Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3) List and discuss cautions which must be taken in using industry average ratios 5) Discuss how to solve the airlines most pressing problems Case

3) List and discuss cautions which must be taken in using industry average ratios

5) Discuss how to solve the airlines most pressing problems

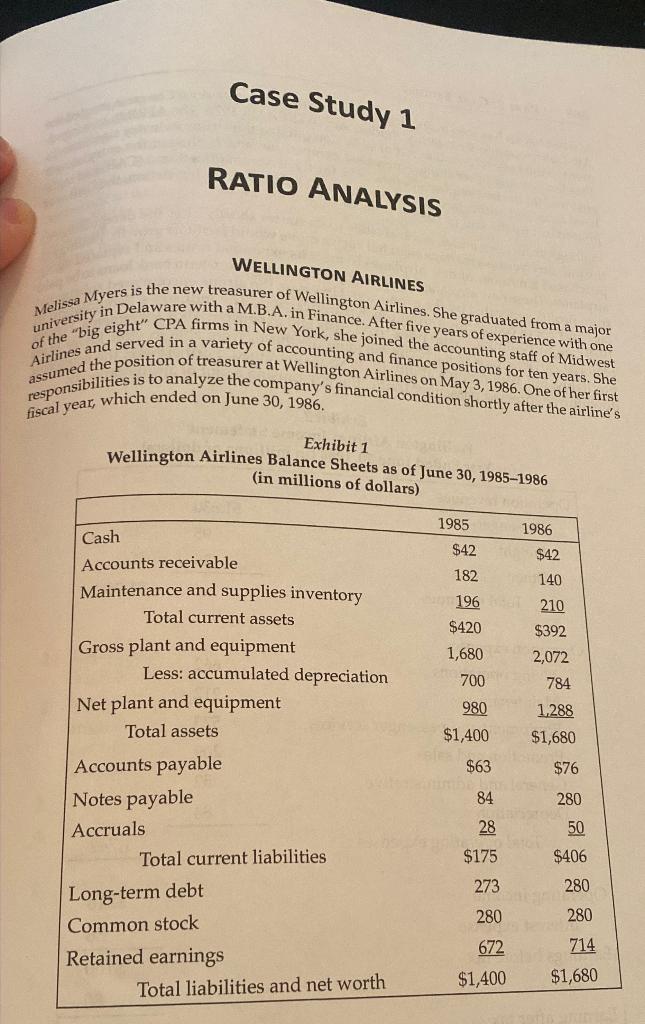

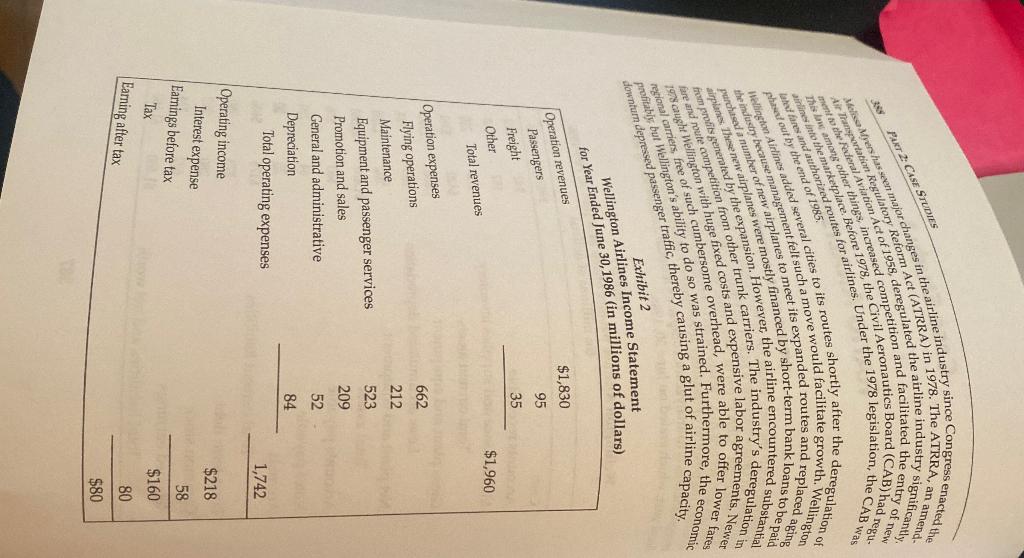

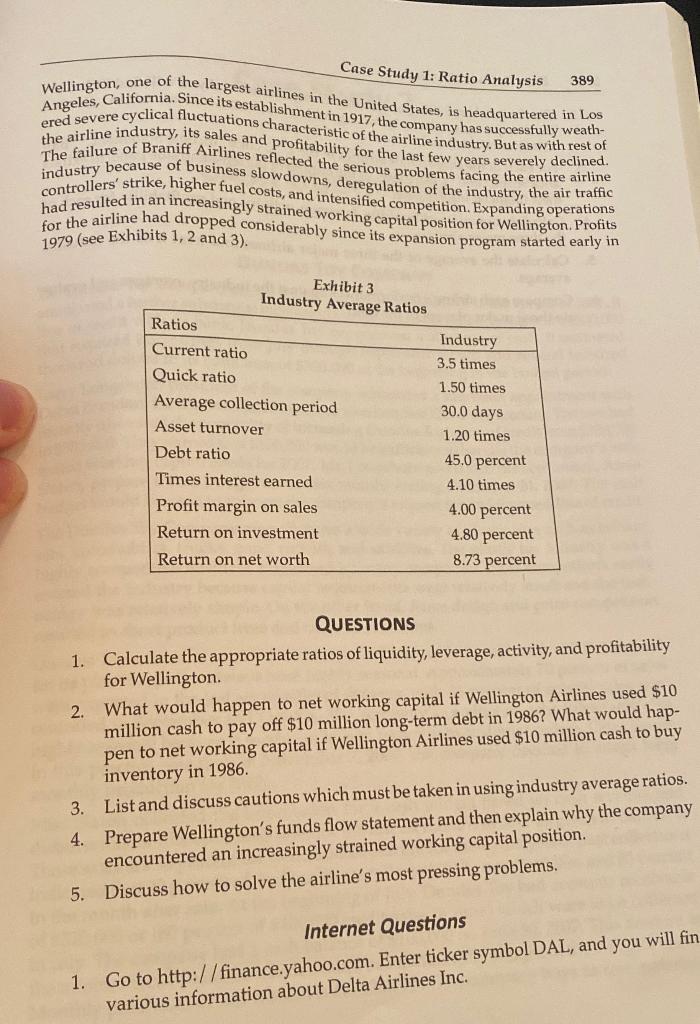

Case Study 1 RATIO ANALYSIS WELLINGTON AIRLINES Melissa Myers is the new treasurer of Wellington Airlines. She graduated from a major university in Delaware with a M.B.A. in Finance. After five years of experience with one of the "big eight" CPA firms in New York, she joined the accounting staff of Midwest assumed the position of treasurer at Wellington Airlines on May 3, 1986. One of her first Airlines and served in a variety of accounting and finance positions for ten years. She responsibilities is to analyze the company's financial condition shortly after the airline's fiscal year, which ended on June 30, 1986. Exhibit 1 Wellington Airlines Balance Sheets as of June 30, 1985-1986 (in millions of dollars) 1985 1986 $42 182 196 $420 1,680 $42 140 210 $392 2,072 784 700 980 1.288 $1,680 Cash Accounts receivable Maintenance and supplies inventory Total current assets Gross plant and equipment Less: accumulated depreciation Net plant and equipment Total assets Accounts payable Notes payable Accruals Total current liabilities Long-term debt Common stock Retained earnings Total liabilities and net worth $1,400 $63 $76 84 280 28 $175 50 $406 280 273 280 280 672 714 $1,680 $1,400 PART 2 CASE STUDIES 26 memathie phased out by the end of 1985 Regulatory Reform Act (ATRRA) in 1978. The ATRRA, an amend The one among other things increased competition and facilitated the entry of new Mel Myers has seen major changes in the airline industry since Congress enacted the stiraleral Aviation Act of 1958, deregulated the airline industry significantly ilies in the marketplace Before 1978, the Civil Aeronautics Board (CAB) had regu. fares and authorized routes for airlines. Under the 1978 legislation, the CAB was Airlines added several cities to its routes shortly after the deregulation of airplane These new airplanes were mostly financed by short-term bank loans to be paid Wewe management felt such a move would facilitate growth. Wellington purchased a number of new airplanes to meet its expanded routes and replaced aging pris generated by the expansion. However, the airline encountered substantial Regional armers free of such