Answered step by step

Verified Expert Solution

Question

1 Approved Answer

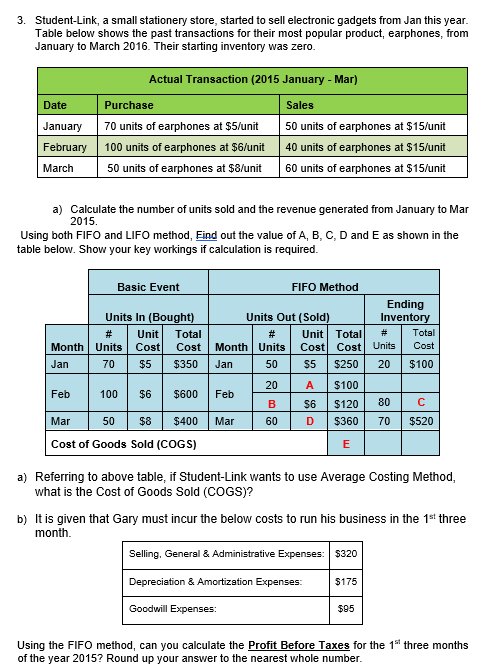

3. Student-Link, a small stationery store, started to sell electronic gadgets from Jan this year. Table below shows the past transactions for their most

3. Student-Link, a small stationery store, started to sell electronic gadgets from Jan this year. Table below shows the past transactions for their most popular product, earphones, from January to March 2016. Their starting inventory was zero. Date January February March Month Jan a) Calculate the number of units sold and the revenue generated from January to Mar 2015. Using both FIFO and LIFO method, Find out the value of A, B, C, D and E as shown in the table below. Show your key workings if calculation is required. Feb Actual Transaction (2015 January - Mar) Sales 50 units of earphones at $15/unit 40 units of earphones at $15/unit 60 units of earphones at $15/unit Purchase 70 units of earphones at $5/unit 100 units of earphones at $6/unit 50 units of earphones at $8/unit Basic Event Units In (Bought) # Unit Total Units Cost Cost 70 $5 100 $600 Mar 50 $8 $400 Cost of Goods Sold (COGS) $350 $6 Month Jan Feb Mar Units Out (Sold) FIFO Method # Units 50 20 B 60 Unit Total # Cost Cost Units $5 Ending Inventory $250 20 $100 A $100 $6 $120 80 D $360 70 $520 E a) Referring to above table, if Student-Link wants to use Average Costing Method, what is the Cost of Goods Sold (COGS)? Selling, General & Administrative Expenses: $320 Depreciation & Amortization Expenses: Goodwill Expenses: Total Cost b) It is given that Gary must incur the below costs to run his business in the 1st three month. $175 $95 Using the FIFO method, can you calculate the Profit Before Taxes for the 1st three months of the year 2015? Round up your answer to the nearest whole number.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started