Answered step by step

Verified Expert Solution

Question

1 Approved Answer

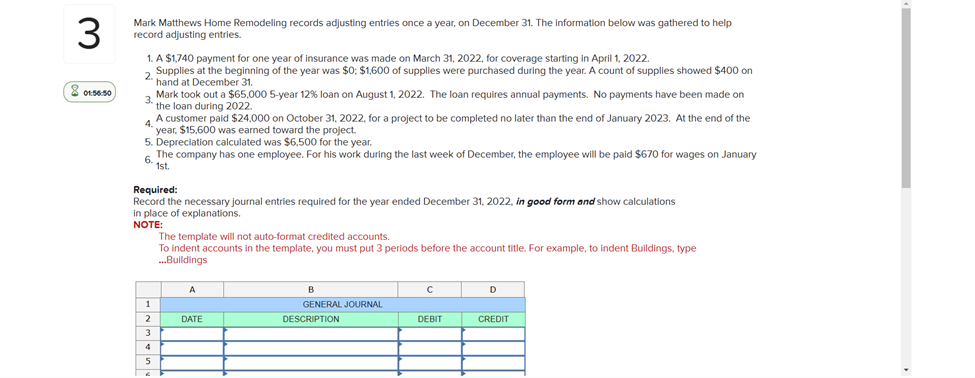

3 Mark Matthews Home Remodeling records adjusting entries once a year, on December 31. The information below was gathered to help record adjusting entries.

3 Mark Matthews Home Remodeling records adjusting entries once a year, on December 31. The information below was gathered to help record adjusting entries. 01:56:50 1. A $1,740 payment for one year of insurance was made on March 31, 2022, for coverage starting in April 1, 2022. Supplies at the beginning of the year was $0; $1,600 of supplies were purchased during the year. A count of supplies showed $400 on 2. hand at December 31. 3. Mark took out a $65,000 5-year 12% loan on August 1, 2022. The loan requires annual payments. No payments have been made on the loan during 2022. 4. A customer paid $24,000 on October 31, 2022, for a project to be completed no later than the end of January 2023. At the end of the year, $15,600 was earned toward the project. 5. Depreciation calculated was $6,500 for the year. The company has one employee. For his work during the last week of December, the employee will be paid $670 for wages on January 6. 1st. Required: Record the necessary journal entries required for the year ended December 31, 2022, in good form and show calculations in place of explanations. NOTE: 1 2 3 5 6 The template will not auto-format credited accounts. To indent accounts in the template, you must put 3 periods before the account title. For example, to indent Buildings, type ...Buildings A DATE B GENERAL JOURNAL DESCRIPTION DEBIT D CREDIT 3 01:56:25 Record the necessary journal entries required for the year ended December 31, 2022, in good form and show calculations in place of explanations. NOTE: 1 2 3 4 5 6 7 8 9 10 11 12 13. 14 15 16 17 18 The template will not auto-format credited accounts. To indent accounts in the template, you must put 3 periods before the account title. For example, to indent Buildings, type ...Buildings A DATE B GENERAL JOURNAL DESCRIPTION DEBIT D CREDIT

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

A DATE B GENERAL JOURNAL C DESCRIPTION D DEBIT CREDIT 1 Insurance Expense Prepaid Insurance 1740 Pre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started