Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. PQR Corporation is examining the possibility of purchasing a new packaging machine to improve the throughput of the plant. The machine would cost $250,000

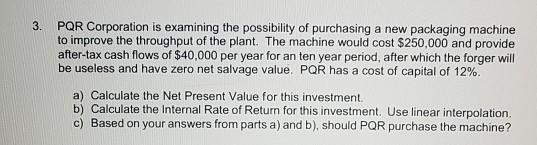

3. PQR Corporation is examining the possibility of purchasing a new packaging machine to improve the throughput of the plant. The machine would cost $250,000 and provide after-tax cash flows of $40,000 per year for an ten year period, after which the forger will be useless and have zero net salvage value. PQR has a cost of capital of 12%. a) Calculate the Net Present Value for this investment. b) Calculate the Internal Rate of Return for this investment. Use linear interpolation. c) Based on your answers from parts a) and b), should PQR purchase the machine

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started