Answered step by step

Verified Expert Solution

Question

1 Approved Answer

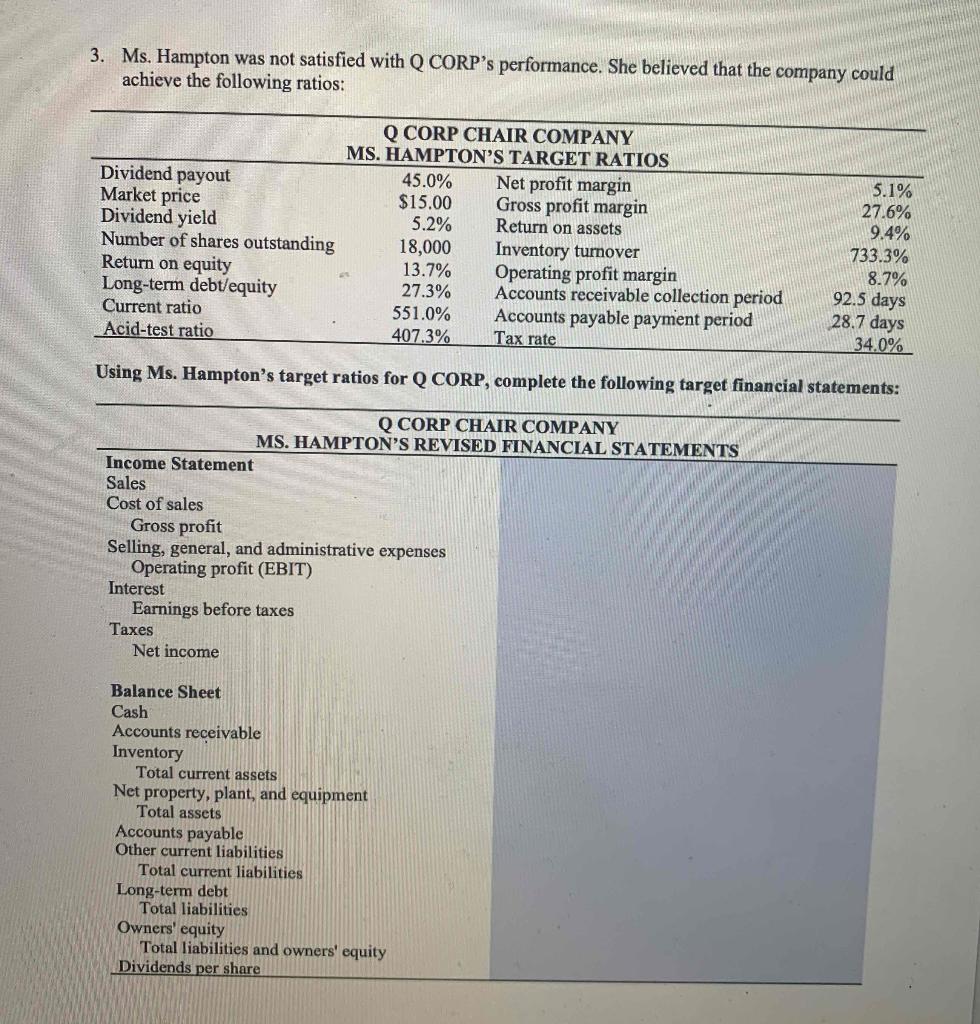

3. Ms. Hampton was not satisfied with Q CORP's performance. She believed that the company could achieve the following ratios: Q CORP CHAIR COMPANY

3. Ms. Hampton was not satisfied with Q CORP's performance. She believed that the company could achieve the following ratios: Q CORP CHAIR COMPANY MS. HAMPTON'S TARGET RATIOS Dividend payout 45.0% Net profit margin Market price $15.00 Gross profit margin 5.1% 27.6% Dividend yield 5.2% Return on assets 9.4% Number of shares outstanding 18,000 Inventory turnover 733.3% Return on equity 13.7% Operating profit margin 8.7% Long-term debt/equity 27.3% Accounts receivable collection period 92.5 days Current ratio 551.0% Accounts payable payment period 28.7 days Acid-test ratio 407.3% Tax rate 34.0% Using Ms. Hampton's target ratios for Q CORP, complete the following target financial statements: Income Statement Sales Cost of sales Gross profit Q CORP CHAIR COMPANY MS. HAMPTON'S REVISED FINANCIAL STATEMENTS Selling, general, and administrative expenses Operating profit (EBIT) Interest Earnings before taxes Taxes Net income Balance Sheet Cash Accounts receivable Inventory Total current assets Net property, plant, and equipment Total assets Accounts payable Other current liabilities Total current liabilities Long-term debt Total liabilities Owners' equity Total liabilities and owners' equity Dividends per share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started