cumbersome overhead, were able to offer lower fares downtum depressed passenger traffic thereby causing a glut of airline capacity. profitabis bul Wellington's ability to do so was strained. Furthermore, the economic Exhibit 2 Wellington Airlines Income Statement for Year Ended June 30, 1986 (in millions of dollars) k carriers. The industry's deregulation in expensive labor agreements, Newer other trunk 1978aught Wellington with huge fixed costs and fare and nute competition from Operation revenues $1,830 95 35 Passengers Freight Other Total revenues $1,960 662 212 523 Operation expenses Flying operations Maintenance Equipment and passenger services Promotion and sales General and administrative Depreciation 209 52 84 Total operating expenses 1,742 Operating income $218 58 Interest expense Earnings before tax Tax Earning after tax $160 80 $80 389 Case Study 1: Ratio Analysis Wellington, one of the largest airlines in the United States, is headquartered in Los Angeles, California. Since its establishment in 1917, the company has successfully weath- the airline industry, its sales and profitability for the last few years severely declined. ered severe cyclical fluctuations characteristic of the airline industry. But as with rest of The failure of Braniff Airlines reflected the serious problems facing the entire airline industry because of business slowdowns, deregulation of the industry, the air traffic controllers' strike, higher fuel costs, and intensified competition. Expanding operations had resulted in an increasingly strained working capital position for Wellington. Profits for the airline had dropped considerably since its expansion program started early in 1979 (see Exhibits 1, 2 and 3). Exhibit 3 Industry Average Ratios Ratios Current ratio Quick ratio Average collection period Asset turnover Debt ratio Times interest earned Profit margin on sales Return on investment Return on net worth Industry 3.5 times 1.50 times 30.0 days 1.20 times 45.0 perce 4.10 times 4.00 percent 4.80 percent 8.73 percent QUESTIONS 1. Calculate the appropriate ratios of liquidity, leverage, activity, and profitability for Wellington 2. What would happen to net working capital if Wellington Airlines used $10 million cash to pay off $10 million long-term debt in 1986? What would hap- pen to net working capital if Wellington Airlines used $10 million cash to buy inventory in 1986. 3. List and discuss cautions which must be taken in using industry average ratios. 4. Prepare Wellington's funds flow statement and then explain why the company encountered an increasingly strained working capital position. 