Question

3. Question 3 [30 marks] P acquired the whole of the share capital of S for cash on 31 December 2018. The fair value of

3. Question 3 [30 marks]

P acquired the whole of the share capital of S for cash on 31 December 2018. The fair value of Ss net assets at this date were 62,000. The statements of financial position of P and S as at 31 December 2018 are given below.

|

| P | S |

| Property, plant and equipment | 120000 | 40000 |

| Investment in S | 68000 |

|

| Net current assets | 28000 | 15000 |

| Total Assets | 216000 | 55000 |

| Share capital | 136000 | 45000 |

| Reserves | 80000 | 10000 |

| Total Equity and Liabilities | 216000 | 55000 |

a) Prepare the Consolidated Statement of Financial Position (Balance Sheet) of the Group as at 31 December 2018. [10 marks]

b) Control of an entity over another determines which entities should be included in a groups consolidated financial statements. Explain the concept of control. (200-300 words) [10 marks]

c) Discuss the purposes of preparing consolidated financial statements. (200-300 words) [10 marks]

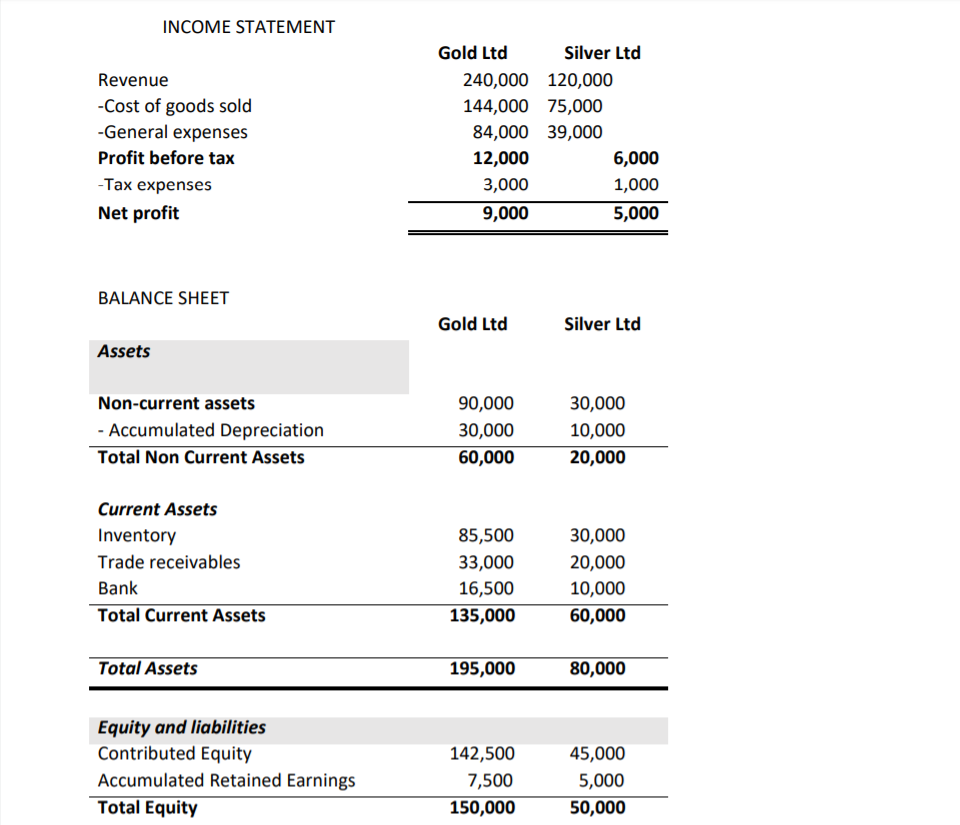

4. Question 4 [30 marks] The income statement and the balance sheet for the year ended 30 June 2019 of Gold Ltd and Silver Ltd, two companies in the same industry, are given as follows:

