Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Stock repurchases Stock repurchases occur when a company buys its outstanding stock which is often referred to as treasury stock and is reported as

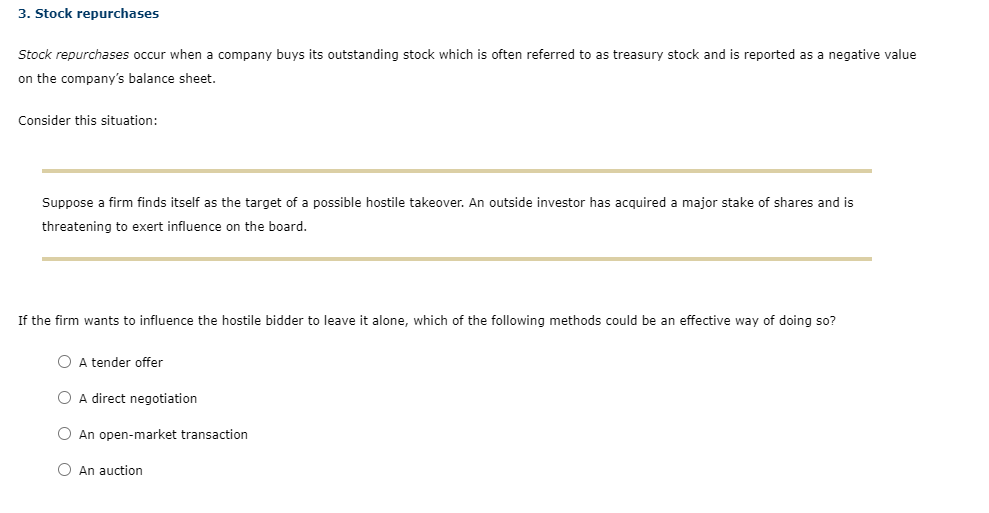

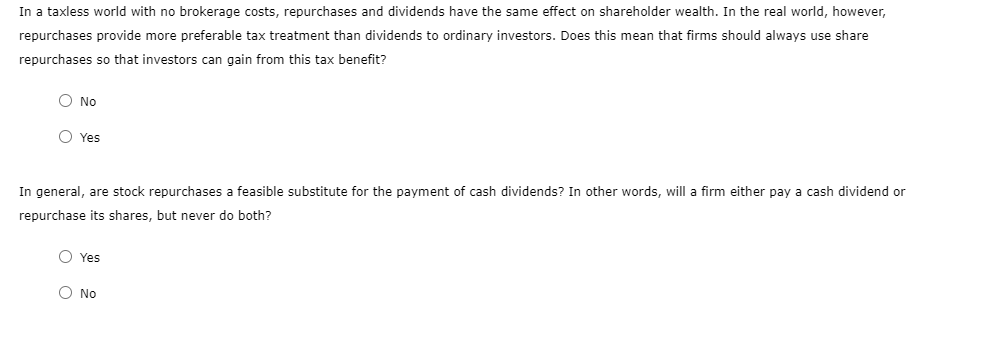

3. Stock repurchases Stock repurchases occur when a company buys its outstanding stock which is often referred to as treasury stock and is reported as a negative value on the company's balance sheet. Consider this situation: Suppose a firm finds itself as the target of a possible hostile takeover. An outside investor has acquired a major stake of shares and is threatening to exert influence on the board. If the firm wants to influence the hostile bidder to leave it alone, which of the following methods could be an effective way of doing so? A tender offer A direct negotiation An open-market transaction An auction In a taxless world with no brokerage costs, repurchases and dividends have the same effect on shareholder wealth. In the real world, however, repurchases provide more preferable tax treatment than dividends to ordinary investors. Does this mean that firms should always use share repurchases so that investors can gain from this tax benefit? No Yes In general, are stock repurchases a feasible substitute for the payment of cash dividends? In other words, will a firm either pay a cash dividend or repurchase its shares, but never do both? Yes No

3. Stock repurchases Stock repurchases occur when a company buys its outstanding stock which is often referred to as treasury stock and is reported as a negative value on the company's balance sheet. Consider this situation: Suppose a firm finds itself as the target of a possible hostile takeover. An outside investor has acquired a major stake of shares and is threatening to exert influence on the board. If the firm wants to influence the hostile bidder to leave it alone, which of the following methods could be an effective way of doing so? A tender offer A direct negotiation An open-market transaction An auction In a taxless world with no brokerage costs, repurchases and dividends have the same effect on shareholder wealth. In the real world, however, repurchases provide more preferable tax treatment than dividends to ordinary investors. Does this mean that firms should always use share repurchases so that investors can gain from this tax benefit? No Yes In general, are stock repurchases a feasible substitute for the payment of cash dividends? In other words, will a firm either pay a cash dividend or repurchase its shares, but never do both? Yes No Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started