Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Franklin Bluth moved from the Sudden Valley Ontario office of The Bluth Building Company, to the head office in Paradise Gardens in November

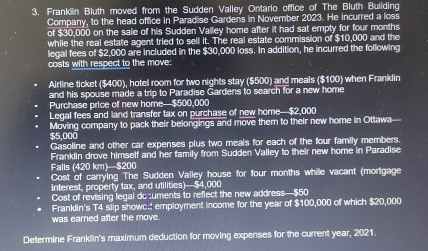

3. Franklin Bluth moved from the Sudden Valley Ontario office of The Bluth Building Company, to the head office in Paradise Gardens in November 2023. He incurred a loss of $30,000 on the sale of his Sudden Valley home after it had sat empty for four months while the real estate agent tried to sell it. The real estate commission of $10,000 and the legal fees of $2,000 are included in the $30,000 loss. In addition, he incurred the following costs with respect to the move: Airline ticket ($400), hotel room for two nights stay ($500) and meals ($100) when Franklin and his spouse made a trip to Paradise Gardens to search for a new home Purchase price of new home-$500,000 Legal fees and land transfer tax on purchase of new home-$2,000 Moving company to pack their belongings and move them to their new home in Ottawa- $5,000 Gasoline and other car expenses plus two meals for each of the four family members. Franklin drove himself and her family from Sudden Valley to their new home in Paradise Falls (420 km) $200 Cost of carrying The Sudden Valley house for four months while vacant (mortgage interest, property tax, and utilities) $4,000 Cost of revising legal documents to reflect the new address-$50 Franklin's T4 slip showc employment income for the year of $100,000 of which $20,000 was earned after the move. Determine Franklin's maximum deduction for moving expenses for the current year, 2021.

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To determine Franklins maximum deduction for moving expenses for the current year 2021 we need to co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started