Answered step by step

Verified Expert Solution

Question

1 Approved Answer

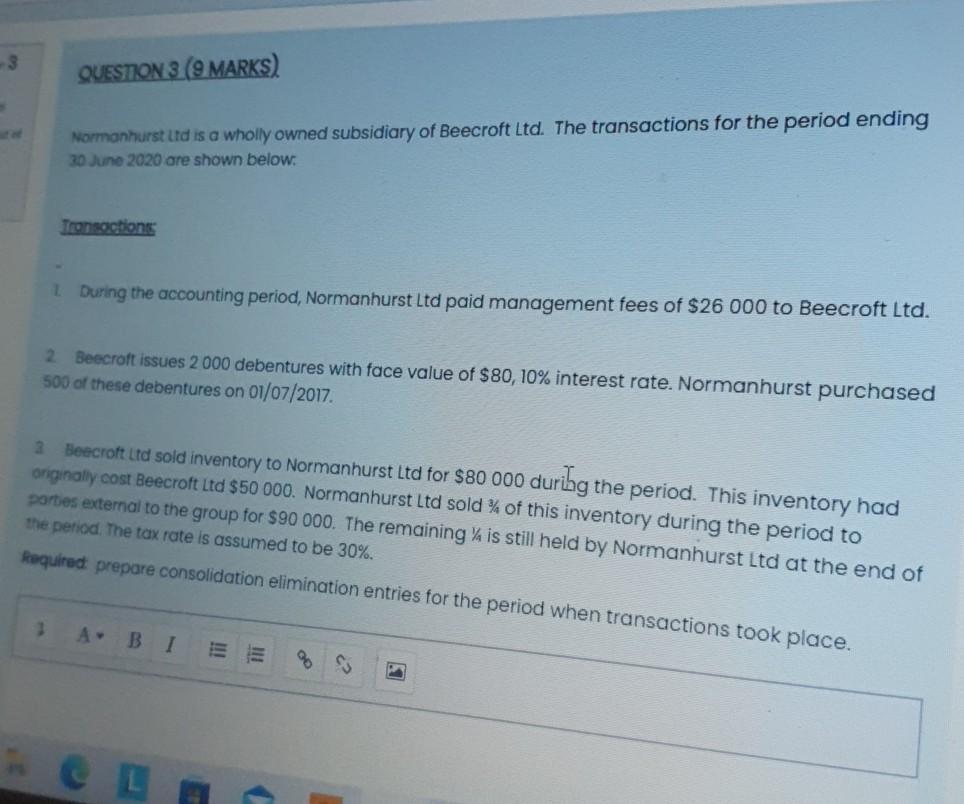

-3 - of QUESTION 3 (9 MARKS) Normanhurst Ltd is a wholly owned subsidiary of Beecroft Ltd. The transactions for the period ending 30

-3 - of QUESTION 3 (9 MARKS) Normanhurst Ltd is a wholly owned subsidiary of Beecroft Ltd. The transactions for the period ending 30 June 2020 are shown below: Transactions 3 1 During the accounting period, Normanhurst Ltd paid management fees of $26 000 to Beecroft Ltd. 2 Beecroft issues 2 000 debentures with face value of $80, 10% interest rate. Normanhurst purchased 500 of these debentures on 01/07/2017. 3 Beecroft Ltd sold inventory to Normanhurst Ltd for $80 000 during the period. This inventory had originally cost Beecroft Ltd $50 000. Normanhurst Ltd sold % of this inventory during the period to parties external to the group for $90 000. The remaining % is still held by Normanhurst Ltd at the end of the period. The tax rate is assumed to be 30%. Required prepare consolidation elimination entries for the period when transactions took place. A. BI CL E SS S

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

CONSOLIDATION JOURNAL ENTRY Particulars 1 Management feeincome M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started