Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3 ) show me steps using financial calculator: Tangshan Mining Company is considering investment in one of two mutually exclusive projects M and N which

show me steps using financial calculator:

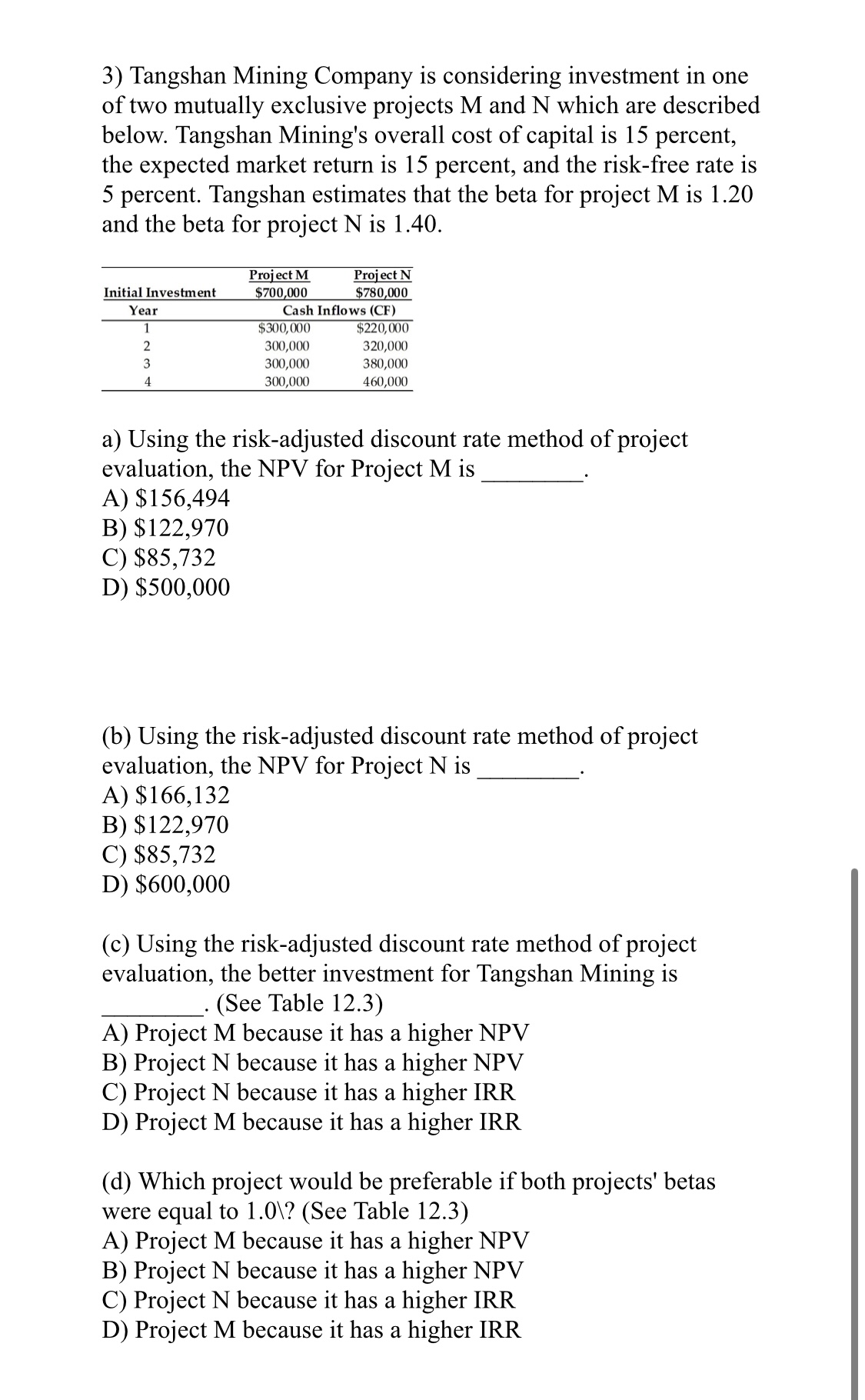

Tangshan Mining Company is considering investment in one

of two mutually exclusive projects M and N which are described

below. Tangshan Mining's overall cost of capital is percent,

the expected market return is percent, and the riskfree rate is

percent. Tangshan estimates that the beta for project M is

and the beta for project N is

a Using the riskadjusted discount rate method of project

evaluation, the NPV for Project is

A $

B $

C $

D $

b Using the riskadjusted discount rate method of project

evaluation, the NPV for Project N is

A $

B $

C $

D $

c Using the riskadjusted discount rate method of project

evaluation, the better investment for Tangshan Mining is

See Table

A Project because it has a higher NPV

B Project because it has a higher NPV

C Project because it has a higher IRR

D Project because it has a higher IRR

d Which project would be preferable if both projects' betas

were equal to See Table

A Project because it has a higher NPV

B Project N because it has a higher NPV

C Project because it has a higher IRR

D Project because it has a higher IRR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started