#3 Imperial and #7 Express

Please help with these two!

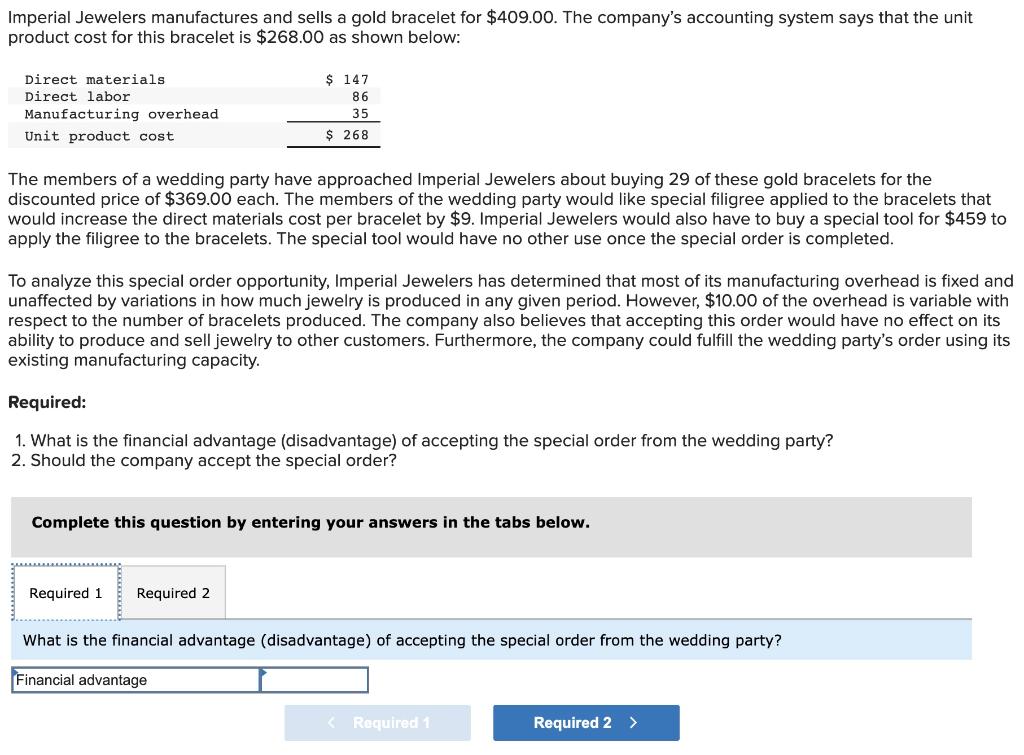

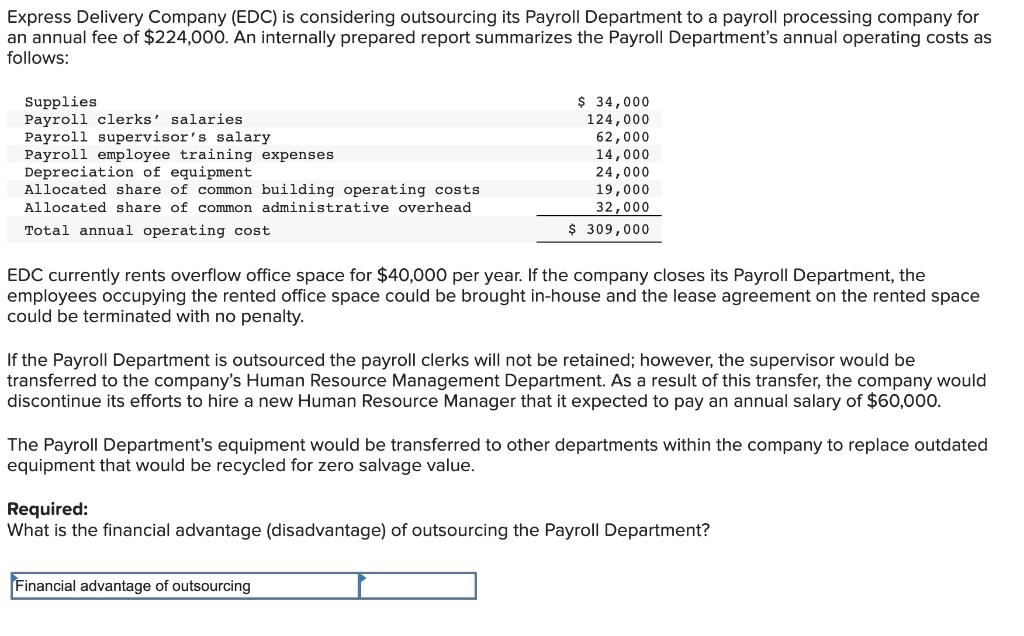

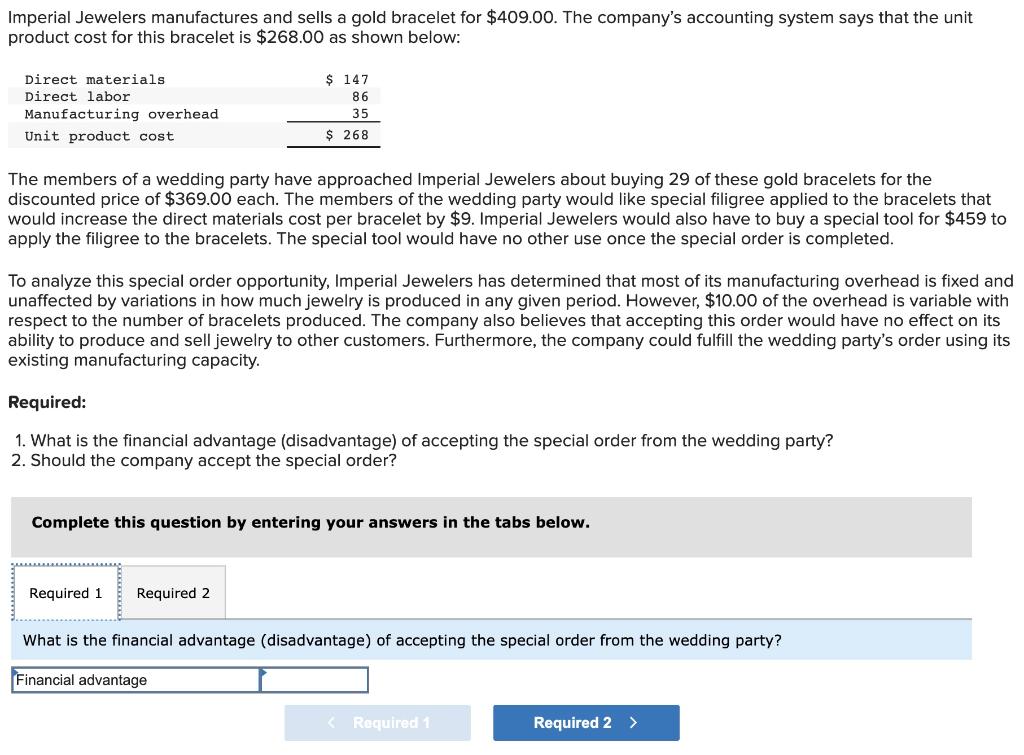

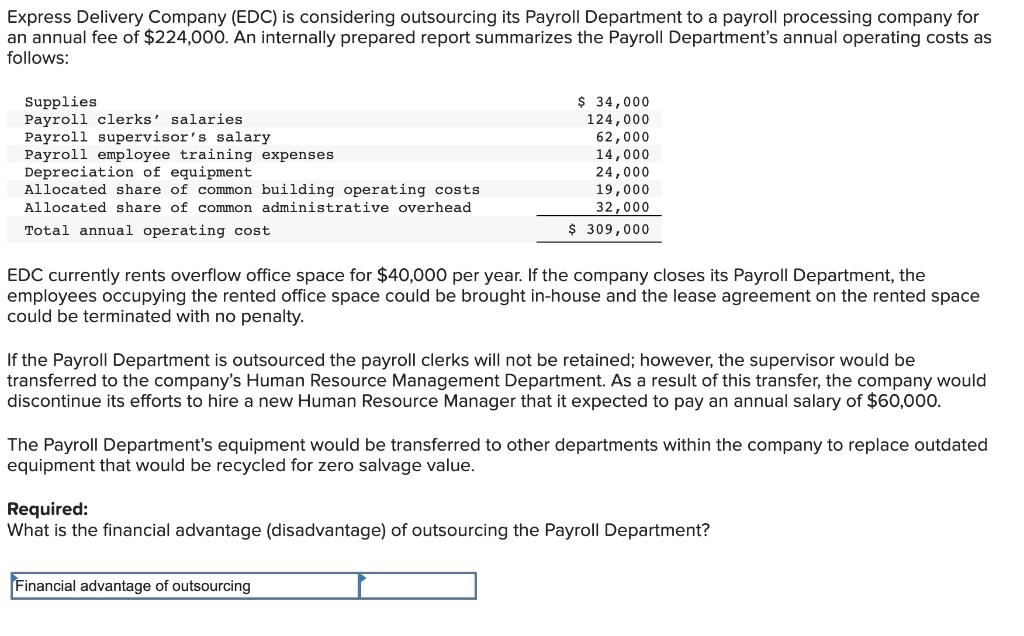

Imperial Jewelers manufactures and sells a gold bracelet for $409.00. The company's accounting system says that the unit product cost for this bracelet is $268.00 as shown below: The members of a wedding party have approached Imperial Jewelers about buying 29 of these gold bracelets for the discounted price of $369.00 each. The members of the wedding party would like special filigree applied to the bracelets that would increase the direct materials cost per bracelet by $9. Imperial Jewelers would also have to buy a special tool for $459 t apply the filigree to the bracelets. The special tool would have no other use once the special order is completed. To analyze this special order opportunity, Imperial Jewelers has determined that most of its manufacturing overhead is fixed ar unaffected by variations in how much jewelry is produced in any given period. However, $10.00 of the overhead is variable wit respect to the number of bracelets produced. The company also believes that accepting this order would have no effect on its ability to produce and sell jewelry to other customers. Furthermore, the company could fulfill the wedding party's order using i existing manufacturing capacity. Required: 1. What is the financial advantage (disadvantage) of accepting the special order from the wedding party? 2. Should the company accept the special order? Complete this question by entering your answers in the tabs below. What is the financial advantage (disadvantage) of accepting the special order from the wedding party? Express Delivery Company (EDC) is considering outsourcing its Payroll Department to a payroll processing company for an annual fee of $224,000. An internally prepared report summarizes the Payroll Department's annual operating costs as follows: EDC currently rents overflow office space for $40,000 per year. If the company closes its Payroll Department, the employees occupying the rented office space could be brought in-house and the lease agreement on the rented space could be terminated with no penalty. If the Payroll Department is outsourced the payroll clerks will not be retained; however, the supervisor would be transferred to the company's Human Resource Management Department. As a result of this transfer, the company would discontinue its efforts to hire a new Human Resource Manager that it expected to pay an annual salary of $60,000. The Payroll Department's equipment would be transferred to other departments within the company to replace outdated equipment that would be recycled for zero salvage value. Required: What is the financial advantage (disadvantage) of outsourcing the Payroll Department