Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. (Modigliani-Miller) Suppose General Electrics operates in a perfect capital market. It has $10 billion of long-term debt and $20 billion of short-term debt. Both

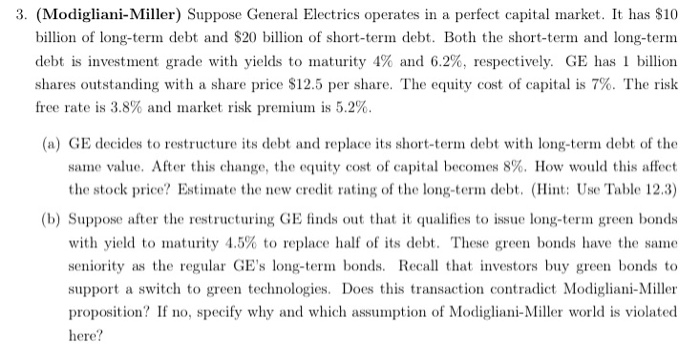

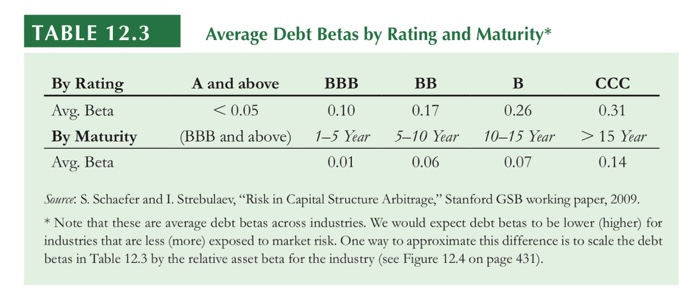

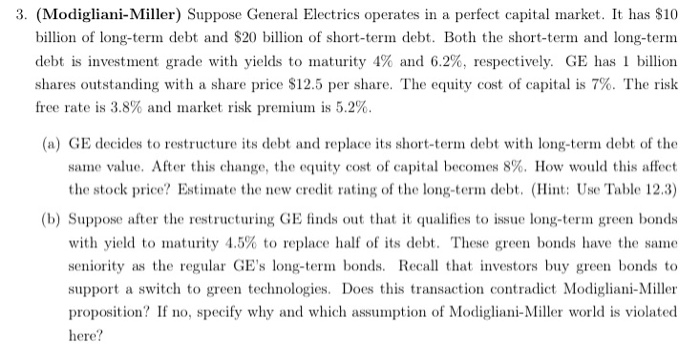

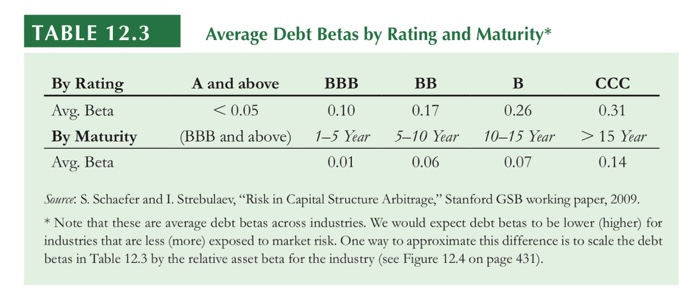

3. (Modigliani-Miller) Suppose General Electrics operates in a perfect capital market. It has $10 billion of long-term debt and $20 billion of short-term debt. Both the short-term and long-term debt is investment grade with yields to maturity 4% and 6.2%, respectively. GE has 1 billion shares outstanding with a share price $12.5 per share. The equity cost of capital is 7%. The risk free rate is 3.8% and market risk premium is 5.2% (a) GE decides to restructure its debt and replace its short-term debt with long-term debt of the same value. After this change, the equity cost of capital becomes 8%. How would this affect the stock price? Estimate the new credit rating of the long-term debt. (Hint: Une Table 12.3) (b) Suppose after the restructuring GE finds out that it qualifies to issue long-term green bonds with yield to maturity 4.5% to replace half of its debt. These green bonds have the same seniority as the regular GE's long-term bonds. Recall that investors buy green bonds to support a switch to green technologies. Does this transaction contradict Modigliani-Miller proposition? If no, specify why and which assumption of Modigliani-Miller world is violated here? TABLE 12.3 Average Debt Betas by Rating and Maturity* By Rating Avg. Beta By Maturity Avg. Beta A and above 15 Year 0.14 Source: S. Schaefer and I. Strebulaev, "Risk in Capital Structure Arbitrage," Stanford GSB working paper, 2009, * Note that these are average debt betas across industries. We would expect debt betas to be lower (higher) for industries that are less (more) exposed to market risk. One way to approximate this difference is to scale the debt betas in Table 12.3 by the relative asset beta for the industry (see Figure 12.4 on page 431)

3. (Modigliani-Miller) Suppose General Electrics operates in a perfect capital market. It has $10 billion of long-term debt and $20 billion of short-term debt. Both the short-term and long-term debt is investment grade with yields to maturity 4% and 6.2%, respectively. GE has 1 billion shares outstanding with a share price $12.5 per share. The equity cost of capital is 7%. The risk free rate is 3.8% and market risk premium is 5.2% (a) GE decides to restructure its debt and replace its short-term debt with long-term debt of the same value. After this change, the equity cost of capital becomes 8%. How would this affect the stock price? Estimate the new credit rating of the long-term debt. (Hint: Une Table 12.3) (b) Suppose after the restructuring GE finds out that it qualifies to issue long-term green bonds with yield to maturity 4.5% to replace half of its debt. These green bonds have the same seniority as the regular GE's long-term bonds. Recall that investors buy green bonds to support a switch to green technologies. Does this transaction contradict Modigliani-Miller proposition? If no, specify why and which assumption of Modigliani-Miller world is violated here? TABLE 12.3 Average Debt Betas by Rating and Maturity* By Rating Avg. Beta By Maturity Avg. Beta A and above 15 Year 0.14 Source: S. Schaefer and I. Strebulaev, "Risk in Capital Structure Arbitrage," Stanford GSB working paper, 2009, * Note that these are average debt betas across industries. We would expect debt betas to be lower (higher) for industries that are less (more) exposed to market risk. One way to approximate this difference is to scale the debt betas in Table 12.3 by the relative asset beta for the industry (see Figure 12.4 on page 431)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started