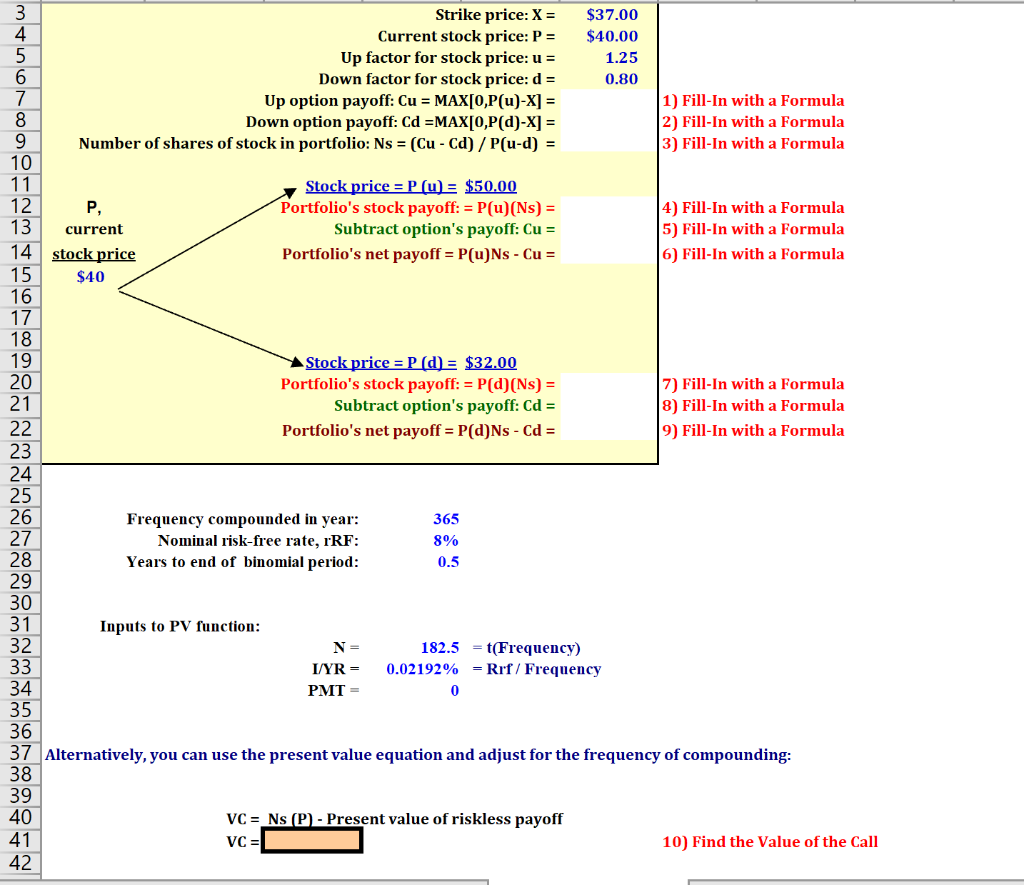

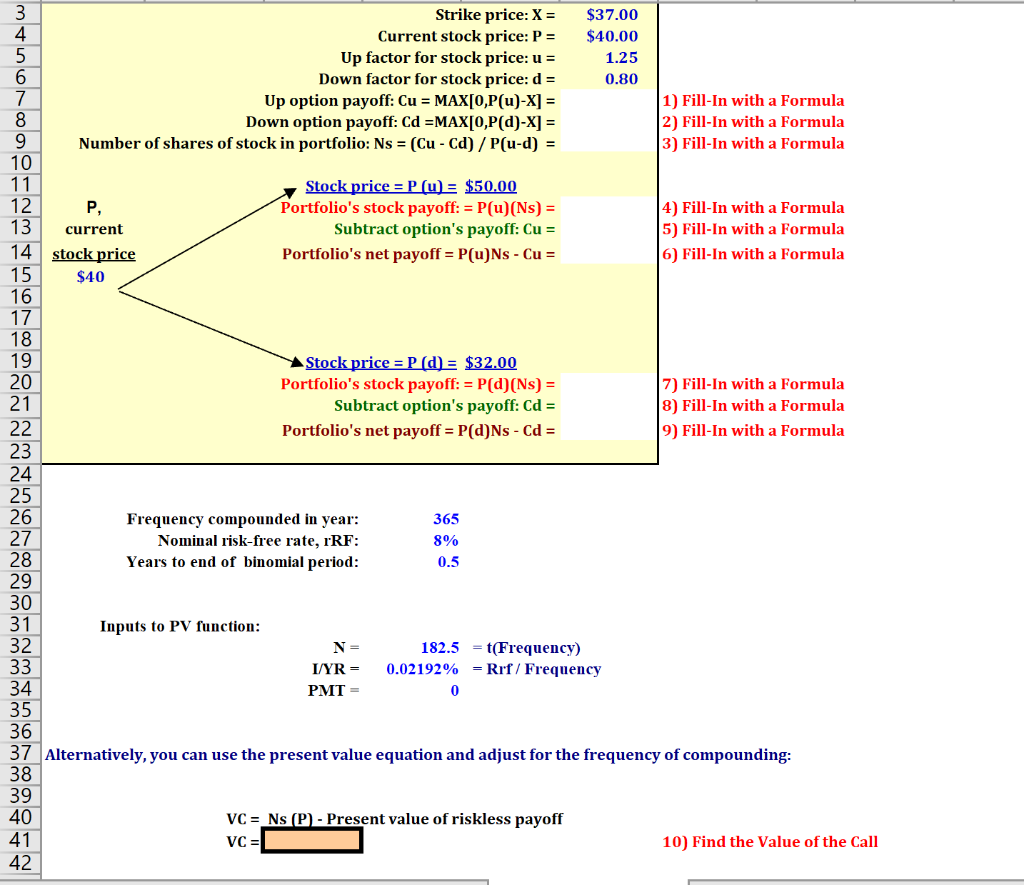

3 Strike price: X = $37.00 4 Current stock price: P = $40.00 5 Up factor for stock price: u = 1.25 6 Down factor for stock price: d = 0.80 7 Up option payoff: Cu = MAX[0,P(u)-X] = 1) Fill-In with a Formula 8 Down option payoff: Cd =MAX[0,P(d)-X] = 2) Fill-In with a Formula 9 Number of shares of stock in portfolio: Ns = (Cu-Cd) / Pu-d) = 3) Fill-In with a Formula 10 11 Stock price = P (u) = $50.00 12 P, Portfolio's stock payoff: = P(u)(NS) = 4) Fill-In with a Formula 13 current Subtract option's payoff: Cu = 5) Fill-In with a Formula 14 stock price Portfolio's net payoff = P(u)Ns - Cu = 6) Fill-In with a Formula 15 $40 16 17 18 19 Stock price =P (d) = $32.00 20 Portfolio's stock payoff: = P(d)(Ns) = 7) Fill-In with a Formula 21 Subtract option's payoff: Cd = 8) Fill-In with a Formula 22 Portfolio's net payoff = P(a)Ns - Cd = 9) Fill-In with a Formula 23 24 25 26 Frequency compounded in year: 365 27 Nominal risk-free rate, rRF: 8% 28 Years to end of binomial period: 0.5 29 30 31 Inputs to PV function: 32 N= 182.5 = t[Frequency) 33 I/YR = 0.02192% = Rrf / Frequency 34 PMT= 35 36 37 Alternatively, you can use the present value equation and adjust for the frequency of compounding: 38 39 40 VC = Ns (P) - Present value of riskless payoff 