Answered step by step

Verified Expert Solution

Question

1 Approved Answer

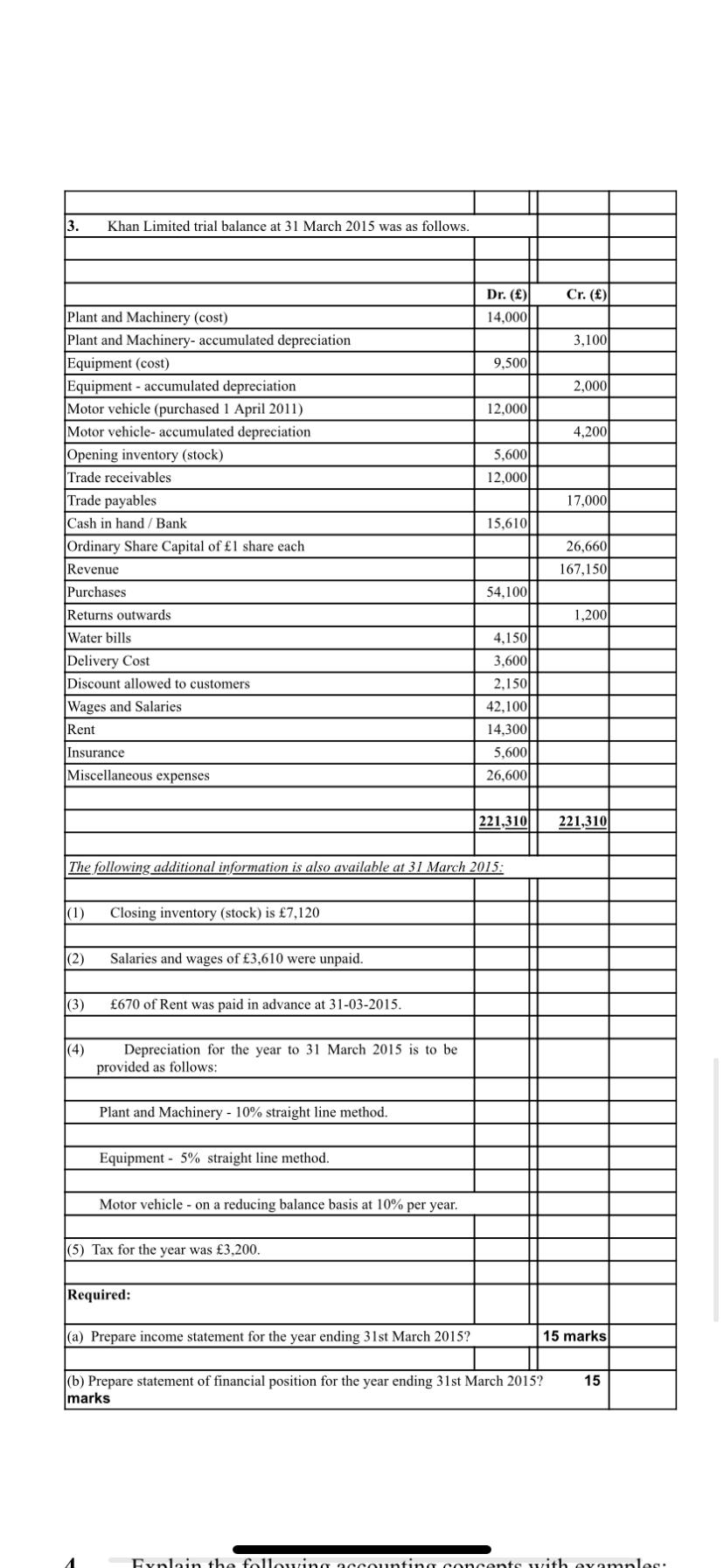

3. Khan Limited trial balance at 31 March 2015 was as follows. Dr. () Cr. () Plant and Machinery (cost) 14,000 Plant and Machinery-

3. Khan Limited trial balance at 31 March 2015 was as follows. Dr. () Cr. () Plant and Machinery (cost) 14,000 Plant and Machinery- accumulated depreciation 3,100 Equipment (cost) 9.500 Equipment accumulated depreciation 2,000 Motor vehicle (purchased 1 April 2011) 12,000 Motor vehicle- accumulated depreciation 4,200 Opening inventory (stock) 5,600 Trade receivables 12,000 Trade payables 17,000 Cash in hand/ Bank 15,610 Ordinary Share Capital of 1 share each 26,660 Revenue 167,150 Purchases 54,100 Returns outwards 1,200 Water bills 4,150 Delivery Cost 3,600 Discount allowed to customers 2,150 Wages and Salaries 42,100 Rent 14,300 Insurance 5,600 Miscellaneous expenses 26,600 221,310 221,310 The following additional information is also available at 31 March 2015: (1) Closing inventory (stock) is 7,120 (2) Salaries and wages of 3,610 were unpaid. (3) 670 of Rent was paid in advance at 31-03-2015. (4) Depreciation for the year to 31 March 2015 is to be provided as follows: Plant and Machinery - 10% straight line method. Equipment 5% straight line method. Motor vehicle on a reducing balance basis at 10% per year. (5) Tax for the year was 3,200. Required: (a) Prepare income statement for the year ending 31st March 2015? 15 marks (b) Prepare statement of financial position for the year ending 31st March 2015? marks 15 Explain the following accour cents with examples:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started