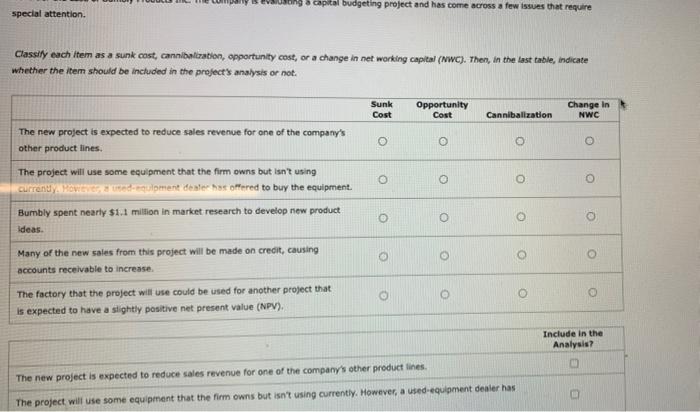

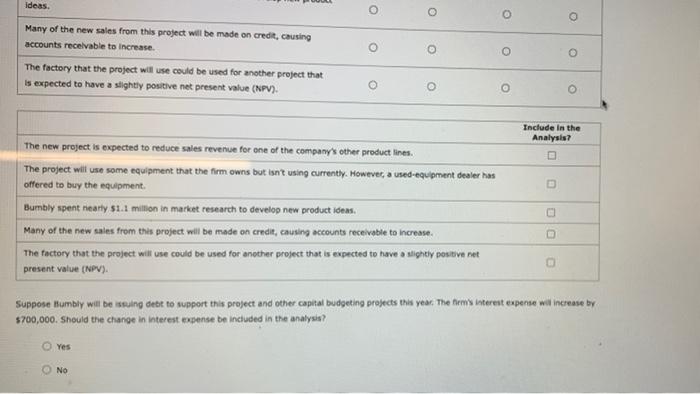

3. Identifying incremental cash flows When firms make capital budgeting decisions, they should concern themselves with incremental cash flows, not net income, when evaluating projects To determine the incremental cash flows associated with a capital project, an analyst should include all of the following except: The project's depreciation expense The project's marginal taxes The project's terminal value The project's financing costs Indirect cach Mows often affect a firm's capital budgeting decisions. However, some of these indirect cash flows are relevant to capital budgeting decisions (because they represent marginal cash flows that depend on the projects acceptance), but others should be ignored, Cannibalization represent the effect of the current project" acceptance on cash flows of the firm's other projects. Because they depend on whether the current project is accepted, they should be included in the analysis Consider the case of Bumbly Products Inc. The company is evaluating a capital budgeting project and has come across a few issues that require special attention Classily each item as a sunk cost, cannibalization, opportunity cost, or a change in net working capital (WC). Then, in the last table, indicate capital budgeting project and has come across a few issues that require special attention. Classily each item as a sunk cost, cannibalization, opportunity cost, or a change in net working capital (NWC). Then, in the last table, indicate whether the item should be included in the projects analysis or not. Sunk Cost Opportunity Cost Change in NWC Cannibalization O o The new project is expected to reduce sales revenue for one of the company's other product lines. The project will use some equipment that the firm owns but isn't using current Kadumene dele har offered to buy the equipment. Bumbly spent nearly $1.1 million in market research to develop new product O o o O O O O o Ideas. Many of the new sales from this project will be made on credit, causing accounts receivable to increase o o o o e The factory that the project will use could be used for another project that is expected to have a slightly positive net present value (NPV). Include in the Analysis? The new project is expected to reduce sales revenue for one of the company's other product lines. The project will use some equipment that the firm owns but isn't using currently. However, a used-equipment dealer has ideas. o O o o Many of the new sales from this project will be made on credit, causing accounts receivable to increase o o 0 O The factory that the project will use could be used for another project that Is expected to have a slightly positive net present value (NPV). o O O Include in the Analysis D The new project is expected to reduce sales revenue for one of the company's other product lines. The project will use some equipment that the firm owns but isn't using currently. However, a used-equipment dealer has offered to buy the equipment Bumbly spent nearly $1.1 million in market research to develop new product ideas Many of the new sales from this project will be made on credit, causing accounts receivable to increase. The factory that the project will use could be used for another project that is expected to have a slightly positive net present value (NPV). DO Suppose Humbly will be issuing debt to support this project and other capital budgeting projects this year. The firm's interest expense wat increase by $700,000. Should the change in interest expense be included in the analysis? Yes No