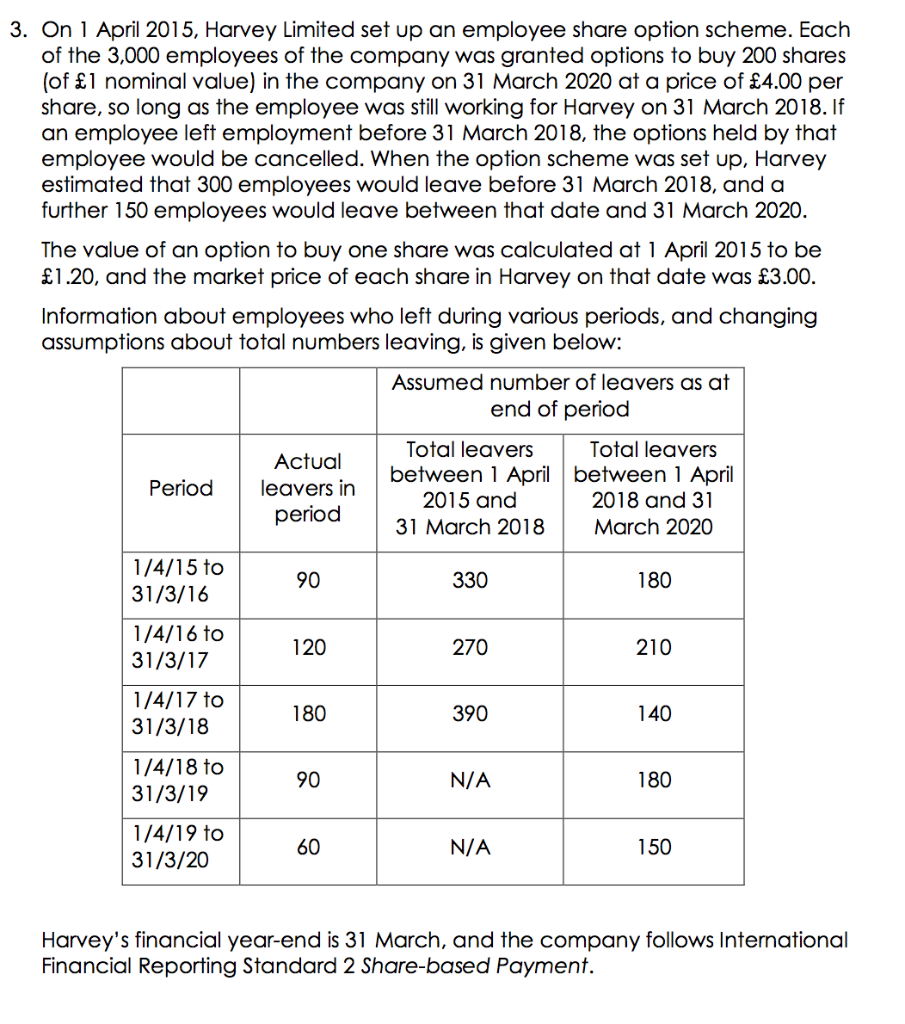

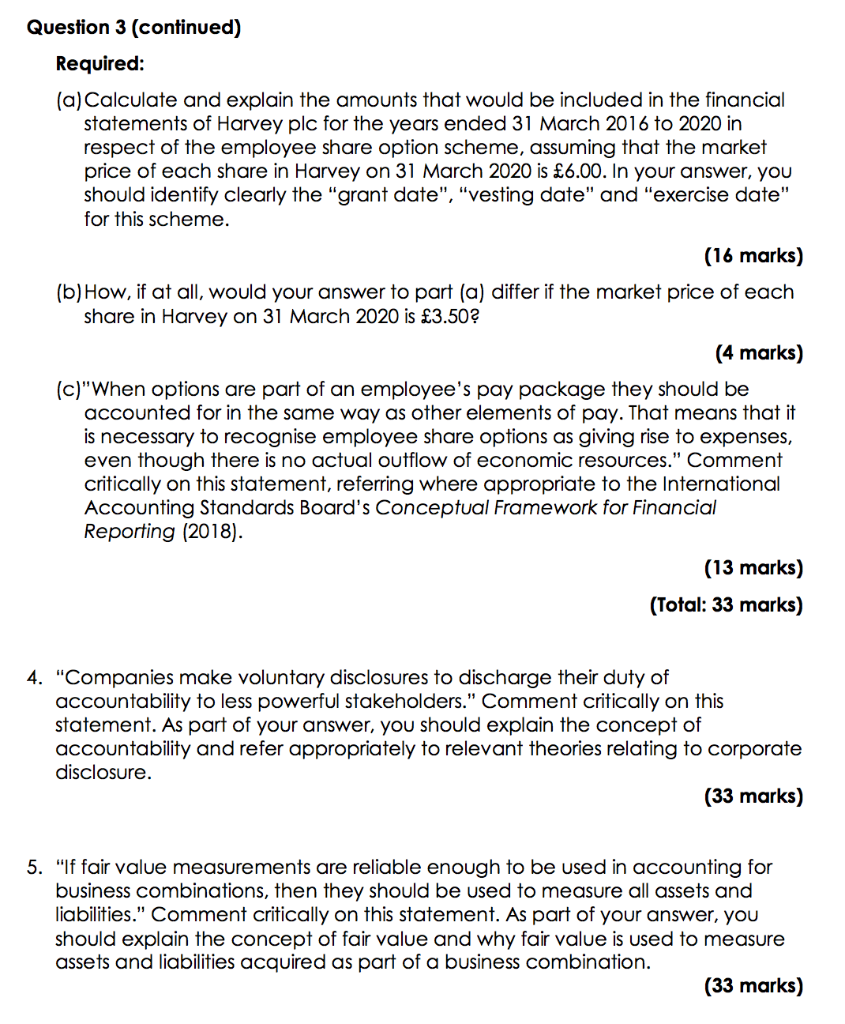

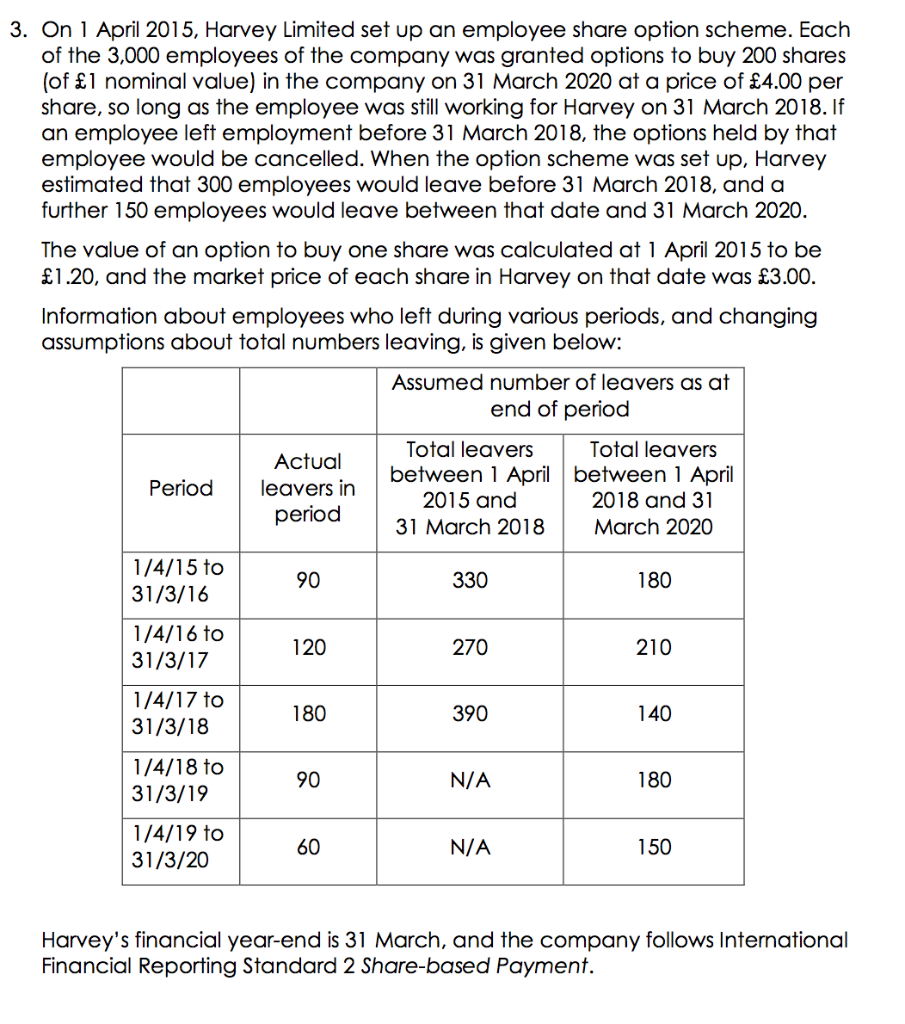

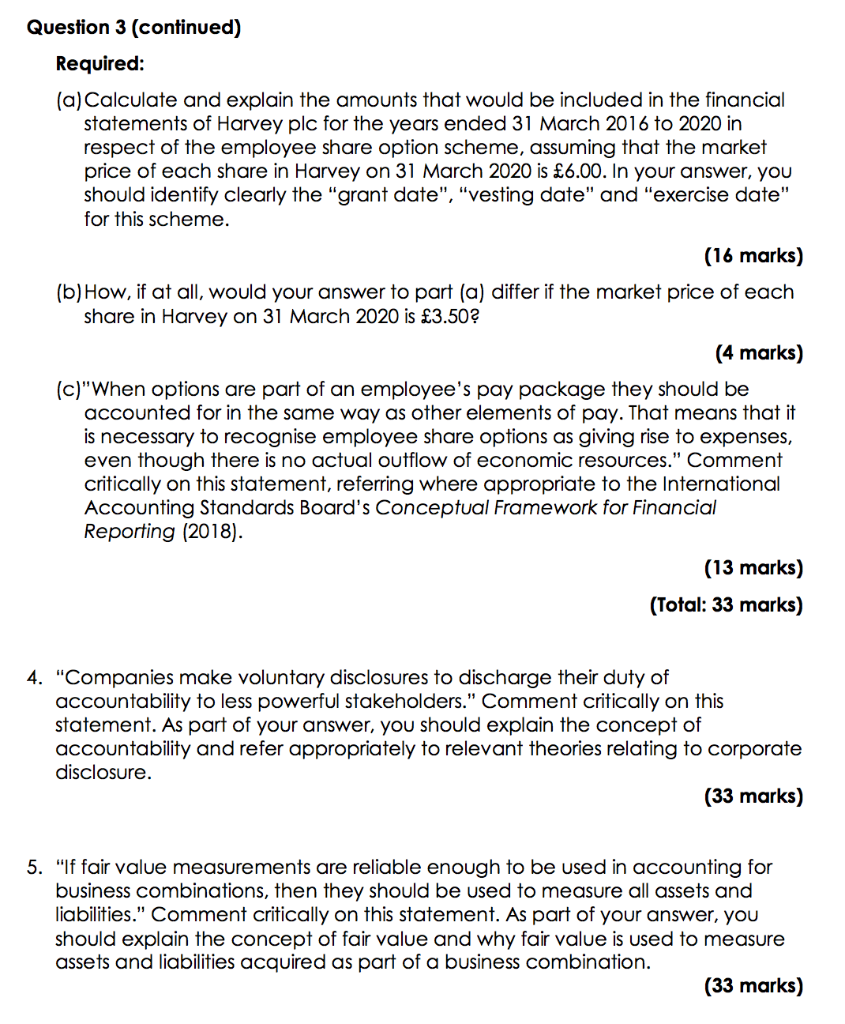

3. On 1 April 2015, Harvey Limited set up an employee share option scheme. Each of the 3,000 employees of the company was granted options to buy 200 shares (of 1 nominal value) in the company on 31 March 2020 at a price of 4.00 per share, so long as the employee was still working for Harvey on 31 March 2018. If an employee left employment before 31 March 2018, the options held by that employee would be cancelled. When the option scheme was set up, Harvey estimated that 300 employees would leave before 31 March 2018, and a further 150 employees would leave between that date and 31 March 2020. The value of an option to buy one share was calculated at 1 April 2015 to be 1.20, and the market price of each share in Harvey on that date was 3.00. Information about employees who left during various periods, and changing assumptions about total numbers leaving, is given below: Assumed number of leavers as at end of period Period Actual leavers in period Total leavers Total leavers between 1 April between 1 April 2015 and 2018 and 31 31 March 2018 March 2020 1/4/15 to 31/3/16 90 330 180 1/4/16 to 31/3/17 120 270 210 1/4/17 to 31/3/18 180 390 140 1/4/18 to 31/3/19 90 N/A 180 1/4/19 to 31/3/20 60 N/A 150 Harvey's financial year-end is 31 March, and the company follows International Financial Reporting Standard 2 Share-based Payment. Question 3 (continued) Required: (a) Calculate and explain the amounts that would