Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Locus Quintatus, Inc., a highly profitable maker of snowmakers, is planning to introduce a new model shortly. The project will have a 3-year

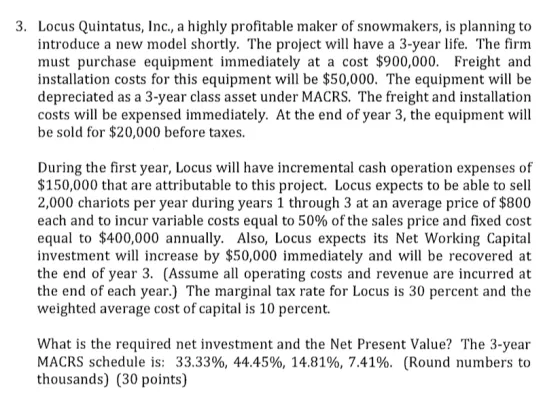

3. Locus Quintatus, Inc., a highly profitable maker of snowmakers, is planning to introduce a new model shortly. The project will have a 3-year life. The firm must purchase equipment immediately at a cost $900,000. Freight and installation costs for this equipment will be $50,000. The equipment will be depreciated as a 3-year class asset under MACRS. The freight and installation costs will be expensed immediately. At the end of year 3, the equipment will be sold for $20,000 before taxes. During the first year, Locus will have incremental cash operation expenses of $150,000 that are attributable to this project. Locus expects to be able to sell 2,000 chariots per year during years 1 through 3 at an average price of $800 each and to incur variable costs equal to 50% of the sales price and fixed cost equal to $400,000 annually. Also, Locus expects its Net Working Capital investment will increase by $50,000 immediately and will be recovered at the end of year 3. (Assume all operating costs and revenue are incurred at the end of each year.) The marginal tax rate for Locus is 30 percent and the weighted average cost of capital is 10 percent. What is the required net investment and the Net Present Value? The 3-year MACRS schedule is: 33.33%, 44.45%, 14.81%, 7.41%. (Round numbers to thousands) (30 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

answer Project Analysis for Locus Quintatus Inc Given Information Project Life 3 years Equipment Cos...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started