Answered step by step

Verified Expert Solution

Question

1 Approved Answer

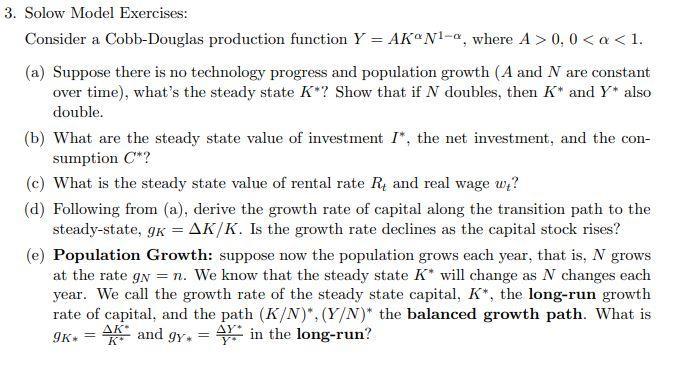

3. Solow Model Exercises: Consider a Cobb-Douglas production function Y = AKN1-a, where A > 0, 0 < a < 1. (a) Suppose there

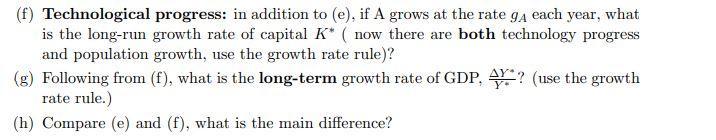

3. Solow Model Exercises: Consider a Cobb-Douglas production function Y = AKN1-a, where A > 0, 0 < a < 1. (a) Suppose there is no technology progress and population growth (A and N are constant over time), what's the steady state K*? Show that if N doubles, then K* and Y* also double. (b) What are the steady state value of investment I*, the net investment, and the con- sumption C*? (c) What is the steady state value of rental rate R and real wage w? (d) Following from (a), derive the growth rate of capital along the transition path to the steady-state, gk = AK/K. Is the growth rate declines as the capital stock rises? (e) Population Growth: suppose now the population grows each year, that is, N grows at the rate gn=n. We know that the steady state K* will change as N changes each year. We call the growth rate of the steady state capital, K*, the long-run growth rate of capital, and the path (K/N)*, (Y/N)* the balanced growth path. What is 9K* = K and gy* = in the long-run? AK* (f) Technological progress: in addition to (e), if A grows at the rate 94 each year, what is the long-run growth rate of capital K* ( now there are both technology progress and population growth, use the growth rate rule)? (g) Following from (f), what is the long-term growth rate of GDP. A? (use the growth rate rule.) (h) Compare (e) and (f), what is the main difference?

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a In the steady state investment equals depreciation so I K where is the depreciation rate Setting I K we can solve for the steadystate capital stock ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started