Answered step by step

Verified Expert Solution

Question

1 Approved Answer

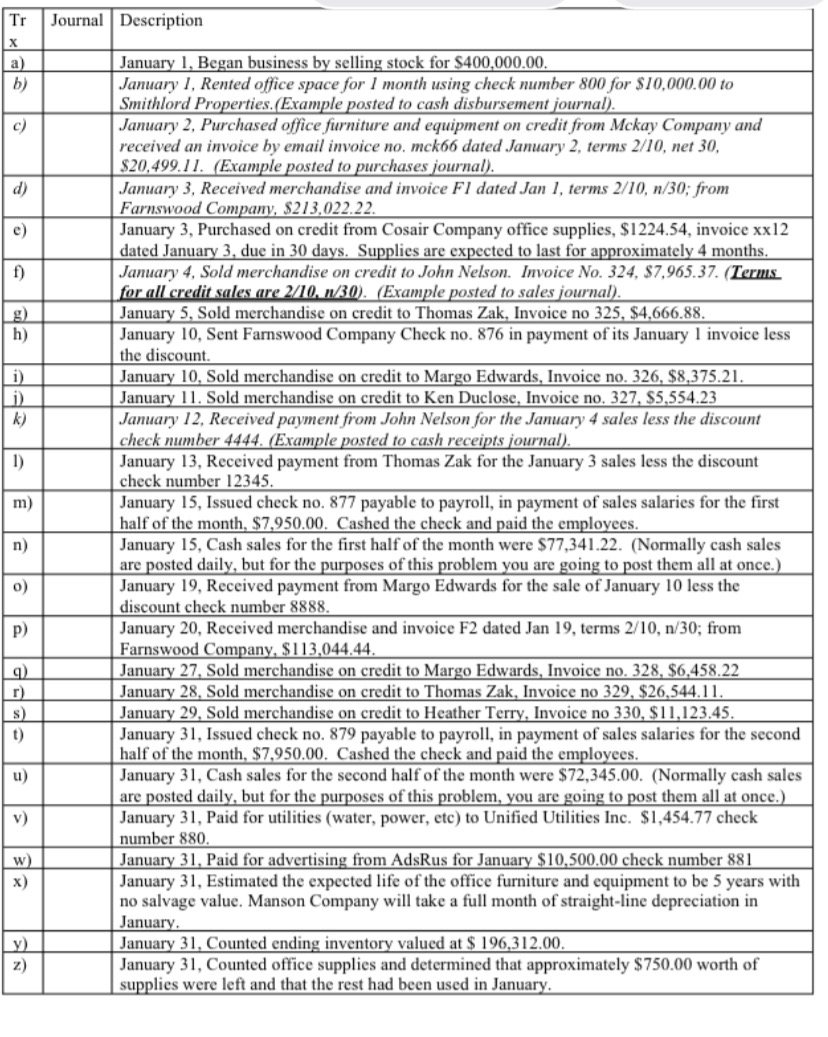

3 ) Post to the appropriate subledgers ( if applicable. ) a ) Hint: use the post column to keep yourself organized as to which

Post to the appropriate subledgers if applicable.a Hint: use the post column to keep yourself organized as to which amounts you have transferred to theledgers Post to the general ledger accounts.a Hint: if there are several transactions to the same account in a special journal, you only transfer the totalto the general ledger Calculate a total for each general ledger account. Draw a line under the last transaction and then the totalamount on the side debit or credit that has an account balance.a I am not requiring you to do a closing process or produce the Statement of StockholdersEquityRetained Earnings but you still must add the amount of net income to retained earnings in orderfor your BS to balance Prepare a trial balance using the totals from each general ledger Prepare a multistep Income Statement, complete with a line header. Produce a nicely formatted, highquality work product.a Use your Income Statement to calculate your ending balance of retained earnings. You dont need toturn in the Statement of Retained Earnings, but you need to calculate it before preparing your BalanceSheet Prepare a classified Balance Sheet separate current assets from longterm and current liabilities from longterm. Be sure to include the line header. Produce a nicely formatted, high quality work product Prepare simple schedules of AR and AP to test the accuracy of the subledgers. nice formatting is notnecessary for these. Please need help with trial balance general ledger, balance sheet income sheet schedule AR &AP

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started