Question

Ed's year end is 30 September. He depreciates office furniture at 15% per annum on the straight line basis. A full year's depreciation is

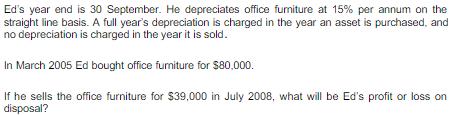

Ed's year end is 30 September. He depreciates office furniture at 15% per annum on the straight line basis. A full year's depreciation is charged in the year an asset is purchased, and no depreciation is charged in the year it is sold. In March 2005 Ed bought office furniture for $80,000. If he sells the office furniture for $39,000 in July 2008, what will be Ed's profit or loss on disposal?

Step by Step Solution

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Ans D A loss of 5000 Computation Table Year Particular Amount ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Accounting

Authors: Tracie L. Miller Nobles, Brenda L. Mattison, Ella Mae Matsumura, Carol A. Meissner, Jo Ann L. Johnston, Peter R. Norwood

10th Canadian edition Volume 1

978-0134213101, 134213106, 133855376, 978-0133855371

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App