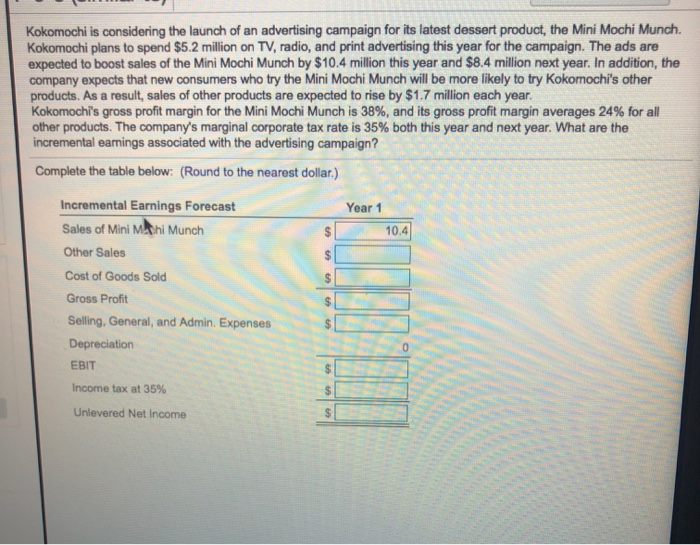

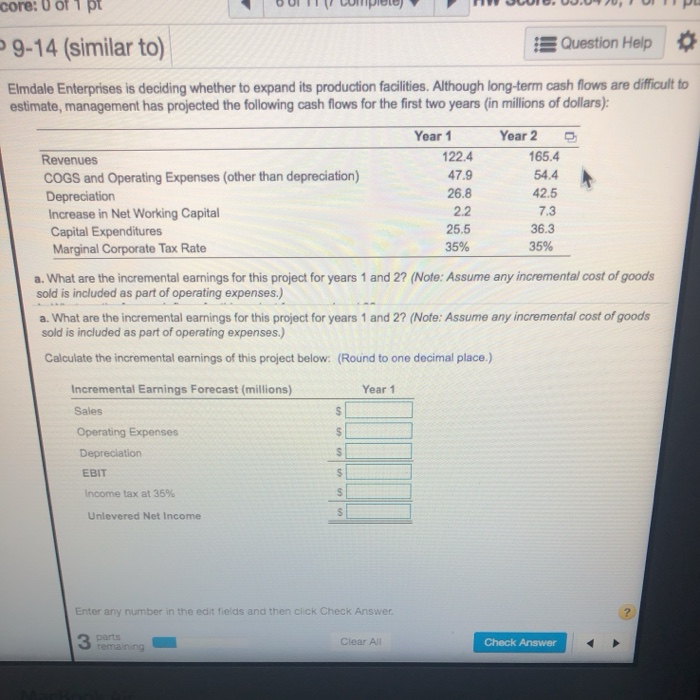

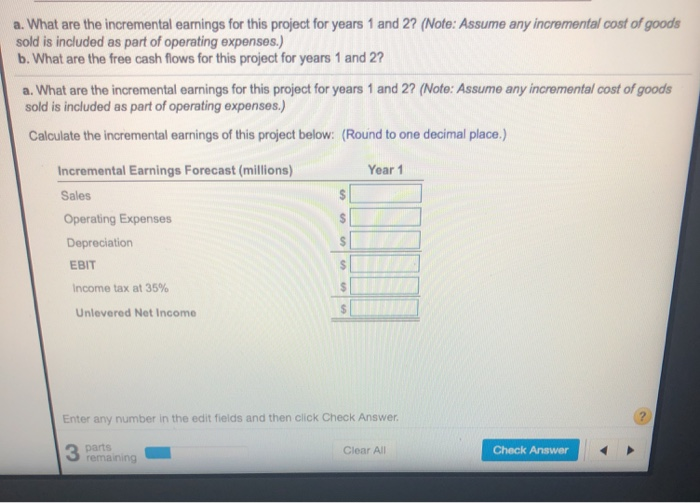

3 Kokomochi is considering the launch of an advertising campaign for its latest dessert product, the Mini Mochi Munch. Kokomochi plans to spend $5.2 million on TV, radio, and print advertising this year for the campaign. The ads are expected to boost sales of the Mini Mochi Munch by $10.4 million this year and $8.4 million next year. In addition, the company expects that new consumers who try the Mini Mochi Munch will be more likely to try Kokomochi's other products. As a result, sales of other products are expected to rise by $1.7 million each year. Kokomochi's gross profit margin for the Mini Mochi Munch is 38%, and its gross profit margin averages 24% for all other products. The company's marginal corporate tax rate is 35% both this year and next year. What are the incremental earings associated with the advertising campaign? Complete the table below: (Round to the nearest dollar.) Year 1 Incremental Earnings Forecast Sales of Mini Mithi Munch Other Sales Cost of Goods Sold Gross Profit Selling, General, and Admin Expenses Depreciation EBIT Income tax at 35% Unlevered Net Income core: 0 of 1 pt DUI LUMPU H JUIL. UU. UU, UN PL 9-14 (similar to) Question Help Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in millions of dollars): 3 Revenues COGS and Operating Expenses (other than depreciation) Depreciation Increase in Net Working Capital Capital Expenditures Marginal Corporate Tax Rate Year 1 122.4 47.9 26.8 2.2 25.5 35% Year 2 165.4 54.4 42.5 7.3 36.3 35% a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.) a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.) Calculate the incremental earnings of this project below: (Round to one decimal place.) Incremental Earnings Forecast (millions) Year 1 Sales Operating Expenses Depreciation EBIT Income tax at 35% Unlevered Net Income Enter any number in the edit fields and then click Check Answer 2 Darts s remaining Clear All Check Answer a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.) b. What are the free cash flows for this project for years 1 and 2? a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.) Calculate the incremental earnings of this project below: (Round to one decimal place.) Incremental Earnings Forecast (millions) Year 1 Sales Operating Expenses Depreciation EBIT Income tax at 35% Unlevered Net Income Enter any number in the edit fields and then click Check Answer. 2 parts 3 remaining Clear All Check