41 VC= 10) Find the value of the Call 42 0 3 Strike price: X = $37.00 4 Current stock price: P = $40.00 5 Up factor for stock price: u = 1.25 6 Down factor for stock price: d = 0.80 7 Up option payoff: Cu = MAX[0,P(u)-X] = 1) Fill-In with a Formula 8 Down option payoff: Cd =MAX[0,P(d)-X] = 2) Fill-In with a Formula 9 Number of shares of stock in portfolio: Ns = (Cu-Cd) / Pu-d) = 3) Fill-In with a Formula 10 11 Stock price = P (u) = $50.00 12 P, Portfolio's stock payoff: = P(u)(NS) = 4) Fill-In with a Formula 13 current Subtract option's payoff: Cu = 5) Fill-In with a Formula 14 stock price Portfolio's net payoff = P(u)Ns - Cu = 6) Fill-In with a Formula 15 $40 16 17 18 19 Stock price =P (d) = $32.00 20 Portfolio's stock payoff: = P(d)(Ns) = 7) Fill-In with a Formula 21 Subtract option's payoff: Cd = 8) Fill-In with a Formula 22 Portfolio's net payoff = P(a)Ns - Cd = 9) Fill-In with a Formula 23 24 25 26 Frequency compounded in year: 365 27 Nominal risk-free rate, rRF: 8% 28 Years to end of binomial period: 0.5 29 30 31 Inputs to PV function: 32 N= 182.5 = t[Frequency) 33 I/YR = 0.02192% = Rrf / Frequency 34 PMT= 35 36 37 Alternatively, you can use the present value equation and adjust for the frequency of compounding: 38 39 40 VC = Ns (P) - Present value of riskless payoff 41 VC= 10) Find the value of the Call 42 0