Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. On August 1, 19xx, Carl Luzinski opened Luzinski Appliance Service. During the month, he completed the following transactions for the company: Aug. 1

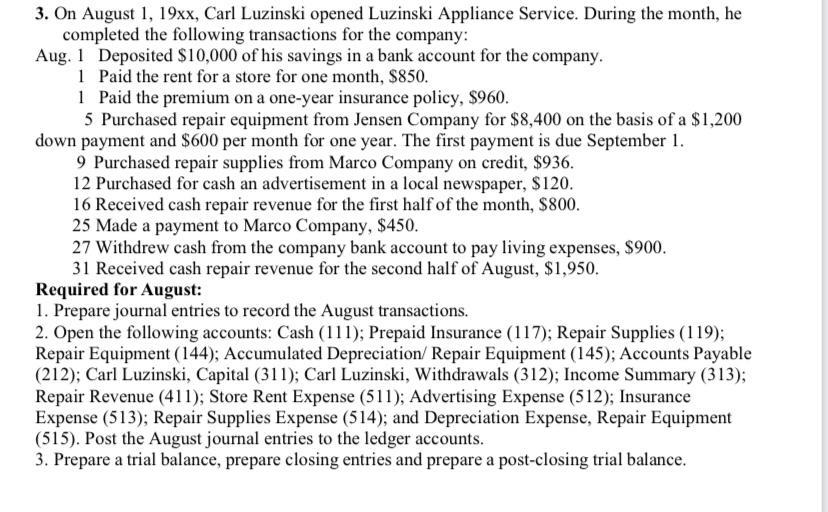

3. On August 1, 19xx, Carl Luzinski opened Luzinski Appliance Service. During the month, he completed the following transactions for the company: Aug. 1 Deposited $10,000 of his savings in a bank account for the company. 1 Paid the rent for a store for one month, $850. 1 Paid the premium on a one-year insurance policy, $960. 5 Purchased repair equipment from Jensen Company for $8,400 on the basis of a $1,200 down payment and $600 per month for one year. The first payment is due September 1. 9 Purchased repair supplies from Marco Company on credit, $936. 12 Purchased for cash an advertisement in a local newspaper, $120. 16 Received cash repair revenue for the first half of the month, $800. 25 Made a payment to Marco Company, $450. 27 Withdrew cash from the company bank account to pay living expenses, $900. 31 Received cash repair revenue for the second half of August, $1,950. Required for August: 1. Prepare journal entries to record the August transactions. 2. Open the following accounts: Cash (111); Prepaid Insurance (117); Repair Supplies (119); Repair Equipment (144); Accumulated Depreciation/Repair Equipment (145); Accounts Payable (212); Carl Luzinski, Capital (311); Carl Luzinski, Withdrawals (312); Income Summary (313); Repair Revenue (411); Store Rent Expense (511); Advertising Expense (512); Insurance Expense (513); Repair Supplies Expense (514); and Depreciation Expense, Repair Equipment (515). Post the August journal entries to the ledger accounts. 3. Prepare a trial balance, prepare closing entries and prepare a post-closing trial balance.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Conclusion The following can be concluded from above 1 All journal entries and ledger...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started