Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Suppose everyone in the U.S. earns $40,000 per year with certainty. However, each person can get sick. If they get sick, they incur

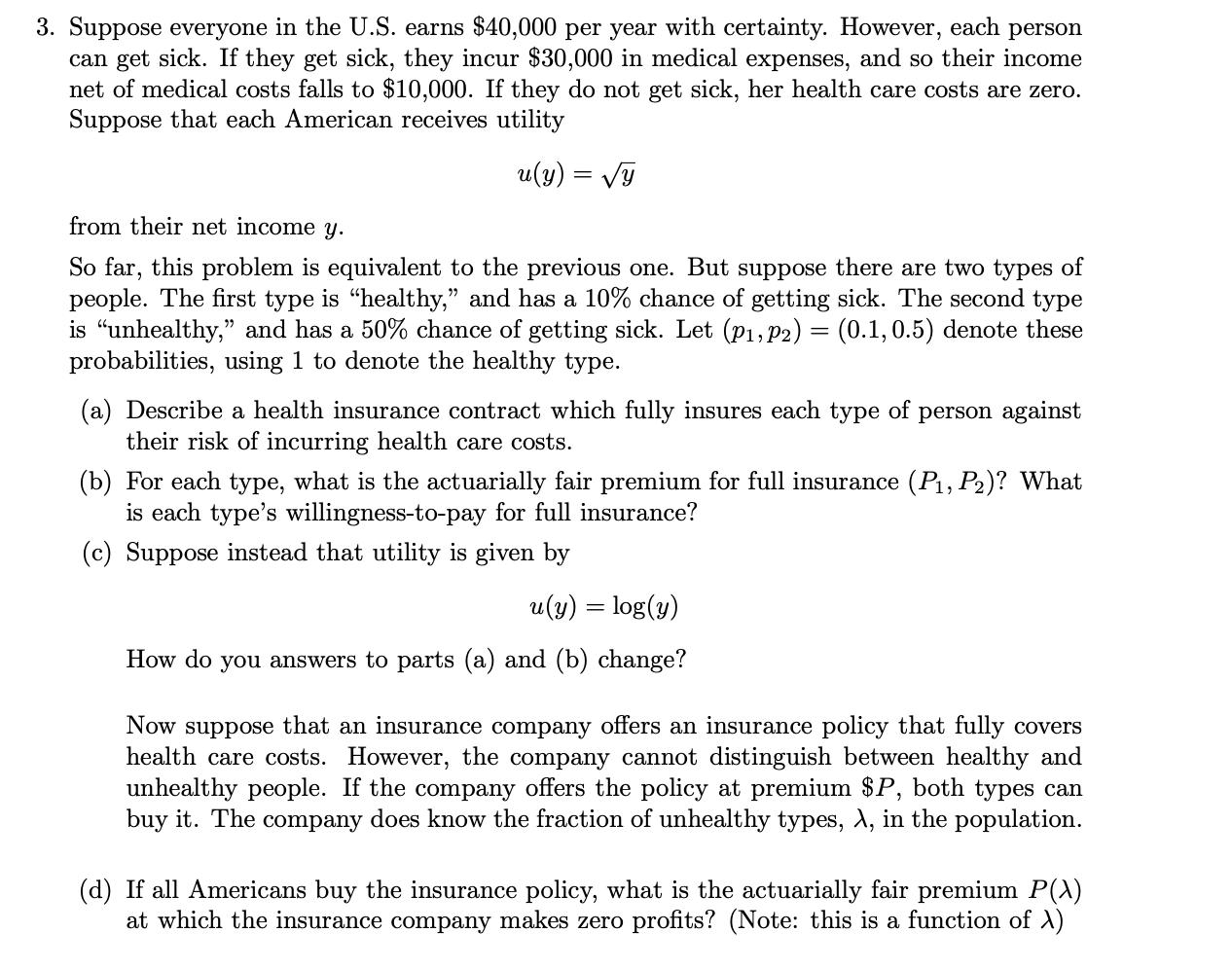

3. Suppose everyone in the U.S. earns $40,000 per year with certainty. However, each person can get sick. If they get sick, they incur $30,000 in medical expenses, and so their income net of medical costs falls to $10,000. If they do not get sick, her health care costs are zero. Suppose that each American receives utility u(y) = y from their net income y. So far, this problem is equivalent to the previous one. But suppose there are two types of people. The first type is "healthy," and has a 10% chance of getting sick. The second type is "unhealthy," and has a 50% chance of getting sick. Let (p, p2) = (0.1, 0.5) denote these probabilities, using 1 to denote the healthy type. (a) Describe a health insurance contract which fully insures each type of person against their risk of incurring health care costs. (b) For each type, what is the actuarially fair premium for full insurance (P, P2)? What is each type's willingness-to-pay for full insurance? (c) Suppose instead that utility is given by u(y) = log(y) How do you answers to parts (a) and (b) change? Now suppose that an insurance company offers an insurance policy that fully covers health care costs. However, the company cannot distinguish between healthy and unhealthy people. If the company offers the policy at premium $P, both types can buy it. The company does know the fraction of unhealthy types, , in the population. (d) If all Americans buy the insurance policy, what is the actuarially fair premium P(X) at which the insurance company makes zero profits? (Note: this is a function of X)

Step by Step Solution

★★★★★

3.34 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a The insurance company would charge a premium of 15000 wh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started