#3

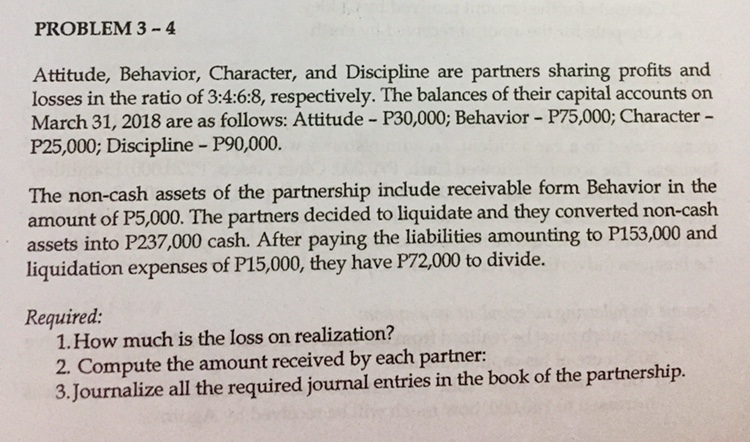

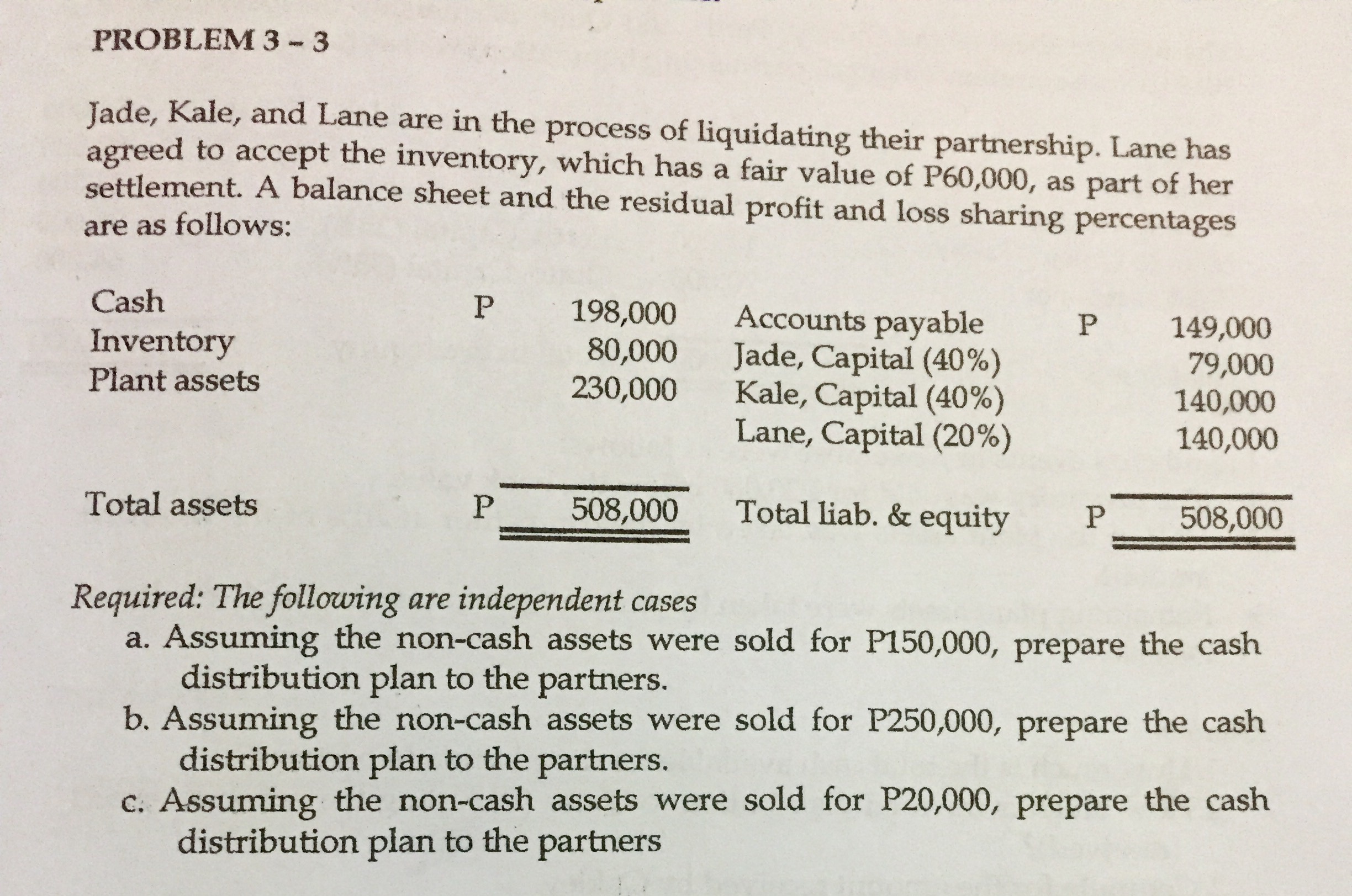

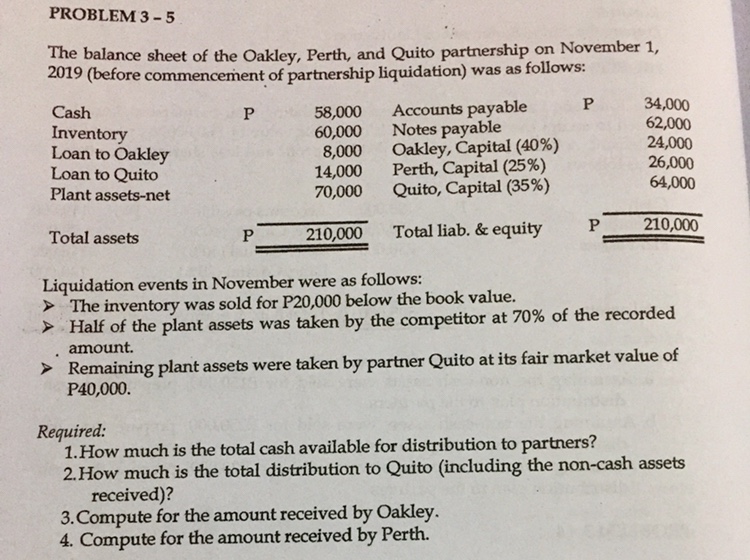

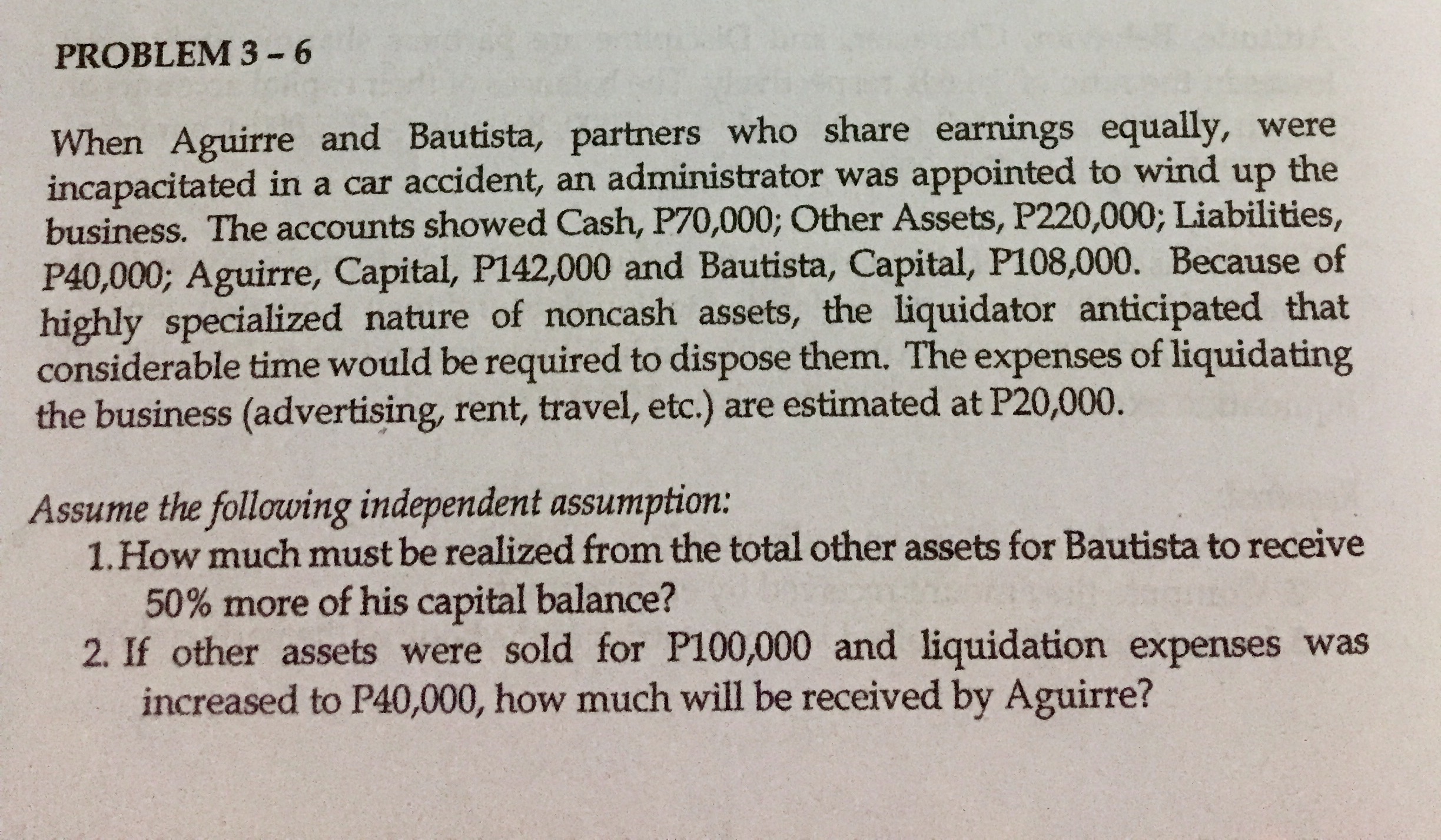

PROBLEM 3 - 4 Attitude, Behavior, Character, and Discipline are partners sharing profits and losses in the ratio of 3:4:6:8, respectively. The balances of their capital accounts on March 31, 2018 are as follows: Attitude - P30,000; Behavior - P75,000; Character - P25,000; Discipline - P90,000. The non-cash assets of the partnership include receivable form Behavior in the amount of P5,000. The partners decided to liquidate and they converted non-cash assets into P237,000 cash. After paying the liabilities amounting to P153,000 and liquidation expenses of P15,000, they have P72,000 to divide. Required: 1. How much is the loss on realization? 2. Compute the amount received by each partner: 3. Journalize all the required journal entries in the book of the partnership.PROBLEM 3 - 3 Jade, Kale, and Lane are in the process of liquidating their partnership. Lane has agreed to accept the inventory, which has a fair value of P60,000, as part of her settlement. A balance sheet and the residual profit and loss sharing percentages are