5. Discuss how to solve the airline's most pressing problems, 1. Internet Questions Go to http://finance.yahoo.com. Enter ticker symbol DAL, and you will fin various information about Delta Airlines Inc. Case Study 1 RATIO ANALYSIS WELLINGTON AIRLINES Melissa Myers is the new treasurer of Wellington Airlines. She graduated from a major university in Delaware with a M.B.A. in Finance. After five years of experience with one of the "big eight" CPA firms in New York, she joined the accounting staff of Midwest assumed the position of treasurer at Wellington Airlines on May 3, 1986. One of her first Airlines and served in a variety of accounting and finance positions for ten years. She responsibilities is to analyze the company's financial condition shortly after the airline's fiscal year, which ended on June 30, 1986. Exhibit 1 Wellington Airlines Balance Sheets as of June 30, 1985-1986 (in millions of dollars) 1985 1986 $42 182 196 $420 1,680 $42 140 210 $392 2,072 784 700 980 1.288 $1,680 Cash Accounts receivable Maintenance and supplies inventory Total current assets Gross plant and equipment Less: accumulated depreciation Net plant and equipment Total assets Accounts payable Notes payable Accruals Total current liabilities Long-term debt Common stock Retained earnings Total liabilities and net worth $1,400 $63 $76 84 280 28 $175 50 $406 280 273 280 280 672 714 $1,680 $1,400 PART 2 CASE STUDIES 26 memathie phased out by the end of 1985 Regulatory Reform Act (ATRRA) in 1978. The ATRRA, an amend The one among other things increased competition and facilitated the entry of new Mel Myers has seen major changes in the airline industry since Congress enacted the stiraleral Aviation Act of 1958, deregulated the airline industry significantly ilies in the marketplace Before 1978, the Civil Aeronautics Board (CAB) had regu. fares and authorized routes for airlines. Under the 1978 legislation, the CAB was Airlines added several cities to its routes shortly after the deregulation of airplane These new airplanes were mostly financed by short-term bank loans to be paid Wewe management felt such a move would facilitate growth. Wellington purchased a number of new airplanes to meet its expanded routes and replaced aging pris generated by the expansion. However, the airline encountered substantial Regional armers free of such cumbersome overhead, were able to offer lower fares downtum depressed passenger traffic thereby causing a glut of airline capacity. profitabis bul Wellington's ability to do so was strained. Furthermore, the economic Exhibit 2 Wellington Airlines Income Statement for