Answered step by step

Verified Expert Solution

Question

1 Approved Answer

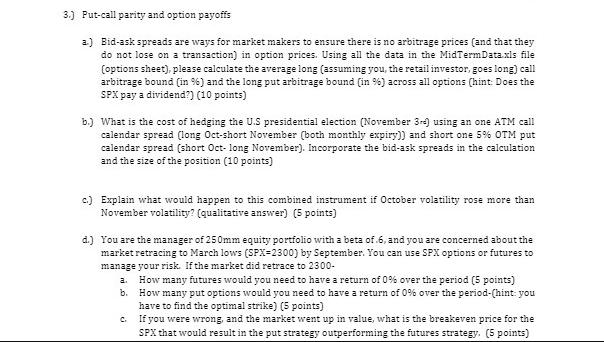

3.) Put-call parity and option payoffs a) Bid-ask spreads are ways for market makers to ensure there is no arbitrage prices (and that they

3.) Put-call parity and option payoffs a) Bid-ask spreads are ways for market makers to ensure there is no arbitrage prices (and that they do not lose on a transaction) in option prices. Using all the data in the MidTermData.xls file (options sheet), please calculate the average long (assuming you, the retail investor, goes long) call arbitrage bound (in %) and the long put arbitrage bound (in %) across all options (hint: Does the SPX pay a dividend?) (10 points) b.) What is the cost of hedging the U.S presidential election (November 3-) using an one ATM call calendar spread (long Oct-short November (both monthly expiry)) and short one 5% OTM put calendar spread (short Oct- long November). Incorporate the bid-ask spreads in the calculation and the size of the position (10 points) c.) Explain what would happen to this combined instrument if October volatility rose more than November volatility? (qualitative answer) (5 points) d.) You are the manager of 250mm equity portfolio with a beta of 6, and you are concerned about the market retracing to March lows (SPX=2300) by September. You can use SPX options or futures to manage your risk. If the market did retrace to 2300- a. b. How many futures would you need to have a return of 0% over the period (5 points) How many put options would you need to have a return of 0% over the period-(hint you have to find the optimal strike) (5 points) C. If you were wrong, and the market went up in value, what is the breakeven price for the SPX that would result in the put strategy outperforming the futures strategy. (5 points)

Step by Step Solution

★★★★★

3.56 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a The arbitrage bound for a European call option is given by the difference between the call price and the present value of the strike price which is equal to the price of the corresponding put option ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started