Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Jim, age 32, purchased a $300,000 five-year renewable and convertible term insurance policy. In answering the health questions, Jim told the agent that he

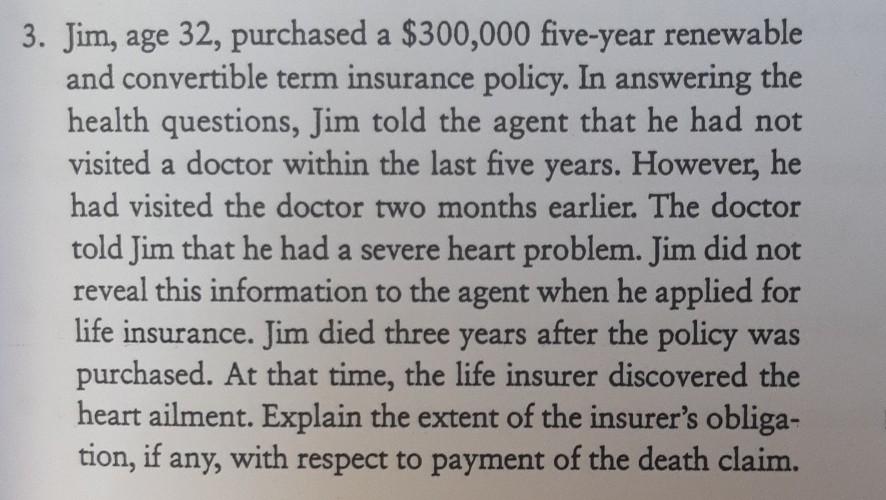

3. Jim, age 32, purchased a $300,000 five-year renewable and convertible term insurance policy. In answering the health questions, Jim told the agent that he had not visited a doctor within the last five years. However, he had visited the doctor two months earlier. The doctor told Jim that he had a severe heart problem. Jim did not reveal this information to the agent when he applied for life insurance. Jim died three years after the policy was purchased. At that time, the life insurer discovered the heart ailment. Explain the extent of the insurer's obliga- tion, if any, with respect to payment of the death claim

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started