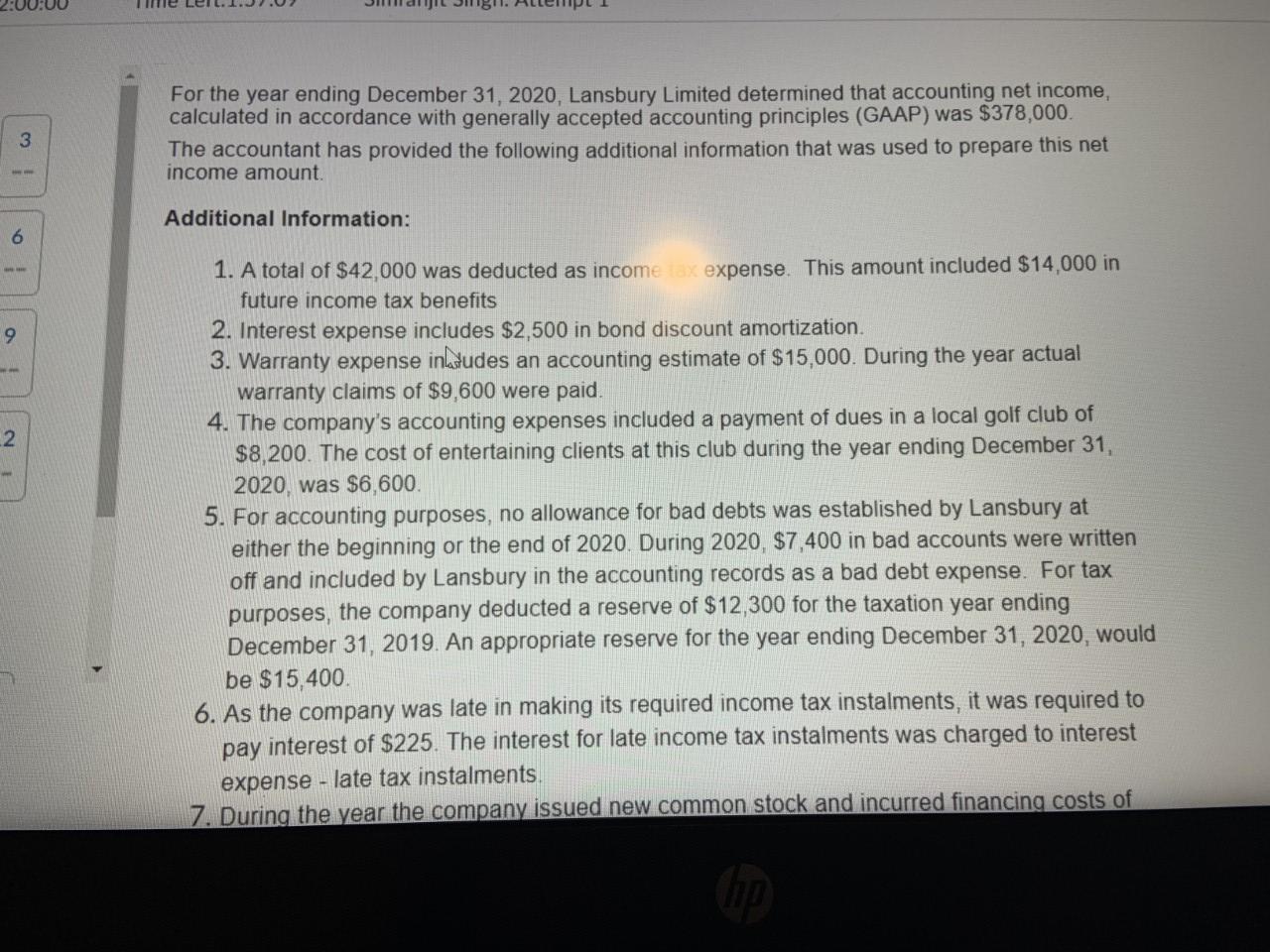

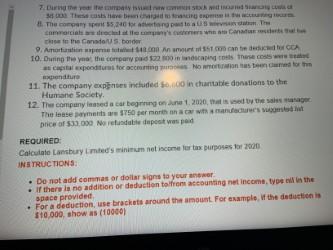

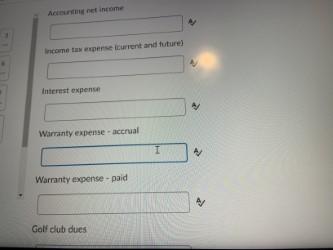

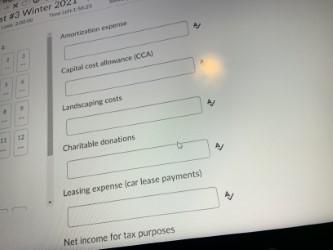

3 For the year ending December 31, 2020, Lansbury Limited determined that accounting net income, calculated in accordance with generally accepted accounting principles (GAAP) was $378,000. The accountant has provided the following additional information that was used to prepare this net income amount. Additional Information: 6 9. 2 1. A total of $42,000 was deducted as income expense. This amount included $14,000 in future income tax benefits 2. Interest expense includes $2,500 in bond discount amortization. 3. Warranty expense inlatudes an accounting estimate of $15,000. During the year actual warranty claims of $9,600 were paid. 4. The company's accounting expenses included a payment of dues in a local golf club of $8,200. The cost of entertaining clients at this club during the year ending December 31, 2020, was $6,600. 5. For accounting purposes, no allowance for bad debts was established by Lansbury at either the beginning or the end of 2020. During 2020, $7,400 in bad accounts were written off and included by Lansbury in the accounting records as a bad debt expense. For tax purposes, the company deducted a reserve of $12,300 for the taxation year ending December 31, 2019. An appropriate reserve for the year ending December 31, 2020, would be $15,400 6. As the company was late in making its required income tax instalments, it was required to pay interest of $225. The interest for late income tax instalments was charged to interest expense - late tax instalments, 7. During the year the company issued new common stock and incurred financing costs of 7. During the de These cast are cream The company was 50 anos commercial e decide what that the Godsbord 9. Aroupe A 151 CCA 10. During the year the company pod 22.00 .caping the capital podio ac Non tend to the andro 11. The company expens included in charitable donations to the Humane Society, 12. The company and a car beginning on 2020, that we by the same These met 750 per month na tware's women price of $30,000 No refundabile deposit waspad REQUIRED Calculate Lansbury Line's minimum net income for purposes of 2000 INSTRUCTIONS . Do not add comras ar dollar signs to your answer If there is no addition or deduction to from accounting net income to the space provided . For a deduction, use brackets around the amount. For emple. If the deitienis $10,000, show as (10000) Income tax expense current and future) Interest expense Warranty expense - accrual I Warranty expense -paid Golf dub dues Enten Badebt een Adjustment for reserve for doubtfuldet Interest expense - late tax instalments Financing costs Advertising expense # Winter 20 Capital cost once CCA) Laping costs 11 Charitable donations Leasing expense car lease payments) Net Income for tax purposes 3 For the year ending December 31, 2020, Lansbury Limited determined that accounting net income, calculated in accordance with generally accepted accounting principles (GAAP) was $378,000. The accountant has provided the following additional information that was used to prepare this net income amount. Additional Information: 6 9. 