Answered step by step

Verified Expert Solution

Question

1 Approved Answer

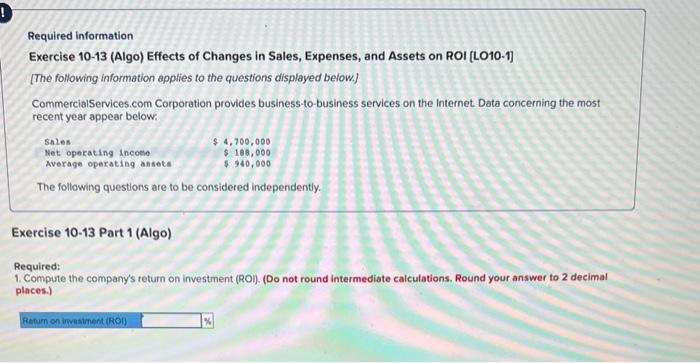

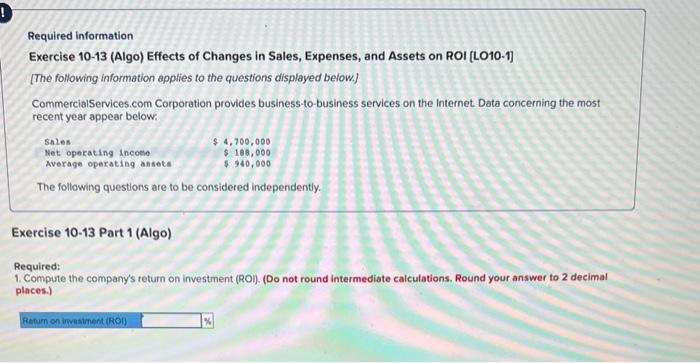

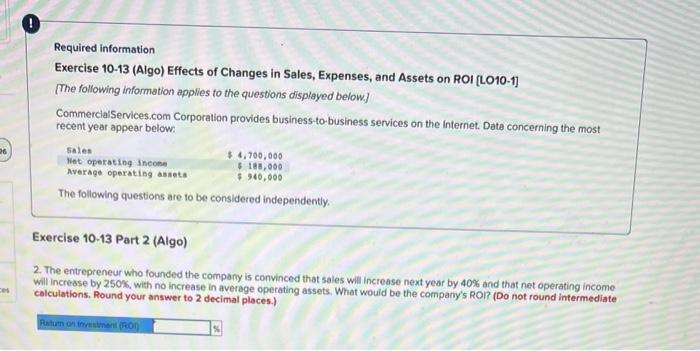

3 part question Required information Exercise 10-13 (Algo) Effects of Changes in Sales, Expenses, and Assets on ROI [LO10-1] [The following information applies to the

3 part question

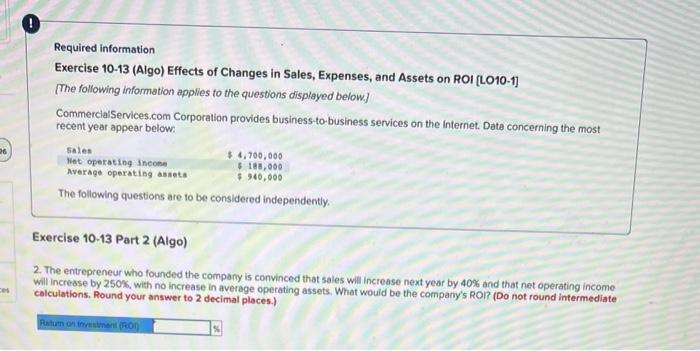

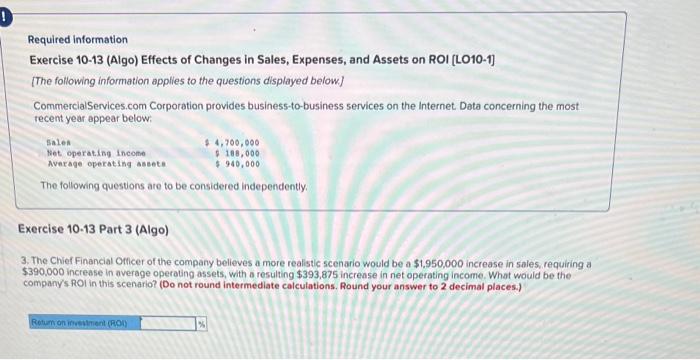

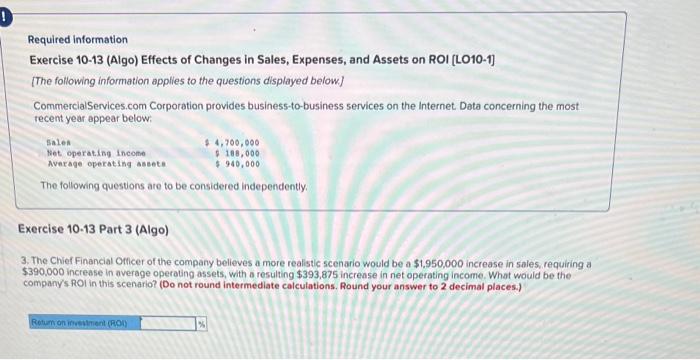

Required information Exercise 10-13 (Algo) Effects of Changes in Sales, Expenses, and Assets on ROI [LO10-1] [The following information applies to the questions displayed below.] CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below: The following questions are to be considered independently. xercise 10-13 Part 1 (Algo) Required: Compute the company's return on investment (RO). (Do not round intermediate calculations, Round your answer to 2 decimal places.) Required information Exercise 10-13 (Algo) Effects of Changes in Sales, Expenses, and Assets on ROI [LO10-1] [The following information applies to the questions displayed below.] CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below: The following questions are to be considered independently. Exercise 10.13 Part 2 (Algo) 2. The entrepreneur who founded the company is convinced that sales will increase next year by 40% and that net operating income Will increase by 250%, with no increase in average operating assets, What would be the company's ROI? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Required information Exercise 10-13 (Algo) Effects of Changes in Sales, Expenses, and Assets on ROI [LO10-1] [The following information applies to the questions displayed below] CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below: The following questions ate to be considered independently. Exercise 10-13 Part 3 (Algo) 3. The Chief Financial Officer of the company believes a more realistic scenario would be a $1,950,000 increase in sales, requiring a $390.000 increase in average operating assets, with a resulting $393,875 increase in net operating income. What would be the company's ROI in this scenario? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started