3. In this problem the bond sells for a premium, which indicates that interest rates have declined. The current yield is $70/$1,222 = 5.73%.

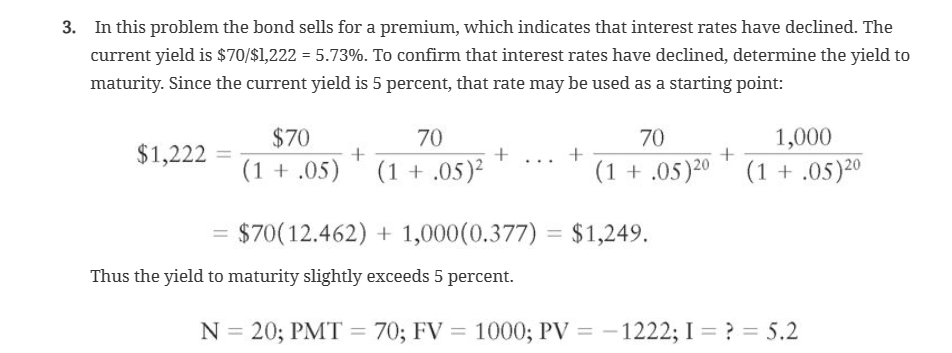

3. In this problem the bond sells for a premium, which indicates that interest rates have declined. The current yield is $70/$1,222 = 5.73%. To confirm that interest rates have declined, determine the yield to maturity. Since the current yield is 5 percent, that rate may be used as a starting point: $1,222 $70 (1 + .05) + 70 (1 + .05) + + Thus the yield to maturity slightly exceeds 5 percent. 70 (1 + .05) 20 $70(12.462) + 1,000(0.377) = $1,249. + 1,000 (1 + .05) 2 N = 20; PMT= 70; FV = 1000; PV = -1222; I = ? = 5.2

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Okay lets solve this using the financial calculator Giv...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started