as follows: Cash P 198,000 Accounts payable P 149,000 Inventory 80,000 Jade, Capital (40%) 79,000 Plant assets 230,000 Kale, Capital (40%) 140,000 Lane, Capital (20%) 140,000 Total assets P 508,000 Total liab. & equity P 508,000 Required: The following are independent cases a. Assuming the non-cash assets were sold for P150,000, prepare the cash distribution plan to the partners. b. Assuming the non-cash assets were sold for P250,000, prepare the cash distribution plan to the partners. c. Assuming the non-cash assets were sold for P20,000, prepare the cash distribution plan to the partnersPROBLEM 3 - 5 The balance sheet of the Oakley, Perth, and Quito partnership on November 1, 2019 (before commencement of partnership liquidation) was as follows: Cash P 58,000 Accounts payable P 34,000 Inventory 60,000 Notes payable 62,000 Loan to Oakley 8,000 Oakley, Capital (40%) 24,000 Loan to Quito 14,000 Perth, Capital (25%) 26,000 Plant assets-net 70,000 Quito, Capital (35%) 64,000 Total assets P 210,000 Total liab. & equity P 210,000 Liquidation events in November were as follows: The inventory was sold for P20,000 below the book value. > Half of the plant assets was taken by the competitor at 70% of the recorded amount. > Remaining plant assets were taken by partner Quito at its fair market value of P40,000. Required: 1. How much is the total cash available for distribution to partners? 2. How much is the total distribution to Quito (including the non-cash assets received)? 3. Compute for the amount received by Oakley. 4. Compute for the amount received by Perth.PROBLEM 3 - 6 When Aguirre and Bautista, partners who share earnings equally, were incapacitated in a car accident, an administrator was appointed to wind up the business. The accounts showed Cash, P70,000; Other Assets, P220,000; Liabilities, P40,000; Aguirre, Capital, P142,000 and Bautista, Capital, P108,000. Because of highly specialized nature of noncash assets, the liquidator anticipated that considerable time would be required to dispose them. The expenses of liquidating the business (advertising, rent, travel, etc.) are estimated at P20,000. Assume the following independent assumption: 1. How much must be realized from the total other assets for Bautista to receive 50% more of his capital balance? 2. If other assets were sold for P100,000 and liquidation expenses was increased to P40,000, how much will be received by Aguirre