2 1. A total of $42,000 was deducted as income expense. This amount included $14,000 in future income tax benefits 2. Interest expense includes $2,500 in bond discount amortization. 3. Warranty expense inlatudes an accounting estimate of $15,000. During the year actual warranty claims of $9,600 were paid. 4. The company's accounting expenses included a payment of dues in a local golf club of $8,200. The cost of entertaining clients at this club during the year ending December 31, 2020, was $6,600. 5. For accounting purposes, no allowance for bad debts was established by Lansbury at either the beginning or the end of 2020. During 2020, $7,400 in bad accounts were written off and included by Lansbury in the accounting records as a bad debt expense. For tax purposes, the company deducted a reserve of $12,300 for the taxation year ending December 31, 2019. An appropriate reserve for the year ending December 31, 2020, would be $15,400 6. As the company was late in making its required income tax instalments, it was required to pay interest of $225. The interest for late income tax instalments was charged to interest expense - late tax instalments, 7. During the year the company issued new common stock and incurred financing costs of 7. During the de These cast are cream The company was 50 anos commercial e decide what that the Godsbord 9. Aroupe A 151 CCA 10. During the year the company pod 22.00 .caping the capital podio ac Non tend to the andro 11. The company expens included in charitable donations to the Humane Society, 12. The company and a car beginning on 2020, that we by the same These met 750 per month na tware's women price of $30,000 No refundabile deposit waspad REQUIRED Calculate Lansbury Line's minimum net income for purposes of 2000 INSTRUCTIONS . Do not add comras ar dollar signs to your answer If there is no addition or deduction to from accounting net income to the space provided . For a deduction, use brackets around the amount. For emple. If the deitienis $10,000, show as (10000) Income tax expense current and future) Interest expense Warranty expense - accrual I Warranty expense -paid Golf dub dues Enten Badebt een Adjustment for reserve for doubtfuldet Interest expense - late tax instalments Financing costs Advertising expense # Winter 20 Capital cost once CCA) Laping costs 11 Charitable donations Leasing expense car lease payments) Net Income for tax purposes