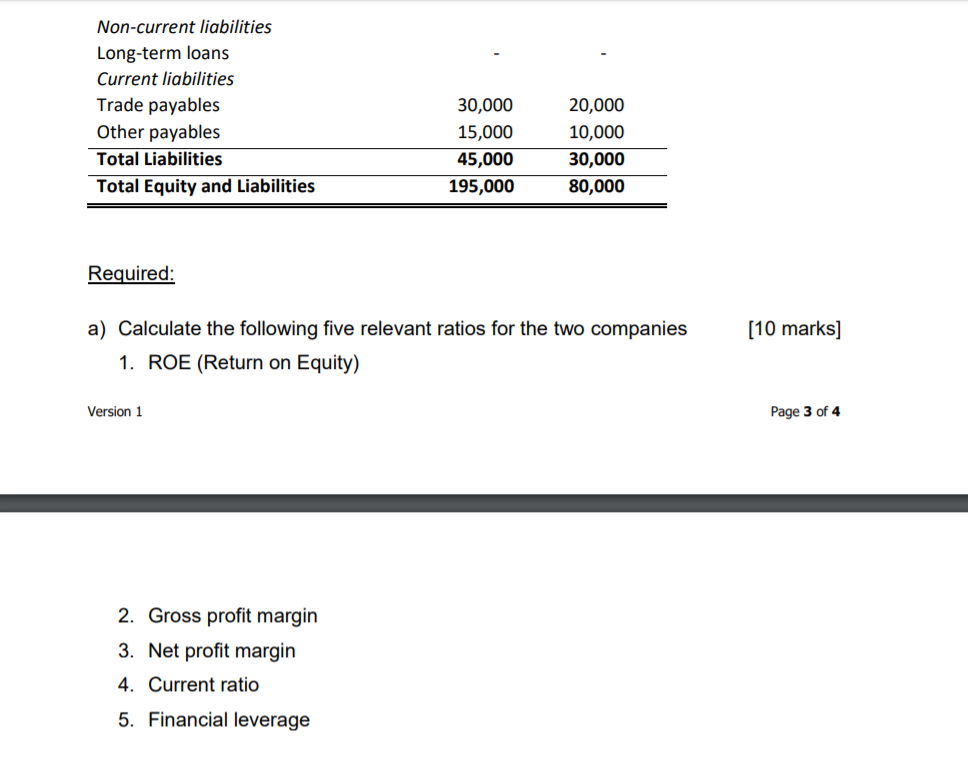

b) Using the ratios calculated above, prepare a brief report comparing the financial performance and financial position of Gold Ltd and Silver Ltd. (200-300 words) [10 marks]

c) Discuss the limitations of ratio analysis. (200-300 words) [10 marks]

INCOME STATEMENT Revenue -Cost of goods sold -General expenses Profit before tax -Tax expenses Net profit Gold Ltd Silver Ltd 240,000 120,000 144,000 75,000 84,000 39,000 12,000 6,000 3,000 1,000 9,000 5,000 BALANCE SHEET Gold Ltd Silver Ltd Assets Non-current assets - Accumulated Depreciation Total Non Current Assets 90,000 30,000 60,000 30,000 10,000 20,000 Current Assets Inventory Trade receivables Bank Total Current Assets 85,500 33,000 16,500 135,000 30,000 20,000 10,000 60,000 Total Assets 195,000 80,000 Equity and liabilities Contributed Equity Accumulated Retained Earnings Total Equity 142,500 7,500 150,000 45,000 5,000 50,000 Non-current liabilities Long-term loans Current liabilities Trade payables Other payables Total Liabilities Total Equity and Liabilities 30,000 15,000 45,000 195,000 20,000 10,000 30,000 80,000 Required: (10 marks] a) Calculate the following five relevant ratios for the two companies 1. ROE (Return on Equity) Version 1 Page 3 of 4 2. Gross profit margin 3. Net profit margin 4. Current ratio 5. Financial leverageStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started