Year Ended June 30, 1986 (in millions of dollars) k carriers. The industry's deregulation in expensive labor agreements, Newer other trunk 1978aught Wellington with huge fixed costs and fare and nute competition from Operation revenues $1,830 95 35 Passengers Freight Other Total revenues $1,960 662 212 523 Operation expenses Flying operations Maintenance Equipment and passenger services Promotion and sales General and administrative Depreciation 209 52 84 Total operating expenses 1,742 Operating income $218 58 Interest expense Earnings before tax Tax Earning after tax $160 80 $80 389 Case Study 1: Ratio Analysis Wellington, one of the largest airlines in the United States, is headquartered in Los Angeles, California. Since its establishment in 1917, the company has successfully weath- the airline industry, its sales and profitability for the last few years severely declined. ered severe cyclical fluctuations characteristic of the airline industry. But as with rest of The failure of Braniff Airlines reflected the serious problems facing the entire airline industry because of business slowdowns, deregulation of the industry, the air traffic controllers' strike, higher fuel costs, and intensified competition. Expanding operations had resulted in an increasingly strained working capital position for Wellington. Profits for the airline had dropped considerably since its expansion program started early in 1979 (see Exhibits 1, 2 and 3). Exhibit 3 Industry Average Ratios Ratios Current ratio Quick ratio Average collection period Asset turnover Debt ratio Times interest earned Profit margin on sales Return on investment Return on net worth Industry 3.5 times 1.50 times 30.0 days 1.20 times 45.0 perce 4.10 times 4.00 percent 4.80 percent 8.73 percent QUESTIONS 1. Calculate the appropriate ratios of liquidity, leverage, activity, and profitability for Wellington 2. What would happen to net working capital if Wellington Airlines used $10 million cash to pay off $10 million long-term debt in 1986? What would hap- pen to net working capital if Wellington Airlines used $10 million cash to buy inventory in 1986. 3. List and discuss cautions which must be taken in using industry average ratios. 4. Prepare Wellington's funds flow statement and then explain why the company encountered an increasingly strained working capital position. 5. Discuss how to solve the airline's most pressing problems, 1. Internet Questions Go to http://finance.yahoo.com. Enter ticker symbol DAL, and you will fin various information about Delta Airlines Inc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started