Answered step by step

Verified Expert Solution

Question

1 Approved Answer

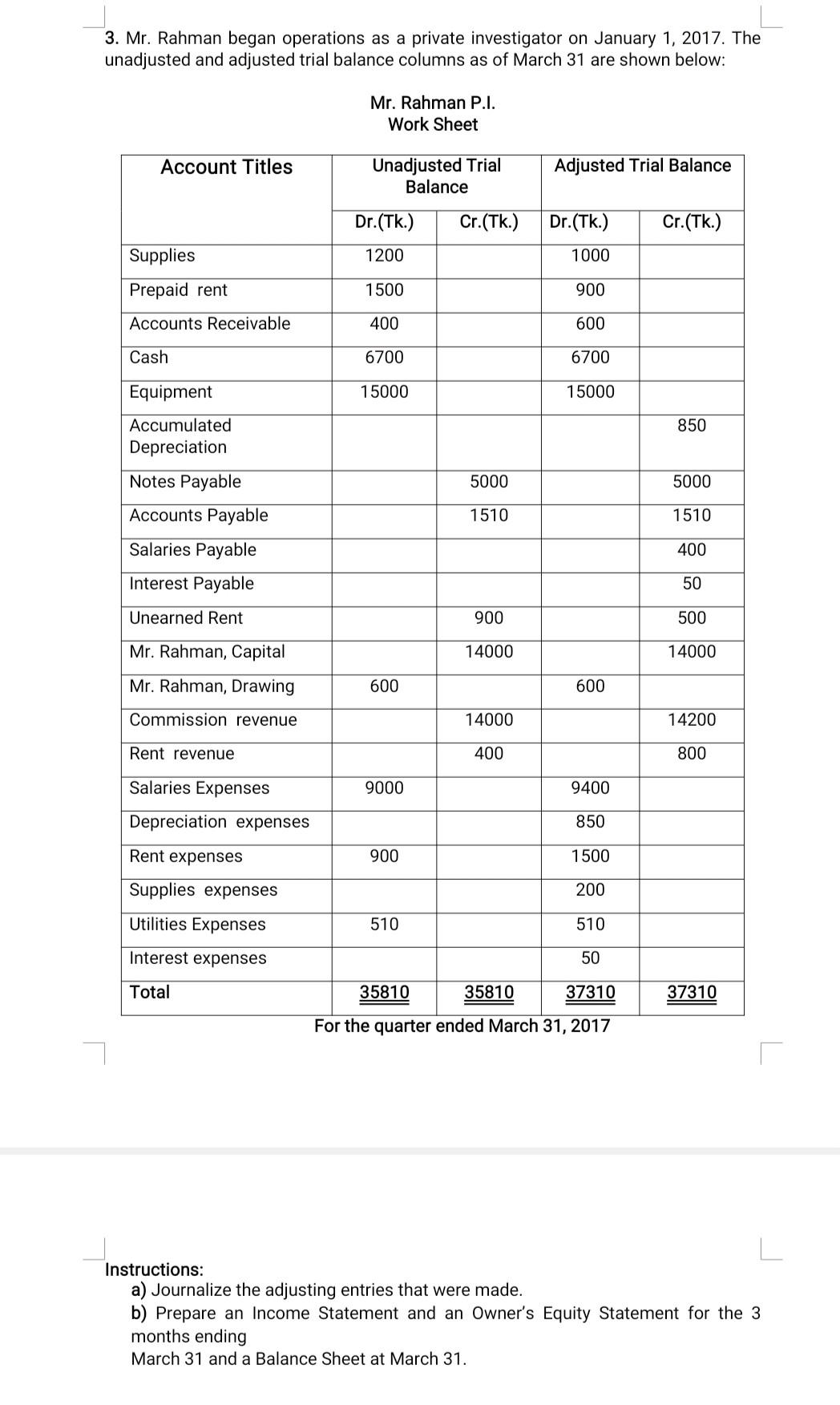

3. Mr. Rahman began operations as a private investigator on January 1, 2017. The unadjusted and adjusted trial balance columns as of March 31 are

3. Mr. Rahman began operations as a private investigator on January 1, 2017. The unadjusted and adjusted trial balance columns as of March 31 are shown below: Mr. Rahman P.I. Work Sheet Account Titles Unadjusted Trial Balance Adjusted Trial Balance Dr.(Tk.) Cr.(Tk.) Dr.(Tk.) Cr.(Tk.) Supplies 1200 1000 Prepaid rent 1500 900 Accounts Receivable 400 600 Cash 6700 6700 15000 15000 Equipment Accumulated Depreciation 850 Notes Payable 5000 5000 Accounts Payable 1510 1510 Salaries Payable 400 Interest Payable 50 Unearned Rent 900 500 Mr. Rahman, Capital 14000 14000 Mr. Rahman, Drawing 600 600 Commission revenue 14000 14200 Rent revenue 400 800 Salaries Expenses 9000 9400 Depreciation expenses 850 Rent expenses 900 1500 200 Supplies expenses Utilities Expenses 510 510 Interest expenses 50 Total 35810 35810 37310 37310 For the quarter ended March 31, 2017 Instructions: a) Journalize the adjusting entries that were made. b) Prepare an Income Statement and an Owner's Equity Statement for the 3 months ending March 31 and a Balance Sheet at March 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started