Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Given below are selected transactions for January for Leah Garcia, an interior designer: Jan. Invested P200,000 cash to start the business. 2 3

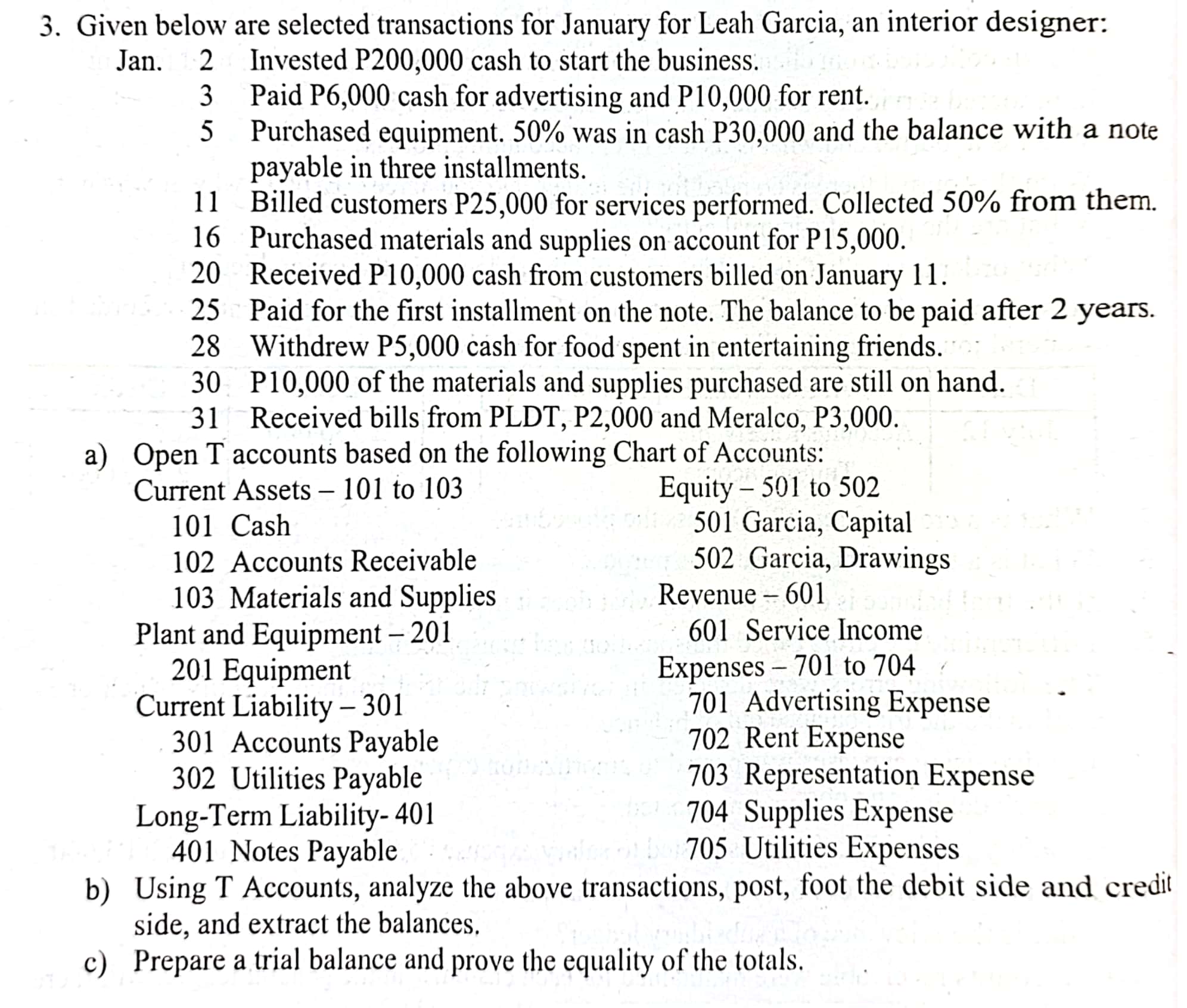

3. Given below are selected transactions for January for Leah Garcia, an interior designer: Jan. Invested P200,000 cash to start the business. 2 3 5 Paid P6,000 cash for advertising and P10,000 for rent. Purchased equipment. 50% was in cash P30,000 and the balance with a note payable in three installments. 11 Billed customers P25,000 for services performed. Collected 50% from them. 16 Purchased materials and supplies on account for P15,000. 20 Received P10,000 cash from customers billed on January 11. 25 Paid for the first installment on the note. The balance to be paid after 2 years. 28 Withdrew P5,000 cash for food spent in entertaining friends. 30 P10,000 of the materials and supplies purchased are still on hand. 31 Received bills from PLDT, P2,000 and Meralco, P3,000. a) Open T accounts based on the following Chart of Accounts: Current Assets - 101 to 103 101 Cash 102 Accounts Receivable 103 Materials and Supplies Plant and Equipment - 201 201 Equipment Current Liability - 301 301 Accounts Payable 302 Utilities Payable Long-Term Liability- 401 401 Notes Payable - Equity 501 to 502 501 Garcia, Capital 502 Garcia, Drawings Revenue - 601 601 Service Income Expenses 701 to 704 701 Advertising Expense 702 Rent Expense 703 Representation Expense 704 Supplies Expense 705 Utilities Expenses b) Using T Accounts, analyze the above transactions, post, foot the debit side and credit side, and extract the balances. c) Prepare a trial balance and prove the equality of the totals.

Step by Step Solution

★★★★★

3.55 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Here are the T accounts based on the given Chart of Accounts Plant and Equipment201 201 Equipment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started