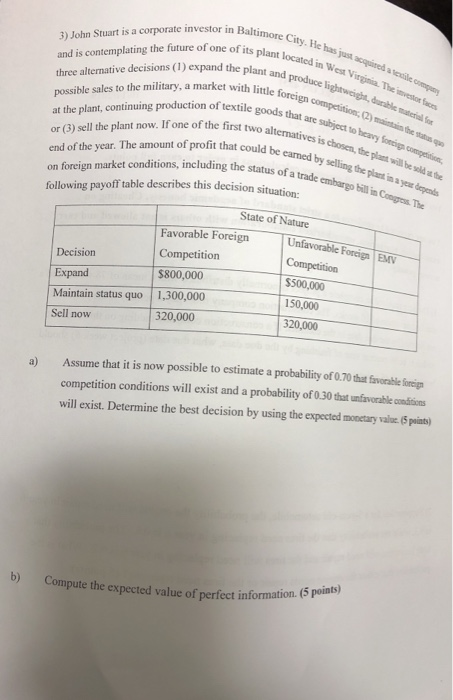

3) John Stuart is a corporate investor in Baltin and is contemplating the future of one of its la three alternative decisions (1) expand the plan possible sales to the military, a market with litt wore City. He has just acquired alle plant located in West Virginia. The investore ant and produce lightweight durable materiale title foreign competition 2) the status oods that are subject to heavy foign compte No alternatives is chosen the plant will be solde ld be earned by selling the plant in a year denis of a trade embargo bill in Congres. The at the plant, continuing production of textile goode or (3) sell the plant now. If one of the first two al end of the year. The amount of profit that could be on foreign market conditions, including the following payoff table describes this decision situatie State of Nature Unfavorable Foreign EMV Competition Decision Expand Maintain status quo Sell now Favorable Foreign Competition $800,000 1,300,000 320,000 $500,000 150,000 320,000 Assume that it is now possible to estimate a probability of 0.70 that favorable foreign competition conditions will exist and a probability of 0.30 that unfavorable conditions will exist. Determine the best decision by using the expected monetary value. (5 points) b) Compute the expected value of perfect information Compute the of perfect information. (5 points) c) What decision will be taken based on the minimax regret criteria? (5 points) 3) John Stuart is a corporate investor in Baltin and is contemplating the future of one of its la three alternative decisions (1) expand the plan possible sales to the military, a market with litt wore City. He has just acquired alle plant located in West Virginia. The investore ant and produce lightweight durable materiale title foreign competition 2) the status oods that are subject to heavy foign compte No alternatives is chosen the plant will be solde ld be earned by selling the plant in a year denis of a trade embargo bill in Congres. The at the plant, continuing production of textile goode or (3) sell the plant now. If one of the first two al end of the year. The amount of profit that could be on foreign market conditions, including the following payoff table describes this decision situatie State of Nature Unfavorable Foreign EMV Competition Decision Expand Maintain status quo Sell now Favorable Foreign Competition $800,000 1,300,000 320,000 $500,000 150,000 320,000 Assume that it is now possible to estimate a probability of 0.70 that favorable foreign competition conditions will exist and a probability of 0.30 that unfavorable conditions will exist. Determine the best decision by using the expected monetary value. (5 points) b) Compute the expected value of perfect information Compute the of perfect information. (5 points) c) What decision will be taken based on the minimax regret criteria? (5 points)