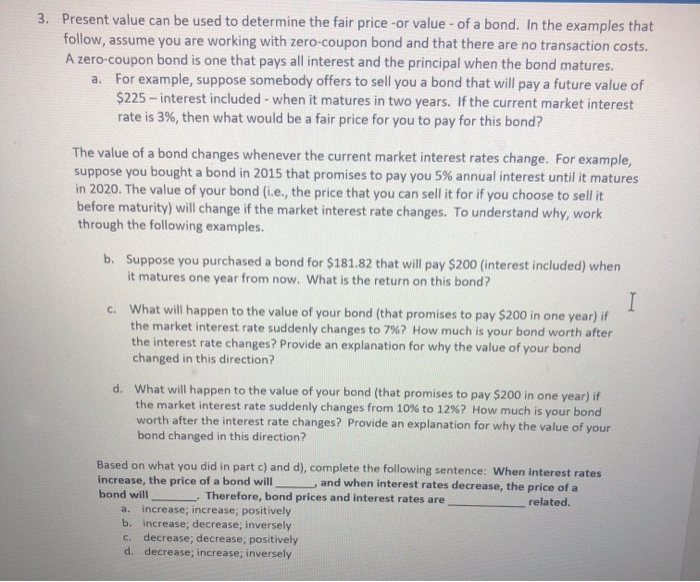

3. Present value can be used to determine the fair price -or value - of a bond. In the examples that follow, assume you are working with zero-coupon bond and that there are no transaction costs. A zero-coupon bond is one that pays all interest and the principal when the bond matures. a. For example, suppose somebody offers to sell you a bond that will pay a future value of $225 - interest included - when it matures in two years. If the current market interest rate is 3%, then what would be a fair price for you to pay for this bond? The value of a bond changes whenever the current market interest rates change. For example, suppose you bought a bond in 2015 that promises to pay you 5% annual interest until it matures in 2020. The value of your bond (i.e., the price that you can sell it for if you choose to sell it before maturity) will change if the market interest rate changes. To understand why, work through the following examples. b. Suppose you purchased a bond for $181.82 that will pay $200 (interest included) when it matures one year from now. What is the return on this bond? I c. What will happen to the value of your bond (that promises to pay $200 in one year) if the market interest rate suddenly changes to 7%? How much is your bond worth after the interest rate changes? Provide an explanation for why the value of your bond changed in this direction? d. What will happen to the value of your bond (that promises to pay $200 in one year) if the market interest rate suddenly changes from 10% to 12%? How much is your bond worth after the interest rate changes? Provide an explanation for why the value of your bond changed in this direction? Based on what you did in part c) and d), complete the following sentence: When interest rates increase, the price of a bond will and when interest rates decrease, the price of a Therefore, bond prices and interest rates are increase; increase; positively b. increase, decrease; inversely c. decrease; decrease; positively d. decrease; increase; inversely bond will a. related