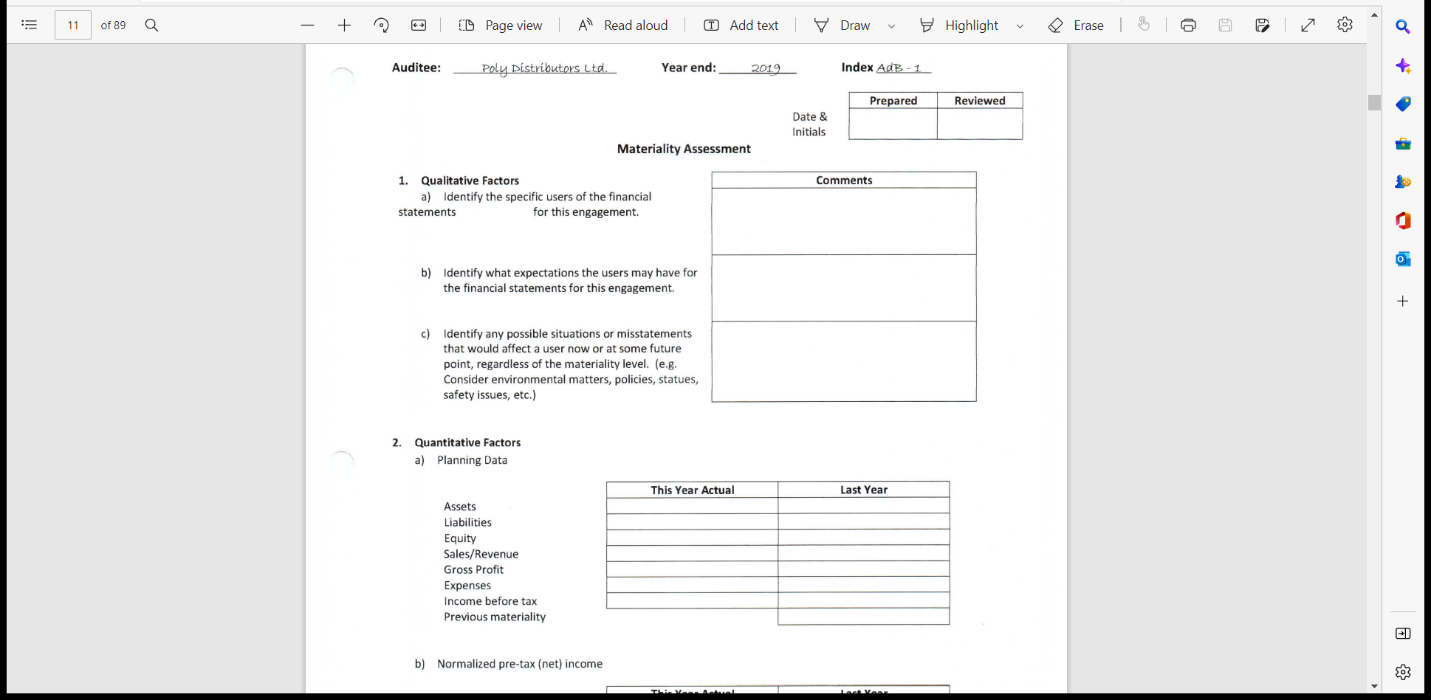

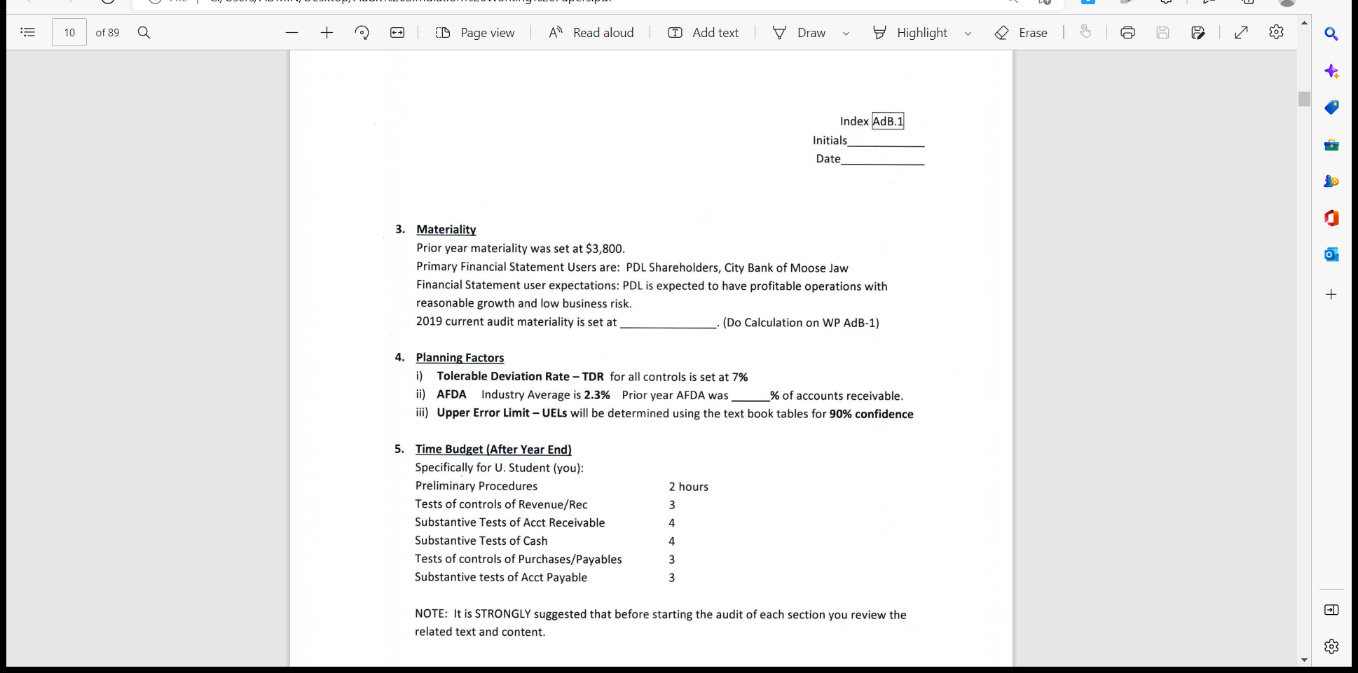

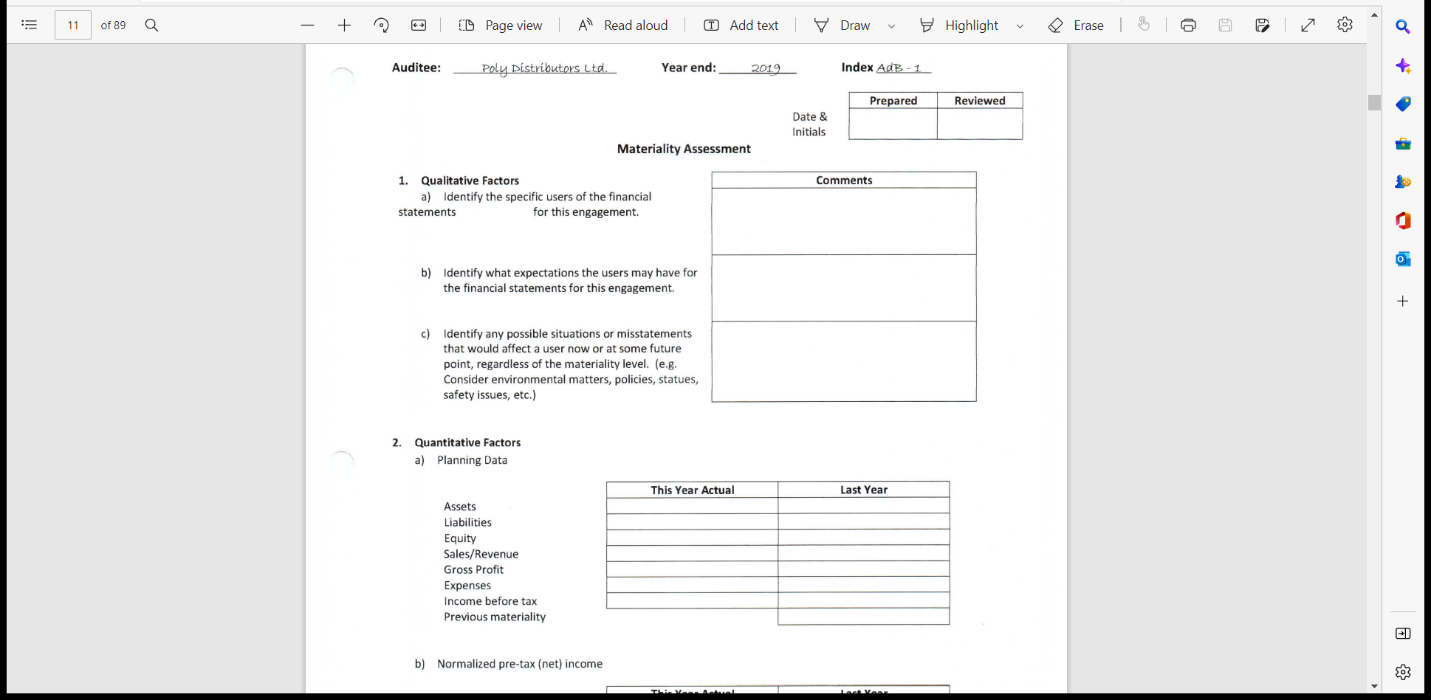

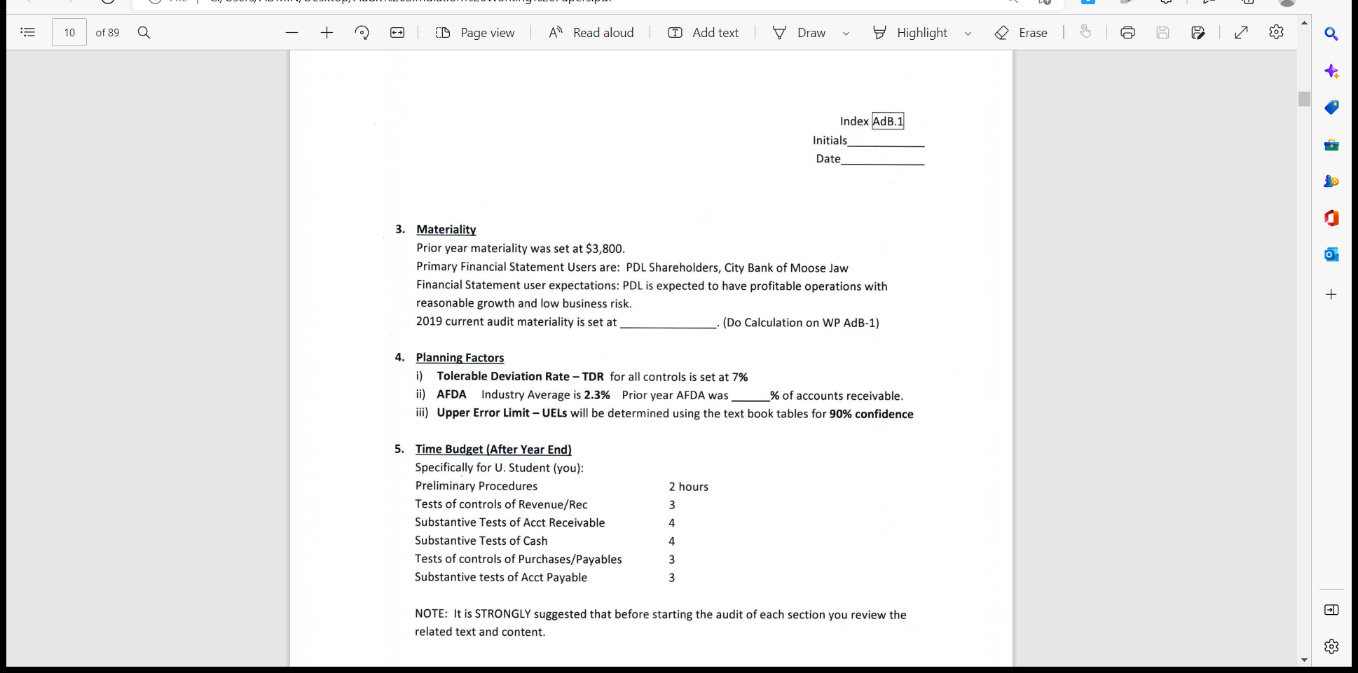

3. Materiality Prior year materiality was set at $3,800. Primary Financial Statement Users are: PDL. Shareholders, City Bank of Moose Jaw Financial Statement user expectations: PDL is expected to have profitable operations with reasonable growth and low business risk. 2019 current audit materiality is set at (Do Calculation on WP AdB-1) Materiality Assessment 2. Quantitative Factors a) Planning Data Assets Liabilities Equity Sales/Revenue Gross Profit Expenses Income before tax Previous materiality b) Normalized pre-tax (net) income 3. Materiality Prior year materiality was set at $3,800. Primary Financial Statement Users are: PDL Shareholders, City Bank of Moose Jaw Financial Statement user expectations: PDL is