be included in the financial statements of Harvey plc for the years ended 31 March 2016 to 2020 in respect of the employee share option scheme, assuming that the market price of each share in Harvey on 31 March 2020 is 6.00. In your answer, you should identify clearly the "grant date", "vesting date" and "exercise date" for this scheme. (16 marks) (b) How, if at all, would your answer to part (a) differ if the market price of each share in Harvey on 31 March 2020 is 3.50 ? (4 marks) (c)"When options are part of an employee's pay package they should be accounted for in the same way as other elements of pay. That means that it is necessary to recognise employee share options as giving rise to expenses, even though there is no actual outflow of economic resources." Comment critically on this statement, referring where appropriate to the International Accounting Standards Board's Conceptual Framework for Financial Reporting (2018). (13 marks) (Total: 33 marks) 4. "Companies make voluntary disclosures to discharge their duty of accountability to less powerful stakeholders." Comment critically on this statement. As part of your answer, you should explain the concept of accountability and refer appropriately to relevant theories relating to corporate disclosure. (33 marks) 5. "If fair value measurements are reliable enough to be used in accounting for business combinations, then they should be used to measure all assets and liabilities." Comment critically on this statement. As part of your answer, you should explain the concept of fair value and why fair value is used to measure assets and liabilities acquired as part of a business combination. (33 marks) 3. On 1 April 2015, Harvey Limited set up an employee share option scheme. Each of the 3,000 employees of the company was granted options to buy 200 shares (of 1 nominal value) in the company on 31 March 2020 at a price of 4.00 per share, so long as the employee was still working for Harvey on 31 March 2018. If an employee left employment before 31 March 2018, the options held by that employee would be cancelled. When the option scheme was set up, Harvey estimated that 300 employees would leave before 31 March 2018, and a further 150 employees would leave between that date and 31 March 2020. The value of an option to buy one share was calculated at 1 April 2015 to be 1.20, and the market price of each share in Harvey on that date was 3.00. Information about employees who left during various periods, and changing assumptions about total numbers leaving, is given below: Assumed number of leavers as at end of period Period Actual leavers in period Total leavers Total leavers between 1 April between 1 April 2015 and 2018 and 31 31 March 2018 March 2020 1/4/15 to 31/3/16 90 330 180 1/4/16 to 31/3/17 120 270 210 1/4/17 to 31/3/18 180 390 140 1/4/18 to 31/3/19 90 N/A 180 1/4/19 to 31/3/20 60 N/A 150 Harvey's financial year-end is 31 March, and the company follows International Financial Reporting Standard 2 Share-based Payment. Question 3 (continued) Required: (a) Calculate and explain the amounts that would be included in the financial statements of Harvey plc for the years ended 31 March 2016 to 2020 in respect of the employee share option scheme, assuming that the market price of each share in Harvey on 31 March 2020 is 6.00. In your answer, you should identify clearly the "grant date", "vesting date" and "exercise date" for this scheme. (16 marks) (b) How, if at all, would your answer to part (a) differ if the market price of each share in Harvey on 31 March 2020 is 3.50 ? (4 marks) (c)"When options are part of an employee's pay package they should be accounted for in the same way as other elements of pay. That means that it is necessary to recognise employee share options as giving rise to expenses, even though there is no actual outflow of economic resources." Comment critically on this statement, referring where appropriate to the International Accounting Standards Board's Conceptual Framework for Financial Reporting (2018). (13 marks) (Total: 33 marks) 4. "Companies make voluntary disclosures to discharge their duty of accountability to less powerful stakeholders." Comment critically on this statement. As part of your answer, you should explain the concept of accountability and refer appropriately to relevant theories relating to corporate disclosure. (33 marks) 5. "If fair value measurements are reliable enough to be used in accounting for business combinations, then they should be used to measure all assets and liabilities." Comment critically on this statement. As part of your answer, you should explain the concept of fair value and why fair value is used to measure assets and liabilities acquired as part of a business combination. (33 marks)