3 PARTS

3 PARTS

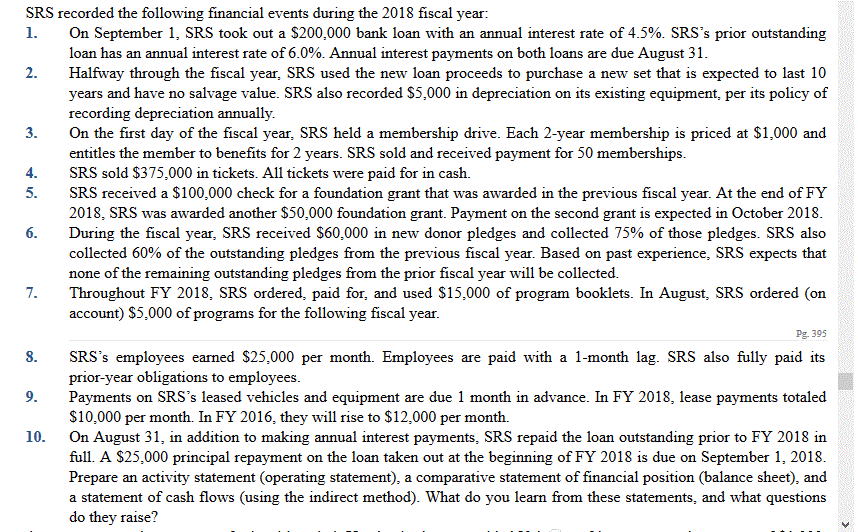

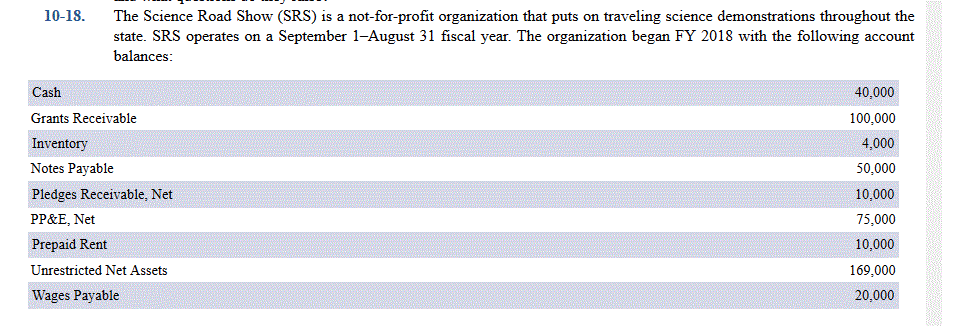

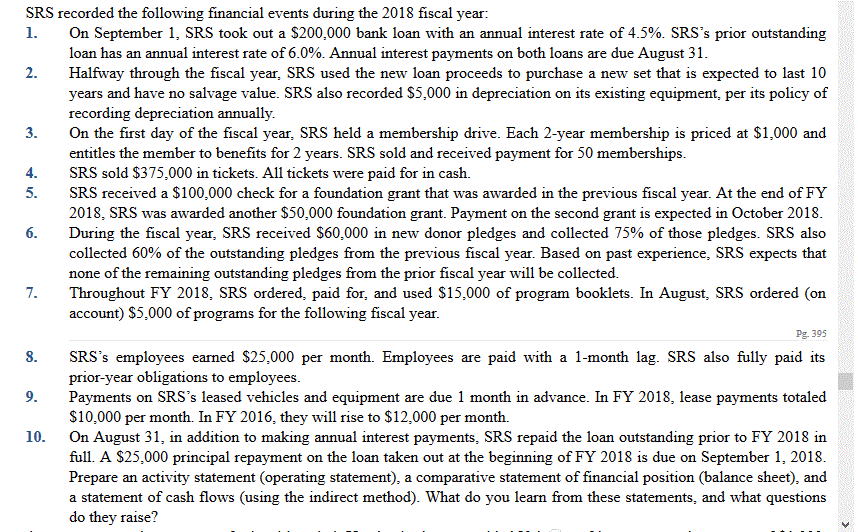

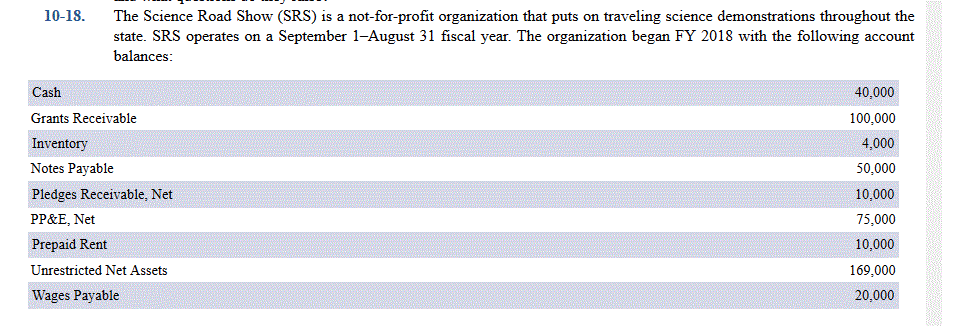

SRS recorded the following financial events during the 2018 fiscal year l. On September 1, SRS took out a $200,000 bank loan with an annual interest rate of 4.5% SRS's prior outstanding loan has an annual interest rate of 6.0 Annual interest payments on both loans are due August 31 Halfway through the fiscal year, SRS used the new loan proceeds to purchase a new set that is expected to last 10 years and have no salvage value. SRS also recorded $5,000 in depreciation on its existing equipment, per its policy of recording depreciation annually On the first day of the fiscal year, SRS held a membership drive. Each 2-year membership is priced at $1,000 and entitles the member to benefits for 2 years. SRS sold and received payment for 50 memberships 4. SRS sold $375,000 in tickets. All tickets were paid for in cash. 5. SRS received a $100,000 check for a foundation grant that was awarded in the previous fiscal year. At the end of FY 2018, SRS was awarded another $50,000 foundation grant. Payment on the second grant is expected in October 2018 6. During the fiscal year, SRS received $60,000 in new donor pledges and collected 75% of those pledges. SRS also collected 60% of the outstanding pledges from the previous fiscal year. Based on past experience, SRS expects that none of the remaining outstanding pledges from the prior fiscal year will be collected. Throughout FY 2018, SRS ordered, paid for, and used $15,000 of program booklets. In August, SRS ordered (on account) $5,000 of programs for the following fiscal year. Pg. 395 S. SRS's employees earned $25,000 per month. Employees are paid with a 1-month lag. SRS also fully paid its prior-year obligations to employees. Payments on SRS's leased vehicles and equipment are due 1 month in advance. In FY 2018, lease payments totaled $10,000 per month. In FY 2016, they will rise to $12,000 per month. 10 n August 31, in addition to making annual interest payments, SRS repaid the loan outstanding prior to FY 2018 in full. A $25,000 principal repayment on the loan taken out at the beginning of FY 2018 is due on September 1, 2018 Prepare an activity statement (operating statement, a comparative statement of financial position (balance sheet, and a statement of cash flows (using the indirect