expected to have profitable operations with reasonable growth and low business risk. 2019 current audit materiality is set at (Do Calculation on WP AdB-1) 4. Planning Factors i) Tolerable Deviation Rate - TDR for all controls is set at 7\% ii) AFDA Industry Average is 2.3\% Prior year AFDA was % of accounts receivable. iii) Upper Error Limit - UELs will be determined using the text book tables for 90% confidence NOTE: It is STRONGLY suggested that before starting the audit of each section you review the related text and content. 3. Materiality Prior year materiality was set at $3,800. Primary Financial Statement Users are: PDL. Shareholders, City Bank of Moose Jaw Financial Statement user expectations: PDL is expected to have profitable operations with reasonable growth and low business risk. 2019 current audit materiality is set at (Do Calculation on WP AdB-1) Materiality Assessment 2. Quantitative Factors a) Planning Data Assets Liabilities Equity Sales/Revenue Gross Profit Expenses Income before tax Previous materiality b) Normalized pre-tax (net) income 3. Materiality Prior year materiality was set at $3,800. Primary Financial Statement Users are: PDL Shareholders, City Bank of Moose Jaw Financial Statement user expectations: PDL is expected to have profitable operations with reasonable growth and low business risk. 2019 current audit materiality is set at (Do Calculation on WP AdB-1) 4. Planning Factors i) Tolerable Deviation Rate - TDR for all controls is set at 7\% ii) AFDA Industry Average is 2.3\% Prior year AFDA was % of accounts receivable. iii) Upper Error Limit - UELs will be determined using the text book tables for 90% confidence NOTE: It is STRONGLY suggested that before starting the audit of each section you review the related text and content