Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Please refer to the data below on exchange rates and interest rates for US, Europe, Japan, and UK, taken from FT for 2/22/21.

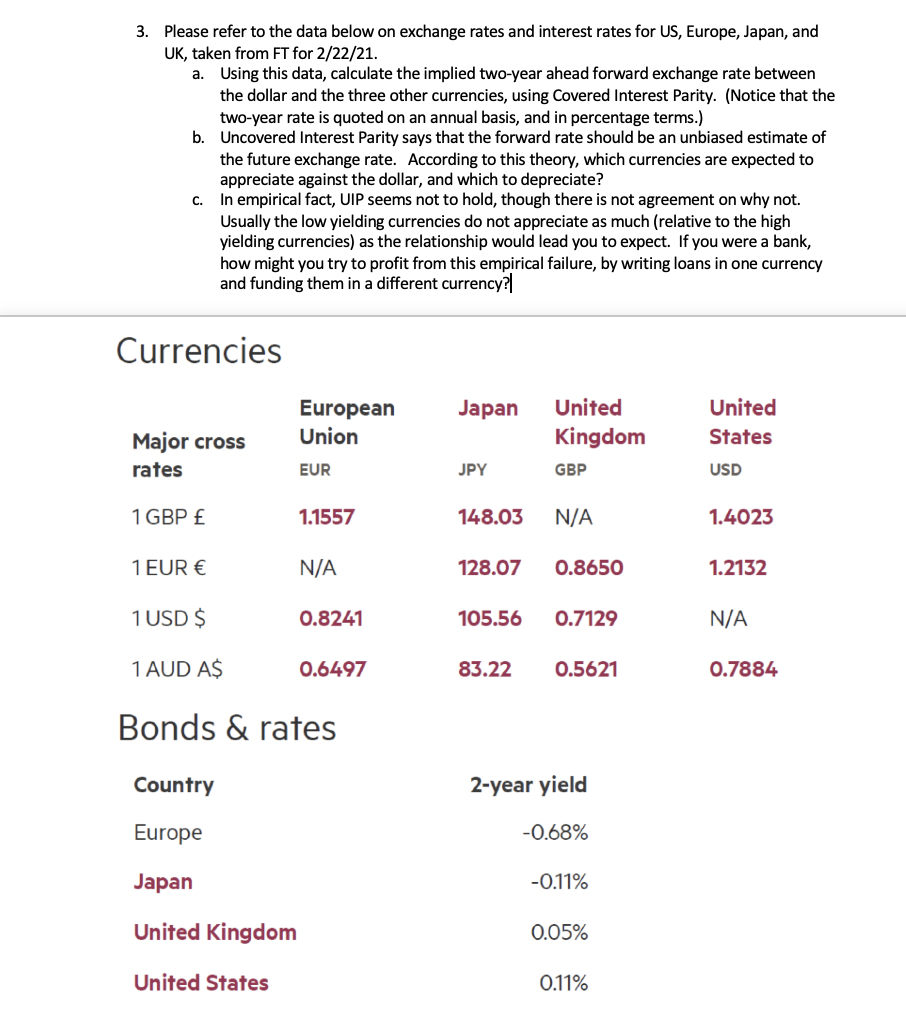

3. Please refer to the data below on exchange rates and interest rates for US, Europe, Japan, and UK, taken from FT for 2/22/21. a. Using this data, calculate the implied two-year ahead forward exchange rate between the dollar and the three other currencies, using Covered Interest Parity. (Notice that the two-year rate is quoted on an annual basis, and in percentage terms.) b. Uncovered Interest Parity says that the forward rate should be an unbiased estimate of the future exchange rate. According to this theory, which currencies are expected to appreciate against the dollar, and which to depreciate? c. In empirical fact, UIP seems not to hold, though there is not agreement on why not. Usually the low yielding currencies do not appreciate as much (relative to the high yielding currencies) as the relationship would lead you to expect. If you were a bank, how might you try to profit from this empirical failure, by writing loans in one currency and funding them in a different currency? Currencies Major cross rates 1 GBP 1 EUR 1 USD $ 1 AUD A$ European Union EUR 1.1557 N/A 0.8241 0.6497 Bonds & rates Country Europe Japan United Kingdom United States Japan JPY United Kingdom GBP 148.03 N/A 128.07 0.8650 105.56 0.7129 83.22 0.5621 2-year yield -0.68% -0.11% 0.05% 0.11% United States USD 1.4023 1.2132 N/A 0.7884

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer a To calculate the implied twoyear ahead forward exchange rate between the dollar and the thr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started