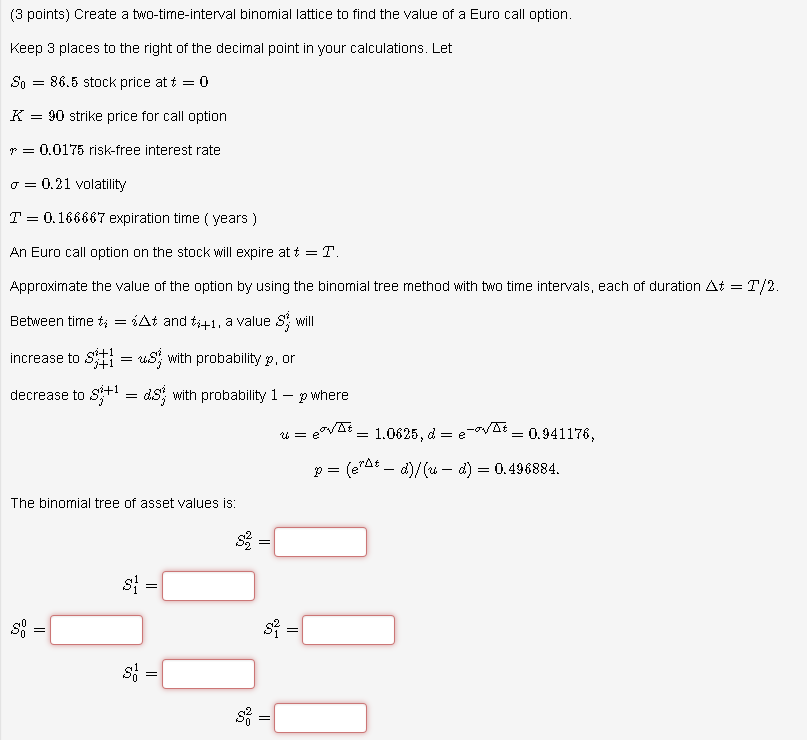

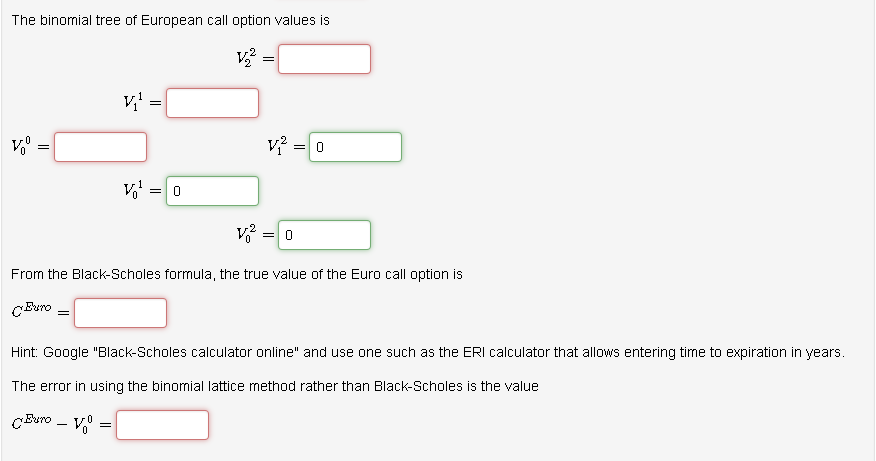

(3 points) Create a two-time-interval binomial lattice to find the value of a Euro call option. Keep 3 places to the right of the decimal point in your calculations. Let So -86.5 stock price at t o K 90 strike price for call option r-0.0175 risk-free interest rate -0.21 volatility T 0.166667 expiration time (years) An Euro call option on the stock will expire at t = T Approximate the value of the option by using the binomial tree method with two time intervals, each of duration Between time t At and titl a value will increase to sit-us, w th probability P, or decrease to s+ds with probability 1- p where At T/2. = eVE = 1.0625, d = e-WAi-0.94 1176, p-(erde-d)/(u-d) = 0.496884. The binomial tree of asset values is: SH The binomial tree of European call option values is vo0 From the Black-Scholes formula, the true value of the Euro call option is cBuro Hint: Google "Black-Scholes calculator online" and use one such as the ERI calculator that allows entering time to expiration in years. The error in using the binomial lattice method rather than Black-Scholes is the value (3 points) Create a two-time-interval binomial lattice to find the value of a Euro call option. Keep 3 places to the right of the decimal point in your calculations. Let So -86.5 stock price at t o K 90 strike price for call option r-0.0175 risk-free interest rate -0.21 volatility T 0.166667 expiration time (years) An Euro call option on the stock will expire at t = T Approximate the value of the option by using the binomial tree method with two time intervals, each of duration Between time t At and titl a value will increase to sit-us, w th probability P, or decrease to s+ds with probability 1- p where At T/2. = eVE = 1.0625, d = e-WAi-0.94 1176, p-(erde-d)/(u-d) = 0.496884. The binomial tree of asset values is: SH The binomial tree of European call option values is vo0 From the Black-Scholes formula, the true value of the Euro call option is cBuro Hint: Google "Black-Scholes calculator online" and use one such as the ERI calculator that allows entering time to expiration in years. The error in using the binomial lattice method rather than Black-Scholes is the value