method. What do you learn from these statements, and what questions do they raise? SRS recorded the following financial events during the 2018 fiscal year l. On September 1, SRS took out a $200,000 bank loan with an annual interest rate of 4.5% SRS's prior outstanding loan has an annual interest rate of 6.0 Annual interest payments on both loans are due August 31 Halfway through the fiscal year, SRS used the new loan proceeds to purchase a new set that is expected to last 10 years and have no salvage value. SRS also recorded $5,000 in depreciation on its existing equipment, per its policy of recording depreciation annually On the first day of the fiscal year, SRS held a membership drive. Each 2-year membership is priced at $1,000 and entitles the member to benefits for 2 years. SRS sold and received payment for 50 memberships 4. SRS sold $375,000 in tickets. All tickets were paid for in cash. 5. SRS received a $100,000 check for a foundation grant that was awarded in the previous fiscal year. At the end of FY 2018, SRS was awarded another $50,000 foundation grant. Payment on the second grant is expected in October 2018 6. During the fiscal year, SRS received $60,000 in new donor pledges and collected 75% of those pledges. SRS also collected 60% of the outstanding pledges from the previous fiscal year. Based on past experience, SRS expects that none of the remaining outstanding pledges from the prior fiscal year will be collected. Throughout FY 2018, SRS ordered, paid for, and used $15,000 of program booklets. In August, SRS ordered (on account) $5,000 of programs for the following fiscal year. Pg. 395 S. SRS's employees earned $25,000 per month. Employees are paid with a 1-month lag. SRS also fully paid its prior-year obligations to employees. Payments on SRS's leased vehicles and equipment are due 1 month in advance. In FY 2018, lease payments totaled $10,000 per month. In FY 2016, they will rise to $12,000 per month. 10 n August 31, in addition to making annual interest payments, SRS repaid the loan outstanding prior to FY 2018 in full. A $25,000 principal repayment on the loan taken out at the beginning of FY 2018 is due on September 1, 2018 Prepare an activity statement (operating statement, a comparative statement of financial position (balance sheet, and a statement of cash flows (using the indirect method. What do you learn from these statements, and what questions do they raise

3 PARTS

3 PARTS