Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3 . Net Present Value and Internal Rate of Return. Below are the projected revenues and expenses for a new clinical nurse specialist program being

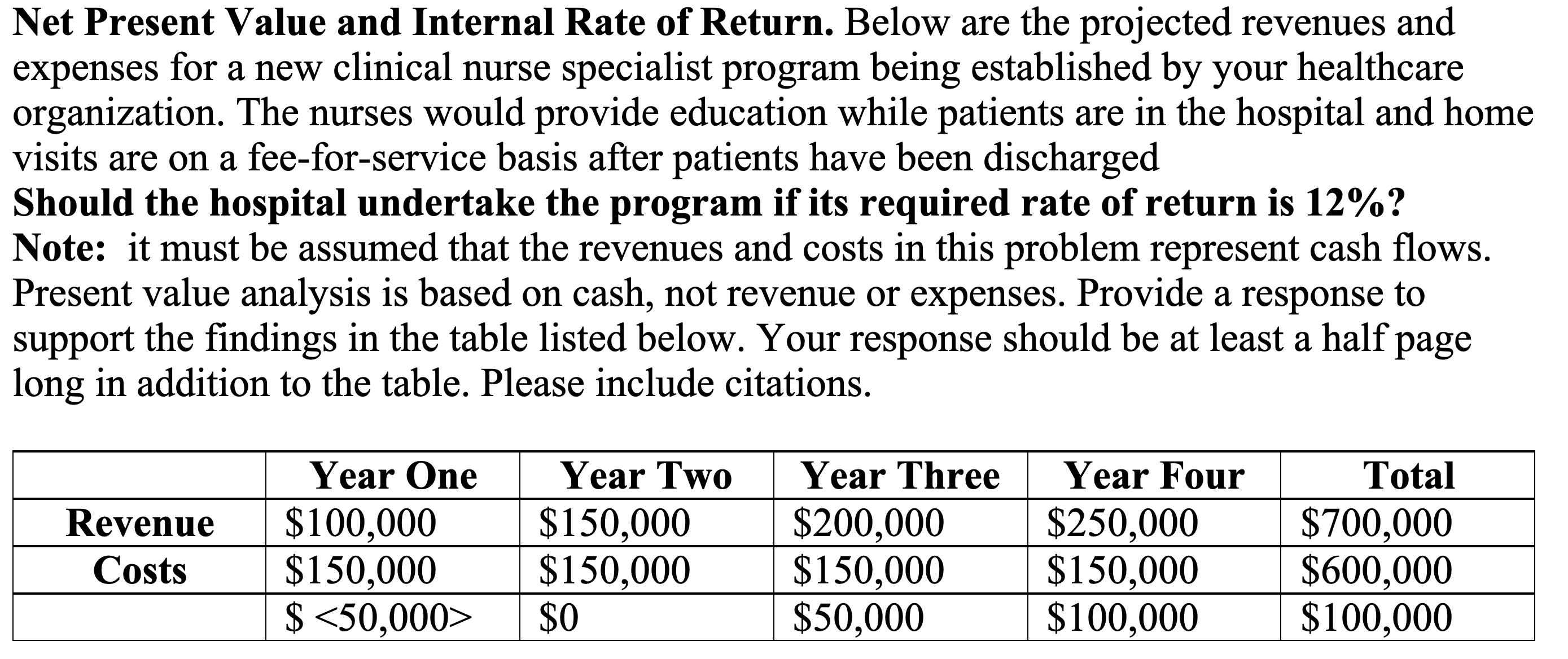

Net Present Value and Internal Rate of Return. Below are the projected revenues and expenses for a new clinical nurse specialist program being established by your healthcare organization. The nurses would provide education while patients are in the hospital and home visits are on a feeforservice basis after patients have been discharged

Should the hospital undertake the program if its required rate of return is

Note: it must be assumed that the revenues and costs in this problem represent cash flows. Present value analysis is based on cash, not revenue or expenses. Provide a response to support the findings in the table listed below.Net Present Value and Internal Rate of Return. Below are the projected revenues and

expenses for a new clinical nurse specialist program being established by your healthcare

organization. The nurses would provide education while patients are in the hospital and home

visits are on a feeforservice basis after patients have been discharged

Should the hospital undertake the program if its required rate of return is

Note: it must be assumed that the revenues and costs in this problem represent cash flows.

Present value analysis is based on cash, not revenue or expenses. Provide a response to

support the findings in the table listed below. Your response should be at least a half page

long in addition to the table. The answer on Chegg is listing a IRR which is not what the quesiton isPlease include citations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started